Ghana-based Startup Degas Raises $6.7 Million to Empower Small Farmers

Degas, the innovative startup dedicated to improving the livelihoods of small farmers in sub-Saharan Africa, has announced the successful completion of a funding round, securing ¥970 million (approximately $6.7 million). The investment round saw participation from prominent investors, including Animal Spirits, Global Catalyst Partners Japan, Hakuhodo DY Ventures, Nanto CVC (operated by Nanto Bank and Nanto Capital Partners), and Primal Capital.

This latest funding round builds upon Degas’ earlier achievements, having secured ¥240 million in the first close of the seed round in November 2020, with contributors such as Primal Capital, Akatsuki’s Heart Driven Fund, and others. Subsequently, in January 2023, the company secured ¥1 billion in a round with notable participants, including Deepcore, Monex Ventures, Inclusion Japan, and Ikemori Venture Support.

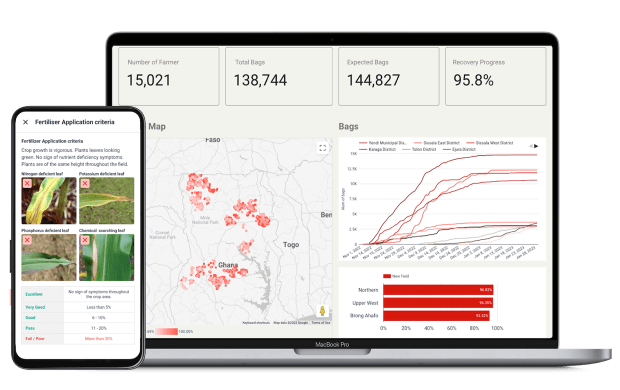

Since its establishment in 2018 by Doga Makiura, recognized by TED as “one of the 12 young people around the world in 2014,” Degas has been providing crucial financial services to over 46,000 small farmers in sub-Saharan Africa. Leveraging its mobile app and localized operations, the company addresses the financial needs of small farmers overlooked by traditional financial institutions, utilizing data collection and AI-based credit decisions.

The newly acquired funds will propel Degas towards its mission of expanding its existing farmer finance business and introducing two new initiatives. The company plans to recruit experts in carbon credits and data analysis to spearhead the decarbonization business, issuing high-quality carbon credits. Simultaneously, Degas aims to establish a marketplace for academic loans, farm machinery leasing, and mobile phone contracts.

Degas, with major offices in both Ghana and Japan, remains committed to its vision of empowering small farmers and fostering sustainable agricultural practices. The company’s innovative approach to financial inclusion and commitment to leveraging technology for positive social impact has garnered support from investors who share its dedication to making a meaningful difference in the lives of those in need.

A Look at Degas

Degas, founded in 2018 by Doga Makiura, is a Tokyo-based startup committed to improving the livelihoods of small farmers in sub-Saharan Africa. Through its mobile app and localized operations, Degas provides financial services to small farmers using data collection and AI-based credit decisions. The company aims to drive positive change by empowering small farmers and promoting sustainable agricultural practices.

Degas farmers Ghana

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard