Senegalese Agtech Startup Tolbi Raises Funding to Drive AI-Powered Precision Agriculture

In a significant stride for African agriculture, Tolbi, a cutting-edge Senegalese startup, has announced a pivotal investment from Fuzé. This funding marks a turning point for the agtech sector in the region, as Tolbi’s innovative solutions promise to revolutionize farm management and environmental sustainability.

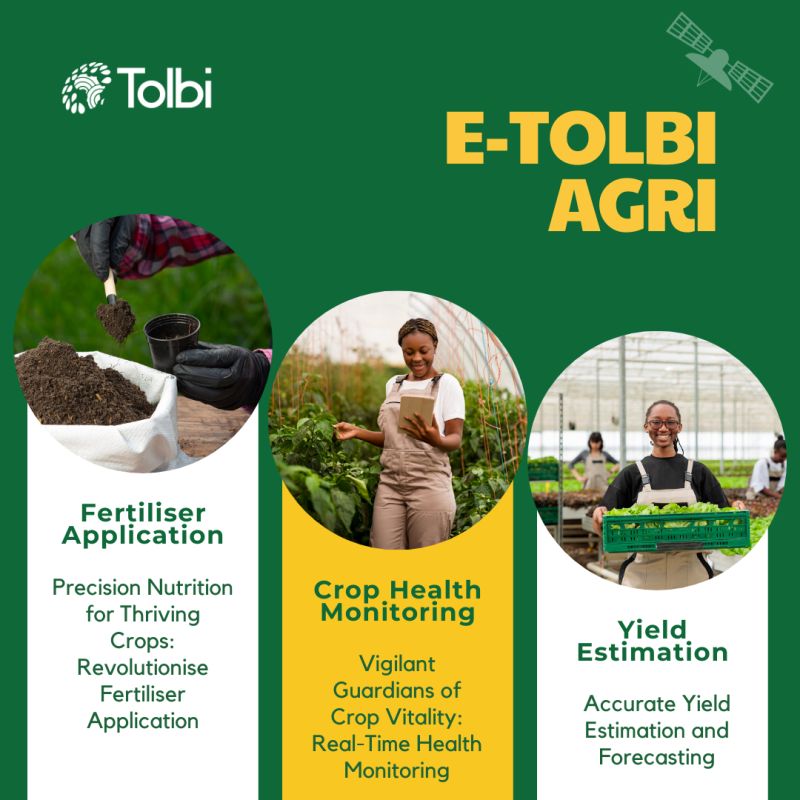

Tolbi’s groundbreaking approach incorporates satellite imagery and artificial intelligence to deliver precise insights for farmers, empowering them to optimize practices, increase yields, and reduce operational costs. The startup’s commitment to sustainable agriculture is further exemplified by its creation of a marketplace facilitating the estimation and trading of carbon credits, allowing farmers to economically benefit from environmentally conscious farming practices.

read also Group Commits $3 Billion Investment to Boost African Agriculture and Food Production

The infusion of capital from Fuzé is poised to catapult Tolbi’s expansion throughout Africa and drive the development of advanced features for its digital solution. This strategic investment underscores Fuzé’s confidence in Tolbi’s potential and its positive impact on the African continent.

Mouhamadou Lamine KEBE, CEO & Founder of Tolbi, expressed enthusiasm about the partnership: “We are thrilled to welcome Digital Africa to our investment round. Their alignment with our vision and impactful initiatives in Agtech will undoubtedly accelerate Tolbi’s growth. With their robust financial and technical support, our team is poised for rapid scalability and progress.”

Ali Mnif, CIO of Digital Africa, echoed the sentiment: “We take pride in announcing our investment in Tolbi. Mouhamadou and his team have developed an innovative technology that seamlessly integrates climate considerations with smart agriculture solutions. With a seasoned team of researchers and specialists, Tolbi is well-positioned to lead the charge in transforming African agriculture.”

Tolbi stands as a pan-African climate-Agtech pioneer, harnessing the power of satellite imagery and AI for precision agriculture. The startup also operates a marketplace facilitating carbon credit estimation and trading in the voluntary market.

read also IFC Injects $2.9 Billion to Boost Business, Energy, and Gender Inclusion in East Africa

Tolbi is a Senegalese agtech startup founded in 2022, dedicated to advancing precision agriculture in Africa. Through the integration of satellite imagery and artificial intelligence, Tolbi empowers farmers with data-driven insights to enhance productivity and environmental sustainability.

Tolbi Fuzé Tolbi Fuzé

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard