South Africans who use cryptocurrencies to wire more money across South African borders than is permitted under the law have got the attention of South Africa ’s government. In the first quarter of 2020 (Jan-March), the country’s central bank is expected to launch new regulations targeted at preventing the use of cryptocurrencies in evading currency control regulations.

Here Is All You Need To Know

- According to reports, South African Reserve Bank deputy governor Kuben Naidoo told journalists last week that the rules would be put in place in the first quarter of next year, bringing to an end the consultations that began in 2014.

- Under South African laws, there are limitations on how much money individuals and companies can send outside the country.

- Sending anything up to R1 million rand ($96,000) would require no declaration to South Africa’s Revenue Service. However, special declaration shall be made to South African Revenue Service for citizens to be able to send up to a further R10m ($750,000) out of the country for foreign investment purposes.

- This therefore limits South Africans to a total of R11m that they are allowed to send across the border.

- This has led consequently led high net-worth individuals looking to protect their wealth against the rand’s devaluation to look for alternative methods to send their money out of the country.

- This has made cryptocurrencies the most popular method of sending money anywhere in the world due to the borderless nature of virtual currencies.

- Naidoo and the SARB are therefore hoping to stop this evasion of currency controls through the new regulations expected early next year.

- According to reports, a premium on Bitcoin developed earlier this year in the country, partly because of the restrictions people face when sending money accross borders.

South African Banks Are Already Shutting Down Some Crypto Exchanges

While the country’s central bank is set to release new crypto regulations, it appears that there is an ongoing crackdown on the virtual currency sector. One of South Africa’s biggest banks, the First National Bank (FNB) last week closed all business banking accounts for companies dealing in cryptocurrencies.

“FNB considers this to be a prudent course of action following a comprehensive review of the potential risks currently associated with these entities, particularly given that appropriate regulatory frameworks are not yet in place,” it said in a statement.

Disappointed With Decision — Says Crypto Community

One of South Africa ’s largest cryptocurrencies exchanges, AltCoinTrader, said they were disappointed with FNB’s decision after having been with the bank since 2015.

“We are disappointed that a financial institution would succumb to international pressure like this, with banking services being denied to individuals and industry players around the globe,” AltCoinTrader chief executive Richard de Sousa said.

Crypto Scams Are Mounting in South Africa

South Africa’s governments and regulatory bodies constantly warn investors not to engage in cryptocurrency schemes because of the risks involved. There are cases of bad actors fleecing unsuspecting investors of their money in the country.

Back in July 2019, victims of a bitcoin scam orchestrated by the owner of a fraudulent South African bitcoin company burned down the owner’s house. The man, Sphelele “Sgumza” Mbatha, set up a Ponzi scheme and promised investors bogus returns in 15 working days. As is the case in most situations, the owner allegedly fled town with clients’ funds.

Also, at the beginning of 2019, the South African Cricket Team came out to state that hackers hacked into the team’s official Twitter account to sell fake bitcoin lottery. The cricket team, however, recovered their account and deleted the fraudulent tweets.

Read also: South African Business People Will Now Get 5-year Visas To Stay In Namibia

Rapidly Rising Rate of Crypto Adoption In South Africa

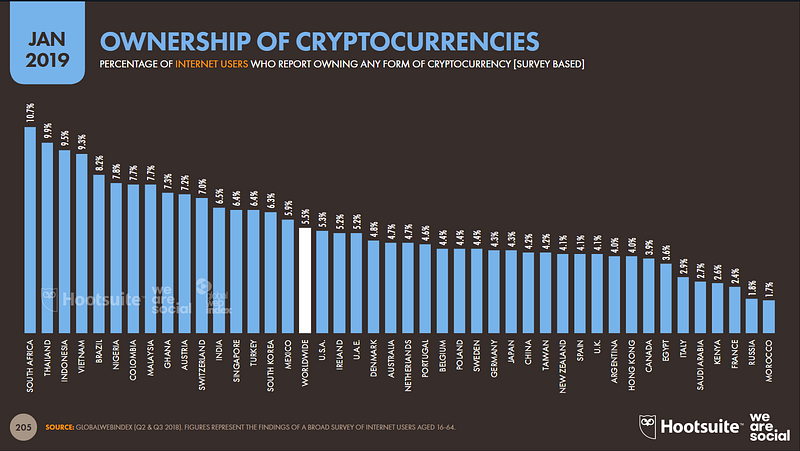

As reported by Blockonomi back in April 2019, crypto adoption in South Africa was on the rise with South Africans regarded as the highest owners of cryptocurrencies globally. Some of the factors that encourage crypto adoption include a volatile rand and the absence of strict digital currency regulations.

However, the new crypto laws coming in 2020 could stifle the growth of cryptocurrency in the country. For now, the only piece of crypto governance in the country is the tax law drafted in 2018.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world