Amid the coronavirus pandemic, Zoom is proving that there is not much difference between physical work places and offices existing on the internet. It was as if investors in the startup during its recent Initial Public Offering (IPO) saw this future on time. In the midst of the raging tumbling down of several stock markets across the world, Zoom Video Communication saw its shares rise almost 2% after the market closed. Earlier, the company’s stock rose 22% as investors went for stocks that could see positive developments as more people work from home because of the coronavirus. The stock was trading at more than double the price that it did at the end of January. Zoom’s success shows some deep insights about going to market in a crowded space and doing so well.

As a matter of fact, even before this time, Zoom made $7.5 million in profit in 2018 alone, making it the rare technology IPO that is profitable.

Here are the reasons we think Zoom’s success story stands out.

1. Zoom is the Not The First Video Conferencing App

Before Zoom came into full operations in 2013, there are other video-conferencing app on the web-conferencing market. There is the BlueJeans which was founded in 2009; Lifesize which was founded in 2003; Adobe Connect, formerly Macromedia, which was released in 2012. CyberLink U Meeting, a Taiwanese multimedia software company, founded in 1996, even Skype among others.These companies are already players who have pitched their tents both in broad and niche industry areas.

2 Zoom Is A Simple Product

With Zoom, you can start or join a 100-person meeting with crystal-clear, face-to-face video, high quality screen sharing, and instant messaging — for free! The Award winning Zoom brings video conferencing, online meetings and group messaging into one easy-to-use application. Zoom platform offers a simple and consistent user experience across all meeting spaces whether it is on desktops, executive offices, open spaces, huddle rooms, and large conference rooms or on phones. This unified platform makes it possible for multiple use cases such as online meetings, large marketing and training webinars, business chat/instant messaging and presence, file sharing, and integration with third-party platforms to happen. Thus, Zoom’s strategy is to provide a product that can offer various similar services. Video conference is one, but meetings and webinars and others are another.

3. Freemium Helped Zoom to Spread Its Message Faster

With Zoom, Eric Yuan was out to test his product and it worked! Zoom’s video conferencing features are free for everyone to use. Pegging its 40 minutes conferencing limit is also as a result of intense research efforts. Zoom came down to the 40 minutes limits because it learned through the research that 45 minutes was the standard duration people are willing to go for in a video conference.

Even with the 40 minutes limit, people have gone ahead to use their freemium model. Apart from Freemium model, Zoom has also used reward for word-of-mouth recommendations from customers to power up their customer acquisition.

In our case, we really want to get the customers to test our product. This market is extremely crowded. It’s really hard to tell customers, “You’ve got to try Zoom.” Without a freemium product, I think you’re going to lose the opportunity to let many users to test your products.

We make our freemium product work so well. We give most of our features for free and one-to-one is no limitation. That’s why almost every day there are so many users coming to our website, free users. If they like our product, very soon they are going to pay for the subscription.

This approach has resulted to:

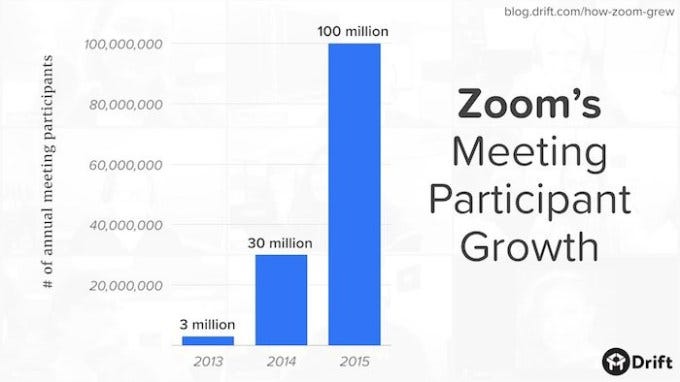

Over 3 million people participating in a Zoom meeting in 2013 alone. The number increased to 30 million in 2014, 100 million in 2015, and over 1 million participants every single day.

4. With Zoom’s Success, Horizontal Saas Has Worked.

As a SaaS program, Zoom meetings are hosted software services, meaning it permits users access to the video conference software , to use the program over the internet instead of having to host the software program on the company’s own server. The horizontal model means that a lot of other similar services, across different industries could be provided using Zoom. In this case, it is the responsibility of Zoom to maintain and update the software, as well as maintain their server to host meetings. Zoom also provides security for this process and ensure that the software is executed regularly. This reduces the cost of hosting online meetings for businesses, and makes Zoom meetings ideal for hosting small business video meetings.

Zoom also makes it possible for the host to not to worry about the technical aspects of the software, and focus instead on planning and hosting the meeting.

Related: Beyond Eric Yuan’s Zoom: How He Went Out All Alone

Zoom’s success at its first IPO shows that horizontal Saas has indeed worked. Concur, the first Saas company to go public could not go beyond the crash of 2001.

5. Zoom is Empowering other AI platforms like Fireflies.ai

With Zoom, other AI platforms are becoming integrated to the whole video conferencing experience. Fireflies.ai recently launched a conversational AI web app that transcribes meetings, highlights portions worthy of keeping in your notes, identifies call participants, and even automates assignments doled out in a meeting. The Fireflies service is integrated with a number of workplace communication apps including Slack, Skype for Business, Zoom, BlueJeans, and Google Hangouts Meet, and it can log notes in CRM systems like HubSpot and Salesforce. Fireflies can be invited to join your calendar to automatically record calls, but can also transcribe and offer insights from prerecorded audio. It is not likely that these AI platforms would want Zoom, and other similar brands to go soon. They would have to join in blowing the trumpet.

These are reasons Zoom is an unrelenting product of the future.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.

He could be contacted at udohrapulu@gmail.com