Time for African tech startups to dust up their pitch decks ahead of a new African Startup Fund expected from September, 2019. A huge $100,000 investment sum for each startup is at stake here. Transsion is one of China’s largest phone makers, with brands such as Tekno, Infinix and Itel to its credit.

Here Is The Deal

- The investment would come by way of partnership, between Chinese mobile-phone and device maker Transsion Kenya-headquatered Wapi Capital.

- The fund would be designated specifically for early-stage African fintech startups, including adtech, fintech, e-commerce, logistics, and media and entertainment startups.

- The investment round is expected to start in September 2019.

- Through the partnership, Transsion will work with Wapi Capital to select early-stage African fintech companies for equity-based investments of up to $100,000.

- Investments for the new partnership will come from Transsion’s Future Hub, an incubator and seed fund for African startups opened by Transsion in 2019.

- Though an exact fund size hasn’t been disclosed, the Transsion Future Hub will also make startup investments on the continent in adtech, fintech, e-commerce, logistics, and media and entertainment, according to Li.

- The Wapi Capital fintech partnership is not Transsion’s only Venture Capital focus in Africa.

Wapi Capital won’t contribute funds to Transsion’s Africa investments, but will help determine the viability and scale of the startups, including due diligence and deal flow, according to Wapi Pay co-founder Eddie Ndichu.

How Startups Can Apply

In the meantime, interested startups based in any of the 54 countries in Africa can benefit from the investment round, by making a direct application to either organisations, preferably Wapi Capital since it is the partner saddled with the task of determining the viability and scale of the prospective African startups, including due diligence and deal flow.

Wapi Pay and Transsion Future Hub will consider ventures from all 54 African countries and interested startups can reach out directly to either organization, Ndichu confirmed.

Here Is Why Both Partners Are Worth Their Offer

Transsion

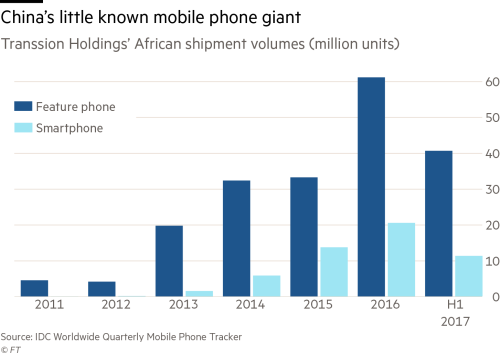

Transsion is the Shenzhen-headquartered top-seller of smartphones in Africa that recently confirmed its imminent IPO in which it could raise up to 3 billion yuan (or $426 million).

In fact, according to official records, the company sold about 124 million phones across the globe in 2018. From these sales, Transsion generated USD 3.9 Bn in revenue, a number with which only comes second to Samsung and ahead of Huawei, which is yet another Chinese phone maker, according to International Data Corporation stats.

Transsion has its R&D centers in Nigeria and Kenya and its sales network in Africa includes retail shops in Nigeria, Kenya, Tanzania, Ethiopia and Egypt. The company also has a manufacturing facility in Ethiopia.

Wapi Capital

Wapi Capital is the venture fund of Kenyan fintech startup Wapi Pay — a Nairobi based company that facilitates digital payments between African and Asia via mobile money or bank accounts.

Wapi Capital, by entering into partnership with Transsion has added to the list of African located and run venture funds.

Of course, inspired by this, Wapi Capital will also start making its own investments.

The fund is already looking to raise $1 million this year and $10 million over the next three years, according to Ndichu, who co-founded the fund and Wapi Pay with his twin brother Paul.

The Implication of This Partnership For Startup Funding

This move by Transsion into venture investing represents greater influence from China in African tech.

China’s engagement with African startups has been light compared to China’s deal-making on infrastructure and commodities.

Transsion’s Wapi Pay partnership is the second recent event — after Chinese owned Opera’s big venture spending in Nigeria — to reflect greater Chinese influence and investment in the continent’s digital scene.

Transsion Future Hub’s existing portfolio includes Africa focused browser company Phoenix, content aggregator Scoop, and music service Boomplay.

China’s influence in the African startup ecosystem has also been noted in Boomplay, a Spotify-style music and video streaming service for African music and Africa, which recently raised $20M, and Opera founded startup OPay which also raised $50M for mobile finance in Nigeria.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.