Once Visa, the global payment giant , concludes its plan to pour over $200 million, representing about 20% ownership stake, Nigerian tech startup Interswitch would then be valued at as much as $1.5 billion, making it Africa’s second unicorn after Jumia. This would mark a watershed for the fintech startup that started its journey in 2002, even as it plans to list on London Stock Exchanges in its first ever IPO.

Here Is All You Need To Know

- According to UK’s Sky News’ reports, Global payments giant Visa is paying $200 million for 20% stake in Interswitch, Nigeria’s largest electronic payments company.

- With this investment, Interswitch would achieve a billion-dollar valuation 17-years after it was founded.

- While Visa’s stake purchase would confirm Interswitch’s unicorn status, the company was reportedly set to be valued at as much as $1.5 billion ahead of a planned IPO next year. The company’s previous plans for a 2016 IPO were scrapped amid a recession in Nigeria.

- Interswitch would not be the first Africa-focused tech company to achieve the billion-dollar so-called unicorn status.

- Jumia, the e-commerce company, led by a mix of international executives and investors listed for over $1.4 billion in April.

Why Visa Is Investing

This investment into Interswitch from Visa is the latest in a string of moves by global payments companies backing African fintech companies and seeking high-growth bets in emerging markets.

The fundamental importance of the services that fintech companies provide — from powering payments, facilitating savings and ensuring financial inclusion for the unbanked to tackling access to credit for small businesses and individuals — underlines why the sector holds long-term appeal for investors.

By most metrics, Interswitch represents significant value proposition given its established strength as an early-day and major player in financial technology with operations in over 20 African countries.

African fintech startups backed by global payments giants include Paystack Visa, Stripe (Aug. 2018)Flutterwave Mastercard (Oct. 2018)TalaPayPal (Oct. 2018)BranchVisa (April 2019)InterswitchVisa (Nov. 2019)

Read also: As Jumia Goes Public, Key Points Every Entrepreneur Should Know

A Look At Interswitch

Interswitch facilitates the exchange of value between service providers by providing a secure shared payment infrastructure and integrated message broker solutions for financial transactions, eCommerce, telecommunications value-added services, eBilling, payment collections, and disbursements. The company developed and administers Verve, the leading card scheme in Nigeria.

The Verve card, which is currently issued by banks in Nigeria, is the first and only chip and PIN card accepted across multiple payment channels including ATMs, Point of Sale (PoS) terminals, online, mobile and at banks, and enjoys the largest range of value-added services.

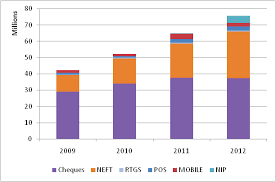

The company has been at the forefront of the development and growth of the e-payment sector in Nigeria, which is evidenced by its unique position of being the only switching and processing company connected to all banks in the country as well as to over 10,000 ATMs and 11,000 PoS terminals.

Aside from this, the company is the leading processor for MasterCard and the market leader in merchant acquiring/PoS, a segment that is still emerging and has the potential for tremendous growth in Nigeria.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world