Tamwilcom’s Innov Invest Program: 12 Incubators Secure Funding to Empower Moroccan Startups

Twelve partnering support structures have been selected for the implementation of the financing offering in the 3rd edition of the Innov Invest program.

Tamwilcom revealed on Monday the twelve Partnering Support Structures (PSS) that will play a key role in the implementation of the new generation of financing dedicated to innovative startups within the framework of the 3rd edition of the Innov Invest program initiated by the Innov Invest Fund with the support of the Ministry of Economy and Finance and the World Bank.

This selection follows a call for expressions of interest launched on June 28, 2023, and the selected PSS were designated by an independent commission composed of national and international experts. These partners will be actively involved in the early stages of the startup lifecycle, namely ideation, incubation, and pre-acceleration.

For the “Ideation” segment, Tamwilcom has selected the following structures: Enactus, Incubooster, Univers Startup & Entrepreneur, and Euromed Innovation Center (EIC). In the “Incubation” segment, the selected PSS are Cluster CE3M, Cluster EnR, Emerging Business Factory (EBF), R&D Maroc, Réseau Entreprendre Maroc (REM), and Startup Maroc. Finally, in the “Pre-acceleration” segment, Impact Lab and SB3S have been chosen.

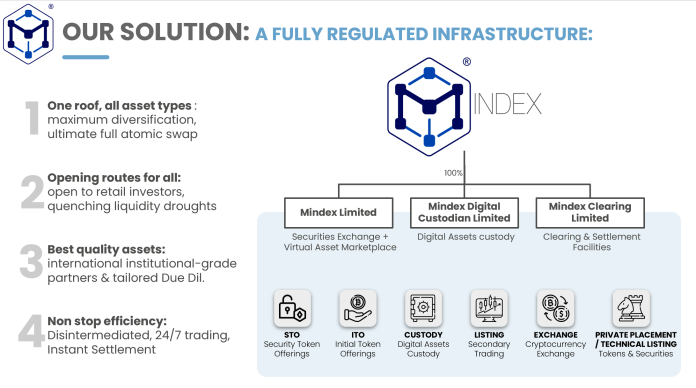

These structures, engaged in a contractual process with Tamwilcom, will be responsible for deploying a financing offering comprising two flagship products: “Tech Start” and “Tech Boost.” “Tech Start,” designed for the “Incubation” segment, supports startups that have surpassed the Proof of Concept (POC) stage by providing a contribution of up to 400,000 DH (USD40,000), covering up to 80% of expenses related to the development of prototypes or products at the MVP (Minimum Viable Product) stage.

Regarding the “Pre-acceleration” segment, “Tech Boost” offers an honorary loan of up to 750,000 DH (USD75,000) for startups that have surpassed the MVP stage and are seeking to introduce their products to the market. This financing can cover up to 80% of the project cost, particularly for breakthrough innovations (Deep Tech).

The PSS involved in the deployment of these instruments, as well as those involved in the “Ideation” segment, will benefit from technical assistance, the extent of which will depend on their performance and achievements.

It is worth noting that the Innov Invest Fund (IIF), created by the Ministry of Economy and Finance in collaboration with Tamwilcom and with the support of the World Bank, aims to promote access to financing for startups and innovative project leaders in Morocco.

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard.