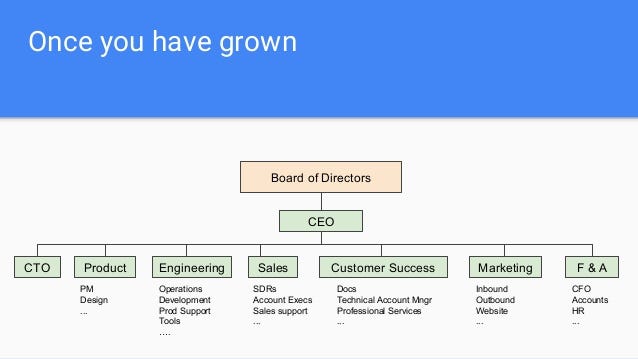

When you set up your startup company, be ready to allow more people onto it in the future. Indeed, once a startup resumes business and goes all out to look for investors, there is a high possibility that the ownership structure and stakes in the business might change. You may give up 30% of your ownership stakes in the venture to these investors. You may even be replaced as the CEO of the company or as a director on the board. How you allow these events to play out would not only determine the life span of your business but how fast the business accomplishes its goals.

Recall that Diamond Bank in Nigeria was recently acquired by Access Bank –much of the reasons for this is that Diamond Bank was not run properly, in accordance with the appropriate governance rules. So, running your startups would require that you put in place some strict measures of checks and balances among its management and on the affairs of the company to ensure that it does not die before it is due.

In Nigeria, the Code of Corporate Governance (recently updated to 2018) sets a guide on how you can effectively run your startup to ensure that it lasts for a reasonably longer time.

The essence of the Code of Corporate Governance is to ensure corporate accountability and business prosperity.

These rules do not have boundaries as they represent the best practices around the world.

Below Are A Few Points To Note About The Nigerian Code of Corporate Governance As It May Affect Your Startup

1. Your Startup Can Appoint Any Number of Persons To Be On Its Board

What this means is that you can appoint two or one hundred persons to sit on the Board of your company. The Board of Directors of company help in the management and running of the affairs of the company. In selecting Board Members for your startup company, you have to ensure that there is:

(a) Appropriate mix of knowledge, skills and experience, including the business, commercial and industry experience needed to govern the Company; (b) Appropriate mix of Executive, Non-Executive and Independent Non-Executive members such that majority of the Board are Non-Executive Directors. It is desirable that most of the Non-executive Directors are independent; c) need for a sufficient number of members that qualify to serve on the committees of the Board; (d) need to secure quorum at meetings; and (e) diversity targets relating to the composition of the Board.

2. No Member of The Board Has The Right To Dominate The Board’s Decision Making

To this effect, the positions of the Chairman of the Board and the Managing Director/Chief Executive Officer (MD/CEO) of the Company should be separate such that no person can combine the two positions

Again, the Chairman of the Board should not serve as chairman or member of any Board committee of your committees. The MD/CEO or an Executive Director should not serve as chairman of any Board committee. A person (or group of persons) who is not a serving Director of the Company should not exercise any influence or dominance over the Board and/or Management. Such a person or group of persons would be deemed a shadow director as defined by extant laws

3. You Can’t Be A Director In Another Company Without Disclosing it in The Present Board.

The Code states therefore that Prospective Directors should disclose memberships on other Boards, and current Directors should notify the Board of prospective appointments on other Boards. This information should be kept current by serving Board members.

The Board should also consider the disclosed directorships, taking into account the number of other directorships and the responsibilities held, and determine whether the individual can discharge his responsibilities and contribute effectively to the performance of the Board before recommending such a person for appointment or continued service

Consequently, Directors should not be members of Boards of competing companies to avoid conflict of interest, breach of confidentiality, diversion of corporate opportunity and divulgence of corporate information.

4. Directors Cannot be Appointed Without Informing the Shareholders

To this effect, Shareholders should be provided with biographical information of proposed Directors to guide their decision. Such information should include: a) name, age, qualifications, country of primary residence and the ownership interest represented, if any (b) whether the appointment is for ED, NED or INED, and any proposed specific area of responsibility or Board committee roles if any; © work experience and occupation; (d) current directorships and appointments; (e) direct and/or indirect shareholding in the Company and/or its subsidiaries; and(f) any other relevant information. Consequently, the Code requires the Company to state the processes used in relation to all Board appointments in its annual report.

5. The MD/CEO Or An Executive Director (ED) Should Not Go On To Be The Chairman Of The Same Company

If in very exceptional circumstances the Board decides that a former MD/CEO or an ED should become Chairman, a cool-off period of three years should be adopted. In any case, the Chairman of the Board should be a Non-Executive Director and not be involved in the day-to-day operations of the Company, which should be the primary responsibility of the MD/CEO and the management team.

6. The MD/CEO Should Not Be A Member Of The Committees Responsible For Remuneration, Audit, Or Nomination And Governance.

The Code also states that MD/CEO should declare any conflict of interest on appointment and annually thereafter. In the event that he becomes aware of any potential conflict of interest at any other point, he should disclose this to the Board at the first possible opportunity. Actions following disclosure should be subject to the Company’s Conflict of Interest Policy.

7. The Presence of An Independent Non-Executive Director In Your Startup Is To Bring Objectivity In The Running of The Affairs of The Company.

To this effect, An Independent Executive Director is a Non-Executive Director who does not possess a shareholding in the Company the value of which is material to the holder such as will impair his independence or in excess of 0.01% of the paid up capital of the Company. Again, the Independent Executive Director is not, or has not been an employee of the Company or group within the last five years;

He/she is not a close family member of any of the Company’s advisers, Directors, senior employees, consultants, auditors, creditors, suppliers, customers or substantial shareholders; He/she does not have, and has not had within the last five years, a material business relationship with the Company either directly, or as a partner, shareholder, Director or senior employee of a body that has, or has had, such a relationship with the Company; He/she has not served at directorate level or above at the Company’s regulator within the last three years.

8. Where The Startup Secretary Is An Employee Of The Company, He/She Should Be A Member Of Senior Management

Where such is the case, the secretary should be appointed through a rigorous selection process similar to that of new Directors.

9. The Board of Your Startup Shall Hold Its Meeting At Least Once Every Three Months in a Year.

The consequence of this is that the attendance record of Directors should be among the criteria for the reelection of a Director.

10. Only Directors may be Members of Board committees of the Board of Your Company

However, members of senior management may be required to attend committee meetings. Committees your company may have include:a) Committee responsible for Nomination and Governance b) Committee responsible for Remuneration c) Committee responsible for Audit, Committee responsible for Risk Management

Each of these committees should be composed of at least three members

11. The Board of Your Company Should Be Evaluated At Least Once In Three Years.

This process is called Board Evaluation.

It is for the Board to establish a system to undertake a formal and rigorous annual evaluation of its own performance, that of its committees, the Chairman and individual Directors. This process should be externally facilitated by an independent external consultant .

Bottom Line

These codes may be applied once your startup takes up fully and begins to accept equity investments from the general public, or once it begins making some substantial profit and growth. These rules do not have boundaries as they represent the best practices around the world. For the fuller rules click here.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world