As 2019 gradually draws to a close, 2020 is looking more eventful for businesses existing in Nigeria. Apart from the fact that Nigeria just climbed places on the world’s Ease of Doing Business Index, the country has refused to open its land borders with neighboring countries, such as Benin Republic or Niger. Below, we look at the totality of policy changes and likely changes that may be coming into effect in the new year.

Payment of A New Value Added Tax(VAT)

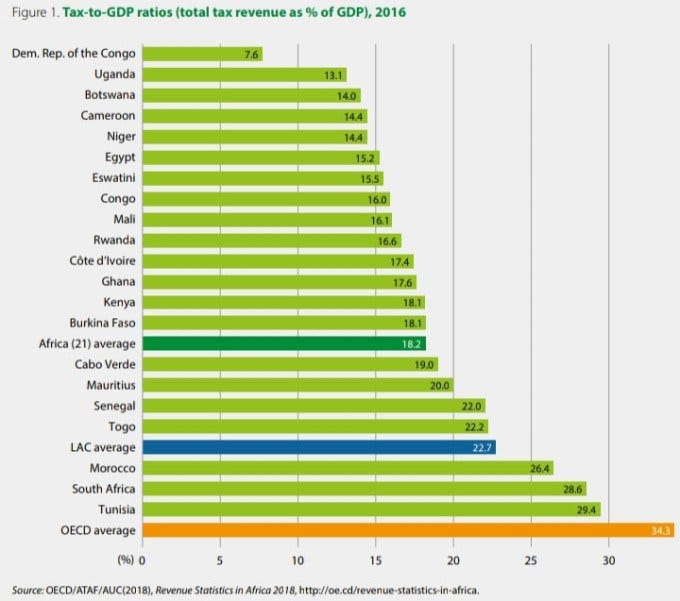

2020 is already looking like a tax year for Africa’s largest economy. From all indications, it appears government has cleared the way for an aggressive pursuit of taxation in the coming year to shore up the country’s dwindling revenue. Recall that Nigeria’s total public debt, which stood at N21.73tn as of December 31, 2017, rose to N25.7tn as of June 30, 2019, according to data from the Debt Management Office, and that the Nigerian Senate, the upper arm of the country parliament appears bent on putting a final approval seal on a $29.96 billion loan request put before it by President Muhammadu Buhari. Taxation may the new oil money come 2020. Currently, Nigeria’s tax-to-GDP ratio has remained at below 10% which is relatively lower when compared to the Sub-Saharan Africa (SSA) average of about 19 per cent.

Nigeria’s government appears also to have put enough strategies on ground towards increasing the tax revenue base of the country, including recently appointing a new head of Nigeria’s federal tax agency.

Prominent among the list of taxes to businesses should expect in 2020 is the Value Added Tax (VAT) which has been increased from its previous 5% to a new 7.5%. Although the Finance Bill which contains the 7.5% VAT increase has scaled parliamentary approval, assenting to the Bill by Nigeria’s President may be part of his new year gift to the country. The Finance Bill when signed into law would introduce the following changes to the Nigerian tax system:

- First off, the Bill will increase Value Added Tax in the country from its current 5% to 7.5%.

- Stamp duty on bank transfer made in Nigeria will now apply only on amount starting from N10,000, and above. However, transfers between the same owner’s accounts in the same bank are to be exempted from stamp duty.

- Dividend distributed from petroleum profits now to attract 10% withholding tax.

- Compensation for loss of employment below N10m to be exempted from Capital Gains Tax.

- VAT registration threshold of N25 million turnover in a calendar year to be introduced

- Any expense incurred to earn exempt income now specifically disallowed as a deduction against other taxable income.

Under the new Finance Bill also:

Small Businesses will not be taxed while early corporate tax payers receive tax deduction bonuses

- Small businesses with annual turnover of less than N25m will now be exempted from Companies Income Tax. However, to benefit from such incentive, such small businesses must first register for taxation in Nigeria and must continue to file tax returns during the period their profits are below the tax N25mn threshold

- A lower Corporate Income Tax rate of 20% ( as against 30%) will however apply to medium-sized companies with turnover between N25m and N100m, to benefit from such incentive, they must first register for taxation in Nigeria and must continue to file tax returns during the period their profits are between the N25m and N100m threshold.

- For companies or businesses that pay their tax dues early, a 2% deduction bonus on tax payable is given in the case of medium-sized companies between N25m and N100m and 1% deduction on payable tax is given for large companies from N100m and above.

Introduction of New Taxable Businesses In Nigeria

- The finance law also extends the scope of taxable businesses in Nigeria to include any digital media agency that transmits, emits or receives signals, sounds, images or data of any kind in Nigeria, including ecommerce companies, app store, online adverts, cloud computing services online payment platforms and so on, as long as the company has significant economic presence in Nigeria and profit can be attributable to such platforms.

- Also taxable in Nigeria under the new finance law would be outsourcing of foreign technical, management, consultancy or professional services to a person or company resident in Nigeria where the company has significant economic presence in Nigeria and profit can be attributable to such platforms.

Introduction of Tax Identification Number (TIN) For Personal Account Holders

Under the finance law, Nigerian banks are to request for Tax Identification Number (TIN) before opening bank accounts for individuals, while existing account holders (accounts opened before September 30, 2019) must provide their TIN to continue operating their accounts.

This is a major worry in a country where poverty rate is so high and financial inclusion rate so low.

Clampdown On Tax Defaulters In The Country

This would be the major highlight on taxation in Nigeria in 2020 as Nigerians would be watching to see how the federal tax authority executes this threat.

“The FIRS hereby informs all taxpayers (individuals, partnerships, enterprises, corporate organisations, ministries, departments and agencies) who are in default of payment of taxes arising from self-assessment, tax audit, tax investigation, transfer pricing audit, demand notices and any other liabilities, that the service will commence a nationwide tax enforcement exercise from December 18, 2019 with a view to prosecuting defaulters and recovering all outstanding tax liabilities.

“The taxes referred to are as follows: 1. Petroleum Profits Tax; 2. Companies Income Tax; 3. Value Added Tax; 4. Withholding Tax; 5. Tertiary Education Tax; 6. NITDA Levy; 7. Stamp Duty; 8. Capital Gains Tax,” a notice issued by the FIRS read.

Given that the Public Notice provides a seven-day time frame for compliance, it is safe to say that Nigerian tax defaulters may wake up in 2020 having the taxman axing its way to their doorsteps.

FIRS targets to generate between N750 billion and N1 trillion from the clampdown, which includes closure of defaulters’ bank accounts.

Digital Media Tax or Internet Tax

Interestingly, Nigeria’s Federal Inland Revenue Service, the national tax man may most likely push forward with its agenda to tax digital services, especially as the new Finance Bill has widened the base of taxable businesses in Nigeria to include, among many other qualifications, any digital media agency that transmits, emits or receives signals, sounds, images or data of any kind in Nigeria, including ecommerce companies, app store, online adverts, cloud computing services online payment platforms and so on, as long as the company has significant economic presence in Nigeria and profit can be attributable to such platforms.

If the Finance Bill goes ahead to win the President’s assent, this will be a deal breaker for online stores in Nigeria. So all startups and businesses in Nigeria that derive their revenue from the internet should get ready to pay 7.5% Value Added Tax on goods and services they sell online. Hard day also for online purchasers in the country. Expect an extra deduction each time you purchase goods or services online, local or international, if the FIRS pull the trigger.

“I am sure that when you order things online, you don’t often pay any VAT and this has two negative effects,’’ Nigeria’s outgone FIRS head stated on the sidelines of the third annual meeting of the Nigerian Tax Research Network held in Abuja recently.

“The number one is that the shop owner who pays rents, who has a staff, is at a disadvantage and if care is not taken, everybody will start ordering online and it will be delivered at their houses without any tax payment.

“We are going to try and address that by January of 2020.”

9% Communication Service Tax

The ‘Communication Tax Bill, 2019, which has scaled through the first reading in Parliament looks like the likely ambush that would shore up Nigeria’s revenue base in the coming year. The Communication Service Tax Bill provides that the rate of the tax is 9% of the charge for the use of the communication service. The Bill provides among other things that:

- There shall be imposed, charged payable and collected a monthly Communication Service Tax to be levied on charges payable by a user of an Electronic Communication Service other than private Electronic Communication Services.

- The tax shall be levied on Electronic Communication Services supplied by Service Providers.

- The tax shall be paid together with the Electronic Communication Service charge payable to the service provider by the consumer of the service.

- The tax is due and payable on any supply of Electronic Communication Service within the time period specified under sub-clause (5) of whether or not the person making the supply is permitted or authorized provide Electronic Communication Services.

- The Federal Inland Revenue Service (FIRS) established under section 1 of the Federal Inland Revenue Service (Establishment) Act, 2007 shall be responsible for collection and remittance of tax, any interest and penalty paid under this Bill.

- The return and the tax due to the accounting period to which the tax return relates shall be submitted and paid to the FIRS not later than the last working day of the month immediately after the month to which the tax return and payment relates.

- Under the Bill, any service provider who without justification fails to submit to the FIRS the tax return by the date is liable to a pecuniary penalty of N50, 000.00 and a further penalty of N10, 000.00 for each day the return is not submitted.

More Savings From Bank charges and Fees

If your business relies on ATM to make withdrawals from Nigerian banks, it is most likely to save some NGN1590 over the course of the 53 weeks that make up 2020, thanks to the sweeping reforms introduced on 2019’s Christmas eve by the Central Bank of Nigeria. Below are some of the changes made to the current charges being incurred by bank customers in Nigeria.

- Bank customers would now pay N10 for electronic transfers below N5,000, and N25 for electronic transfer between N5,000 and N50,000. Only electronic transfer above N50,000 will attract N50 charge. Previously, bank customers pay N50 charge for electronic transfers below N500,000.

- The guide also slashed charges for cash withdrawal via Other bank’s ATM to maximum of N35 after the third withdrawal within the same month from “N65 after the third withdrawal within the same month.

- The new guidelines include the removal of Card Maintenance Fee (CAMF) on all cards linked to current accounts.

- There would be also be a maximum of one Naira per mille for customer induced debit transactions to third parties and transfers or lodgements to the customers’ account in other banks on current accounts only.

- Other reductions include Advance Payment Guarantee (APG), now pegged at maximum of one per cent of the APG value in the first year and 0.5 per cent for subsequent years on contingent liabilities..

- The new guide also stipulates a one-off charge of N1,000 applied to the issuance of cards, irrespective of card type regular or premium.

- The same one-off charge of N1,000 applies for the replacement of debit cards at the customer’s instance for lost or damaged cards.

- Upon expiry of existing cards, customers are to pay the same one-off charge of N1,000 irrespective of card type and no charge should be required for pre-paid card loading or unloading.

- For cards linked to savings account, the maintenance fee has been reduced to a maximum of N50 per quarter from N50 per month amounting to only N200 per annum instead of N600.

- Under the new guidelines, there would be no more charges for reactivation or closure of accounts such as savings, current and domiciliary accounts while status enquiry at the request of the customer like confirmation letter, letter of non-indebtedness and reference letter would now attract a fee of N500 per request.

- On Card Maintenance Fee (CAMF), the guide expressly states that this would be applicable only to current accounts in respect of customer-induced debit transactions to third parties and debit transfers and lodgments to the customer’s account in another bank. It emphasises that CAMF is not applicable to Savings Accounts.

- The guide also emphasises that failure by any bank to comply with CBN’s directive in respect of any infraction shall attract a further penalty of N2,000,000 daily until the directive is complied with or as may be determined by the CBN from time to time.

- To this effect, CBN, has directed banks to log every complaint received from their customers into the Consumer Complaints Management System (CCMS) in addition to generating a unique reference code for each complaint lodged, which must be given to the customer. Failure to log and provide the code to the customer will amount to a breach and is sanctionable with a penalty of N1,000,000 per breach.

Mr Isaac Okorafor, the CBN Director, Corporate Communications Department, said the guidelines would take effect from Jan. 1, 2020.

Nigeria May Open Its Closed Land Borders With Its Neighbours

There are already indications that Nigeria’s closed land borders may be opened in early 2020. Nigeria’s Federal Government has, however, said the decision to reopen the nations’ land boarders will be in strict compliance with the Economic Community of West Africa States (ECOWAS) regional trade protocol agreements.

‘‘We had a strategic meeting with the three countries, and what we agreed with our neighbours is to activate a joint border patrol, and the border patrol comprises the Customs, all the security agencies and ensure to try to follow the actual protocol laid by ECOWAS.

“The committee met on November 25, and it is only when that committee is certain that all the countries are respecting the ECOWAS protocol that they will recommend a day for the opening of the border.

“Government has opened talks with Jaiz Bank Plc, and Small and Medium Development Enterprises, to initiate schemes that will engage women who do little businesses along the border sides,’’ Minister of State for Industry, Trade and Investment, Mariam Katagum, said at a news conference in Abuja recently.

Nigerians May Get Visa On Arrival In More African Countries

As Nigeria prepares to welcome more nationals from other African countries from January, 2020, the country would also be expecting reciprocity from other African countries. Although Nigeria’s President, Mohammed Buhari gave a hint about the plan while attending a peace and development summit in Egypt, the Nigeria Immigration Service (NIS) has notified the general public that it has gotten a go-ahead order to issue visa on arrival all Africans coming to Nigeria without Visa from January 2020.

An interesting dimension to all this is a provision in the Nigerian Immigration Act that authorizes the minister to order the abolition or suspension of the requirement in Nigeria of a visa or other entry permit by nationals of that other country, where the Minister is satisfied that the Government of any other country or a Minister thereof permits the entry of citizens of Nigeria into that country without requiring a visa or other entry permit.

So, Nigerians would most likely get the opportunity to travel freely across Africa. Facts indicate that the more a country is visa open, the more other countries would more likely be willing to be visa open towards them too.

Trading Begins Under The AfCFTA Agreement 1 July 2020, A Huge Opportunity For Nigerian Businesses and Startups To Fly Freely All Over Africa

2020 also promises to be a historic year for the whole of Africa as the continent gets ready to record its first ever trading under the AfCFTA agreement. The operational phase of the AfCFTA was launched during the 12th Extraordinary Session of the Assembly of the African Union in Niamey, Niger on 7 July 2019. The AfCFTA will be governed by five operational instruments, i.e. the Rules of Origin; the online negotiating forum; the monitoring and elimination of non-tariff barriers; a digital payments system and the African Trade Observatory.

AfCFTA is an opportunity for countries and companies to help each other grow, as they have done in other regions. But trade liberalization has the potential to damage the poorest within those countries, which is why it is so important to have supportive policies. The speakers laid out several challenges and solutions.

President Muhammadu Buhari has inaugurated the National Action Committee (NAC) for implementation of the African Continental Free Trade Area (AfCFTA) Agreement.

In July 2019, President Buhari approved the establishment of the committee with the mandate to undertake a process of engagement with stakeholders to sensitize them on the opportunities and challenges of the AfCFTA.

The committee is made up of representatives of Ministries and Agencies with competent and relevant jurisdiction, and selected stakeholder groups from the private sector and the civil society

Comments

From the facts and figures above, 2020 would be relatively tough for Nigerian businesses as they try to fit into the new tax regime. This also would be the first year in a long time Nigerians would be required to present their TAX Ids before opening their bank accounts. This writer foresees an aggressive pursuit of taxes by government and increased prosecution of tax offenders.

On the other hand, those who are ambitious enough may tap into the larger African market through the opportunity offered by AfCFTA.

The best natural advice should be to plan ahead by arranging for expert tax lawyers or tax consultants.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world