Startups in Tunisia can now legally raise funds through crowdfunding, courtesy of a new crowdfunding law. With a majority 127 votes to no opposition or abstention, the country’s parliament, the Assembly of the Representatives of the People (ARP), has finally passed the bill on crowdfunding into law. The law was on January 31st 2020, sent in to the parliament by the country’s Council of Ministers for final adoption. The implication of this adoption is therefore that the bill has finally become law, and is now available to the country’s startups to utilise.

“This law will solve some of the economic problems that the country is going through, by introducing new means of financing projects,” said Iadh Elloumi, chairman of the finance, planning and development committee, at the end of the plenary meeting.

Here Is What You Need To Know

- Members of parliament voted for the law, which has 65 articles, in its entirety.

- Tagged bill n ° 26 of the year 2020, the new crowdfunding law aims to organize the activity of crowdfunding in order to provide the necessary financing for projects and companies in order to stimulate investment.

- The finance, planning and development committee under the ARP, the BCT and the CMF have however agreed to set up a funding control mechanism in order to fight against suspicious funding which the new law would occasion.

- According to the Tunisian Minister of Industry and SMEs, Slim Feriani, early February 2020, the new law is a new mechanism for alternative financing for startups in Tunisia. He said the law meets international standards and can support investment.

‘‘Despite the financial facilities granted by the State to SMEs to cover their financial needs, the SMEs often encounter enormous difficulties in accessing finance, which hinders their development and threatens their sustainability,’’ he said.

- The two types of crowdfunding under the law are equity crowdfunding which will help finance the capital of startups and innovative projects lacking equity; and one which is based on the granting of loans.

- Funding through donations was also added to the crowdfunding law before final adoption by Tunisia ‘s parliament.

- Slim Feriani also highlighted the role of the Tunisian Agency for the Promotion of Industry and Innovation (APII) which, in coordination with the European Union, had helped to set up the new mechanism in the spirit of improving the Tunisian business climate and by the way of also improving Tunisia’s ranking on the World Bank Ease of Doing business index.

- The legal framework for the law, especially as it regards the management of funds from small investors was developed partly by the Tunisian Union of Industry, Commerce and Handicrafts (UTICA) and CONECT.

- The Global Crowdfunding market was valued at 10.2 billion USD in 2018 and is expected to reach 28.8 billion USD by the end of 2025, growing at a CAGR of 16% between 2018 and 2025.

Read also: Nigeria Proposes Its First Ever Crowdfunding Regulation: Here Is What It Looks Like

Understanding How Crowdfunding Works

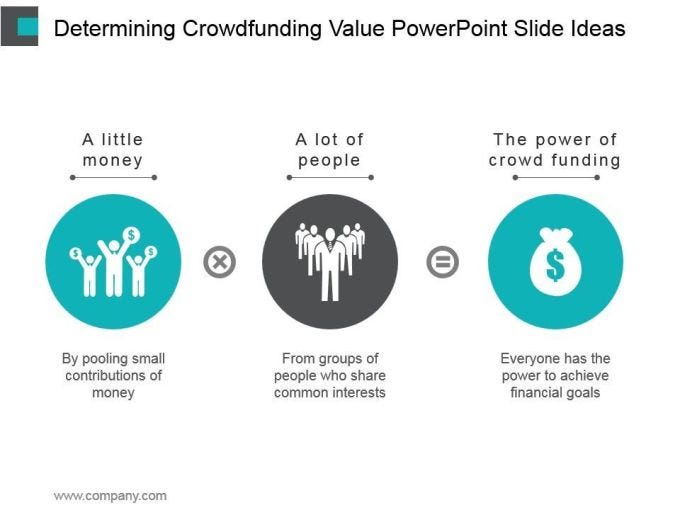

Crowdfunding refers to raising money from the public (who collectively form the “crowd”) primarily through online forums and social media.

Crowdfunding models include: Donation-based crowdfunding (in which donors are not typically granted anything in return for their donation)

Rewards-based crowdfunding (in which backers contribute funds in exchange for some reward–in many cases the item produced by the campaign)

Equity crowdfunding (Equity crowdfunding refers to raising money from small public investors (who collectively form the “crowd”) primarily through online forums and social media. In exchange for relatively small amounts of cash, investors get a proportionate slice of equity in a business venture).

Debt/lending crowdfunding (in which lenders provide money and expect their loan to be paid back with interest).

Crowdfunding means, according to the said law, a financing formula based on the collection of funds from the public, through a platform on the Internet, reserved for this purpose, in order to finance projects and companies.

The interventions of the deputies revolved around the scope of the said law, given that it represents one of the financing tools for small and medium-sized enterprises.

It should be noted that crowdfunding is considered to be a new mechanism for the development of investment and the creation of businesses. This law comes after the adoption of the bill on the solidarity and social economy.

As a reminder, this committee held hearing sessions with the Minister of Industry and SMEs and representatives of the BCT and the CMF, to examine the bill made up of 65 articles after having been 56 articles during its presentation.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.