Today is an industry-changing day for fintech startups in Tunisia as they have finally gotten the go-ahead of the Tunisian government to build any financial technology business models they want under loose regulations or supervision (regulatory sandbox) of the government. This is a major threat to traditional banking institutions as major disruptions look to becoming their ways. Today, the Central Bank of Tunisia (BCT) has officially launched the BCT-fintech website which, as its name suggests, will be entirely dedicated to “technological finance”.

“Due to technological changes in the recent years, many professions within the bank have disappeared and others have emerged. It is now necessary to keep up with this technological development and give the Fintech the opportunity to develop, while strengthening the regulatory framework and facilitating access to financing,” said the Tunisian Professional Association of Banks Hadj Kouider

Here Is What You Need To Know

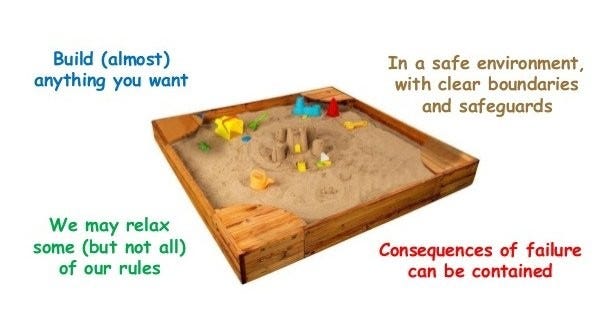

- The latest move makes Tunisia the first country in North Africa to launch a Regulatory Sandbox which is part of efforts to digitise and improve the banking process.

“The Sandbox is an opportunity for dozens of fintech companies to test their technological solutions and understand the regulatory requirements in force, in order to promote a financial services’ offer adapted to the needs of the market,” Minister of Communication Technologies and Digital Economy Anouar Maarouf said.

- Theoretically speaking, the objective of the regulatory sandbox is to support Tunisian fintechs in the development of their products, in a country where credit cards are not approved for transactions in currencies other than the country’s dinar and therefore cannot be used for purchases made on foreign commercial internet sites. Debit and credit cards can therefore only be used for domestic internet payment for services.

- The new BCT-fintech website will allow, among other things, labeled Tunisian start-ups to develop their activities in Tunisia in a more flexible regulatory framework, without being forced to leave their country to settle abroad.

“It is a synergy between the world of innovation and regulation that must surely change,” said BCT Governor Marouane Abassi at the launch ceremony.

“The objective is to ensure inclusion and financial innovation and change the banking model by moving towards the restructuring and digitalisation of banks, to change the ecosystem quickly,” he indicated, pointing out that the year 2020–2021 must be the year of the knowledge economy.

Read also: 200 Nigerian Startups Selected For Forbes Nigeria’s First Digital Startup Accelerator

Presence Of Stiff Laws And Regulations Have Stifled Innovative Financial Business Models In Tunisia

Till now, most Tunisian banks allow account holders to use bank-affiliated credit and debit cards to make domestic online purchases denominated in dinars. The Tunisian dinar is a non-convertible currency, so on-line purchases in foreign currency are not allowed, and few Tunisians make cross-border purchases via eCommerce.

The general lack of credit cards and online payment systems has resulted in Tunisia’s eCommerce markets remaining largely local, with online orders paid for with cash on delivery.

Most Tunisian banks offer account holders bank-affiliated credit and debit cards that can be used on domestic websites only.

General purpose eCommerce retail sites similar to Amazon do not exist in Tunisia, but rather individual retailers and service providers offer their own online checkout systems tailored to Tunisian credit and debit cards.

However, the passage of the Tunisian Startup Act by the country’s government has resulted in some sweeping regulatory changes to the Tunisian innovation landscape. For instance, the country’s central bank has recently outlined a procedure for qualified companies to open hard currency accounts.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer