SMEs in Kenya, Uganda and across other African countries can now pitch to 4G Capital which has raised a $2 million debt facility from Ceniarth LLC for lending to them. The investment, which is its second round of fundraising, brings the total raised to $4million.

“We have surpassed all key performance targets for 2019, and Ceniarth’s investment will help us meet the demands of our growing customer base and continue our positive impact into the future — a fantastic way to end a great year,” said Wayne Hennessy-Barrett, CEO and Founder of 4G Capital.

Here Is All You Need To Know

- 4G Capital will use the investment for onward lending to its growing customer base of informal micro, small and medium-sized enterprises across Kenya and Uganda.

Why The Investor Invested

“With this expansion comes great responsibility to ensure that customers understand and benefit from these services and are not exploited by providers focused more on growth than client impact. We are proud to support 4G Capital as a best-in-class financial lender that listens to the needs of the communities that it serves,” Diane Isenberg, Founder of Ceniarth said.

The firm and the investor share a fierce passion for improving conditions for the underserved and neglected businesses of the African economy by providing financial services that sustainably unlock potential and help communities.

A Look At What 4G Capital Does

- Since its inception in 2013, 4G Capital has lent over 750,000 loans valued at $90m.

- Over the last 12 months, revenue has increased by 97% and it has supported over 60,000 MSMEs.

- By the end of this year, the firm would have lent $43.6m, surpassing all expectations. Repayment rates remain above national averages, at over 94% (without refinancing).

- 4G Capital understands that small businesses benefit from a level of continuous support when handling credit. Therefore, the company offers customers a curriculum of enterprise and financial literacy training blended with appropriately sized working capital loans. This approach has seen 4G Capital’s customers increase their revenue by an average of 82% year on year.

‘‘We provide each client with a bespoke programme of business training which enables them to use the credit we provide to positively grow their business. We look at their current life and business stage to give them the relevant information to help them on their journey.

Conventional service providers see this as an insurmountable challenge. We see it as an opportunity to utilize data in ever smarter ways. Using our proprietorial machine learning system, we’ve found ways to use data from multiple sources to design credit products at scale which are optimized for segments, business risk, timescale and affordability,’’ 4G Capital noted on its website.

How To Apply For 4G Capital Loan

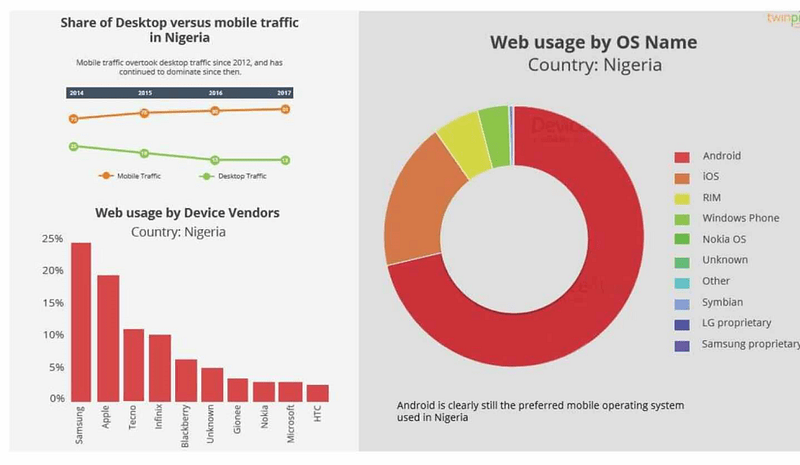

- 4G capital is a capacity-building microcredit company, with mobile network of field staff who use a tablet based credit management system to assess loan affordability through a predictive machine learning algorithm . The startup does not rely on third parties, whether Bank, internet or social media records .

- It disperses first loans within 24 hours directly to the customers phone via mobile money. Customers use the startup’s credit to purchase inventory to get the best deals and make strong profits.

- After repayment, customers can access repeat loans by SMS in under five minutes.

- Loans are combined with face-to-face training delivered by field staff who teach progressive micro lessons hosted on their tablets.

- Loan amounts can increase in line with customer business growth. The startup uses any type of mobile phone including text only feature phone to service both rural and urban markets.

- It reaches micro entrepreneurs who lack smartphones or internet access when the customer needs its and where the market opportunity is greatest.

For more enquiries, contact 4G Capital at contact@4g-capital.com or Phone Number +254712653826

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world