Egyptian Startup Pearl Semiconductor Raises $4.5M from Leading Investors

Shorouk Partners made a significant announcement regarding its strategic investment in Pearl Semiconductor, an innovative Egyptian startup focused on semiconductors. This financial infusion saw the company secure $4.5 million in funding, with prominent participants such as Sawary Ventures, Qatar’s QBN Capital, and a group of angel investors contributing to the financing round.

Semiconductors, as the cornerstone of contemporary technology, facilitate the creation of essential devices and solutions that have seamlessly woven into our daily routines. Shorouk Partners emphasized that its foray into this uncharted territory was not solely a decision based on the immense growth potential in this sector, which is expertly navigated by the formidable team at Pearl Semiconductor. It also underlines the firm’s unwavering commitment to bolstering the emerging technology landscape in Egypt and beyond.

read also Terragon Partners Microsoft to Take African Businesses to New Heights

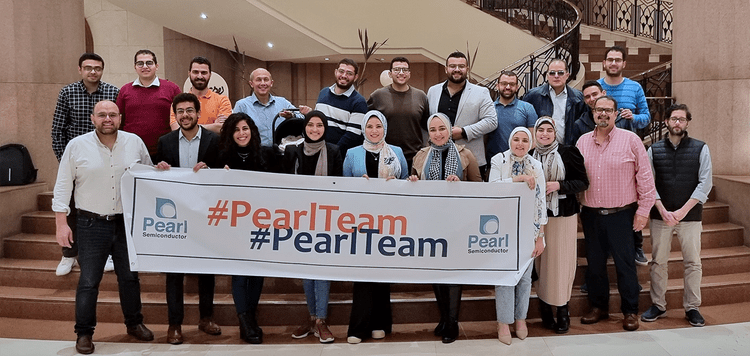

The collaboration between Shorouk Partners and Pearl Semiconductor transcends the realm of a promising investment in a semiconductor company poised for global leadership. It serves as a testament to the ongoing revolutionary movement in Egypt, which aspires to harness the untapped engineering prowess within the nation and the broader region.

Shorouk Partners expressed, “It is imperative to recognize the profound influence of Ayman Ahmed, a semiconductor expert and the CEO of Pearl Semiconductor, in tandem with his esteemed university mentor and industry veteran, Dr. Hisham Haddara, who serves as the Chairman of Pearl Semiconductor.” This pioneering company has been actively involved in Egypt’s semiconductor industry for over three decades, culminating in the recent establishment of Pearl Semiconductor. Their groundbreaking efforts, dating back to the early 1990s, set the stage for a flourishing semiconductor ecosystem in Egypt, enabling the nation to introduce cutting-edge innovations to the global market.

read also Egyptian Insurtech Amenli Closes $1 Million Funding Round with Key Investors

The startup was founded by Ayman Ahmed in the year 2020.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the con