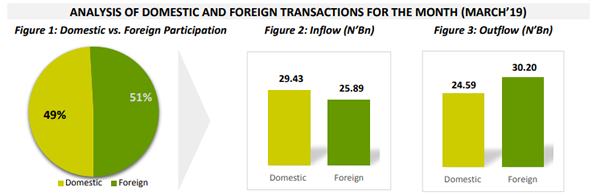

Foreign investors in Nigeria are dumping more of their shares in the country. The Nigerian Stock Market suffered foreign investment outflows of N41bn in April, compared to N30.20bn in the previous month.

This means that they have withdrawn N166bn in four months

A Breakdown of The Movement

- Data obtained from the Nigerian Stock Exchange on Thursday showed that that a total of N166.03bn was pulled out of the Nigerian Stock Exchange in the first four months of the year.

- While total transactions, whether domestic or foreign on the Nigerian Stock Exchange is put at N148.91bn (about $485.9m) in April, total foreign transactions increased by 37.13 per cent from N56.09bn in March 2019 to N76.92bn in April 2019, according to the NSE’s Domestic and Foreign Portfolio Investment Report for April.

- Total foreign outflows also increased by 38.34 per cent from N30.20bn to N41.78bn whilst foreign inflows increased by 35.76 per cent from N25.89bn to N35.15bn between March and April 2019, the NSE said,

- The NSE said the total value of transactions executed by foreign investors outperformed those executed by domestic investors by four per cent.

Foreign portfolio investment outflow includes sales transactions or liquidation of portfolio investments through the stock market, while the FPI inflow includes purchase transactions on the NSE (equities only).

- The report showed that the value of the domestic transactions executed by institutional investors’ outperformed retail investors by 18 per cent in April.

Charles Rapulu Udoh

Charles Rapulu Udoh, a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organisations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution and data analytics both in Nigeria and across the world.