Nigerian Fintech Startup OnePipe Secures $4.8M Debt Financing From TLG Capital

TLG Capital, a pan-African alternative investment business, declared that it has teamed up with OnePipe to offer finance services to Nigeria’s unorganised sector. OnePipe, a Nigerian financial infrastructure company, used the company’s technological platforms to enable traditional companies to integrate financial services into their operations. The company offered up to 2.25 billion Naira ($4.8M) in a collateralized loan facility for OnePipe.

The transaction, which represents TLG Capital’s 34th investment, was executed by the TLG Africa Growth Impact Fund (AGIF). Small retailers in Nigeria would receive inventory financing thanks to the investment.

read also Guinean Fintech Startup YMO Raises $3.1M To Scale In West Africa

OnePipe is a quickly expanding financial infrastructure business that enables retailers to obtain products from bigger distributors that partner with OnePipe on credit. The business has established a wide network of partners and field agents, including banks and payment service providers. Another impressive group of investors in OnePipe is the Norrsken Foundation, Techstars, Tribe Capital, V&R Associates, Canaan Partners, DFS Laboratories, Ingressive Capital, Acquity, Raba, Saison Capital, The Fund, and Two Culture Cap.

With the help of the investment from TLG Capital, OnePipe will be able to grow its business and work towards its goal of being Nigeria’s top supplier of financial services to small businesses. Almost 85% of employment in Africa, according to the International Labour Organization, comes from microbusinesses. Financial access to this industry is essential for promoting economic growth and eradicating poverty. The model developed by OnePipe is ideally suited to meet this requirement, and TLG Capital’s investment will assist in that endeavour.

Ope Adeoye, the CEO of OnePipe, said: “TLG’s extensive experience structuring debt in Nigeria and their deep network across Africa, particularly in the venture, made them the partner of choice as we look to scale. TLG is our first debt partner and has been a powerful resource in planning our growth and balance sheet strategy. Through this partnership, we’re looking to build the infrastructure to provide credit and payment services to the two-thirds of Nigerian business owners who don’t have access to effective and practical banking services.”

Isaac Marshall, an investment professional at TLG, said: “Despite contributing $220 billion per year in economic activity, micro-enterprises that deal in cash are Nigeria’s most neglected business segment. Fintechs tend to prefer more digitally integrated clients and traditional financiers tend to prefer bigger clients. With a clever product to help these small shops to obtain both credit and better purchasing terms on their goods, OnePipe has pioneered a model that can provide sustainable income growth to tens of millions of micro-enterprises.”

A number of Sustainable Development Goals, including SDG 1 (No Poverty), SDG 8 (Decent Work and Economic Growth), and SDG 9, are supported by TLG Capital’s investment in OnePipe (Industry, Innovation and Infrastructure). OnePipe supports economic growth and sustained income growth by extending financing to unregistered microbusinesses.

TLG Capital and OnePipe are thrilled to work together on this project and anticipate doing so in order to advance financial inclusion and economic development in Nigeria.

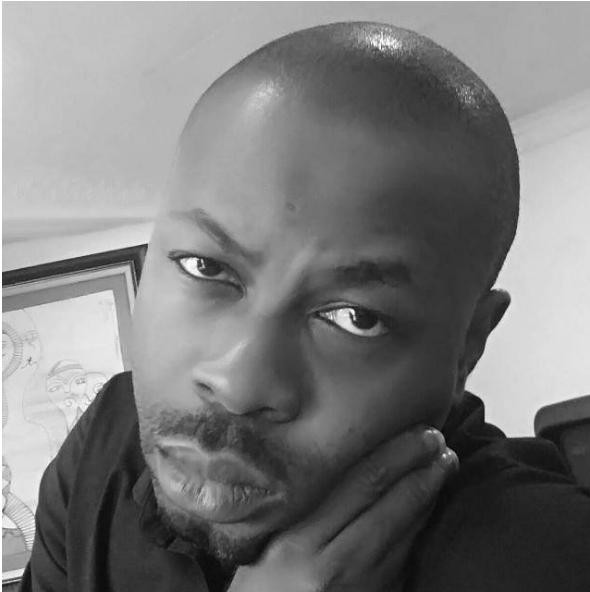

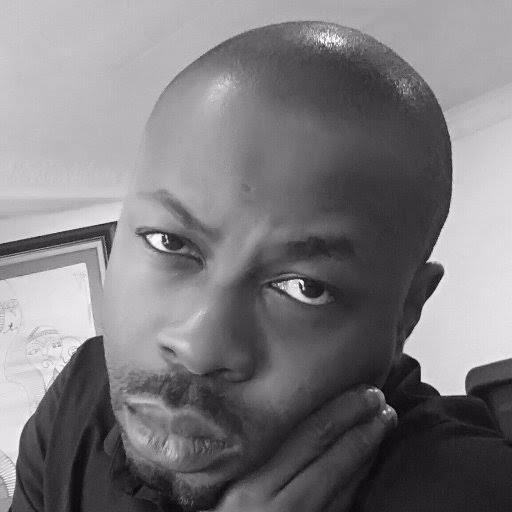

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard