Barring any last minute changes, all venture capital investors in Kenya, who get their funds from public funds, will have all their investment into Kenyan startups scrutinized under a proposed new amendment to the country’s Capital Market Authority law. This would affect venture capital firms’ operations especially those based in Kenya whose only access to funds is from public sources such as pension funds, etc. Also to be affected are private equity (PE) funds.

“In 2015, the investment guidelines under the retirement benefits regulations were amended to allow pension schemes to invest up to 10 per cent of their assets in private equity funds and venture capital funds which are licensed by the Capital Markets Authority (CMA). However, the Capital Markets Act was not amended to provide for regulations of these private equity and the venture capital. In this regard, I have proposed amendments to the Capital Market Act to provide for the regulation of private equity and venture capital companies by the Authority,’’ Kenya’s National Treasury Cabinet Secretary Ukur Yatani said in in his 2020/2021 Budget Statement before parliament.

Here Is What You Need To Know

- Under the proposed amendment to the the Capital Markets Act (Cap 485A), Capital Markets Authority in Kenya will, once the bill is passed into law, now be authorised to license, approve and regulate private equity and venture capital companies that have access to public funds.

- If the amendment is passed by Parliament, CMA will have the powers to scrutinise the books of firms that have attracted resources from public funds considering that pension schemes investments in PE firms has been on a growth trajectory in recent years. Kenya has allowed PE firms to fund raise from pension schemes after amending the Retirements Benefits Authority (RBA) Act allowing schemes to invest up to 10 per cent of their assets in the firms.

- The firms through their lobby group, the East Africa Private Equity and Venture Capital Association (EAVCA), have since gone ahead to oppose the proposal to be regulated by the CMA on the basis that it will amount to “overregulation” given that pension schemes are regulated by Kenya’s Retirement Benefits Authority (RBA).

“If the proposal is passed PE firms will not have the incentive to raise funds locally from pension schemes,” said Eva Warigia, EAVCA executive director.

Read also: Why More South African Startups Have Raised Funds This Year

The Implication Of This For Startups In Kenya

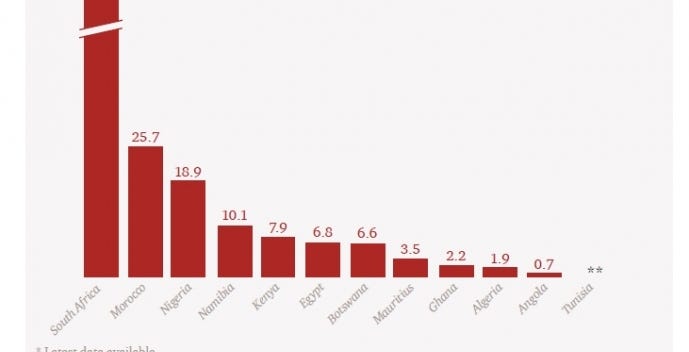

The new law will definitely be life-changing for startups in Kenya, given that Kenya has always attracted a majority of all startup investment in the whole of Africa. In fact in 2017, Kenya was only second to South Africa in terms of total startup funding in Africa by country (a staggering $147 million). The regulation proposed for the Capital Markets Authority of Kenya, over venture capital and private equity funds having access to public funds, by the country’s government would mostly likely result in over-regulation as well as increase in fees and cost of doing business for the investment firms. This is especially as they are already playing in a risk-ridden sector. The bottom line of this could be migration to lower-risk countries like Mauritius or reduction in the number of investment deals concluded on Kenyan businesses by the firms.

From a public policy point of view, the proposal attempts to place a check on access to public funds as well as demand greater accountability on the use of public funds, especially where there could be instances of conflicts of interest in the management of resources by the investment firms. In December 2016, Kenya’s Retirement Benefits Authority then CEO Edward Odundo said Kenya’s pension industry would be KES1trn ($9.8bn) by the end of that month.

One could nevertheless ask what the functions of Retirement Benefits Authority in Kenya are under the law establishing it. For one thing, Section 5(a) of Kenya’s Retirement Benefits Act already empowers the country’s Retirement Benefits Authority to regulate and supervise the establishment and management of retirement benefits schemes. It also vests in the Authority the powers to investigate a manager, custodian, trustee or an administrator who may have engaged in embezzlement, fraud, misfeasance or other misconduct in connection with activities related to pension fund administration in Kenya.

Perhaps the proposed new amendment to the CMA law aims to cast a wider net over all public funds in Kenya made available to private equity funds or venture capital firms in Kenya, and not pension funds alone.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.