No more parallel exchange rate in Zimbabwe as a new set of regulations have been approved to compel businesses in the country to use a single exchange rate for pricing goods and services as the country seeks to control surging costs.

“Any person who provides goods or services in Zimbabwe shall display, quote or offer the price for such goods or services in both Zimbabwe dollar and foreign currency at the ruling exchange rate,” the government said in gazette on Friday.

Here Is What You Need To Know

- Anybody who fails to comply with the new regulations will face fines.

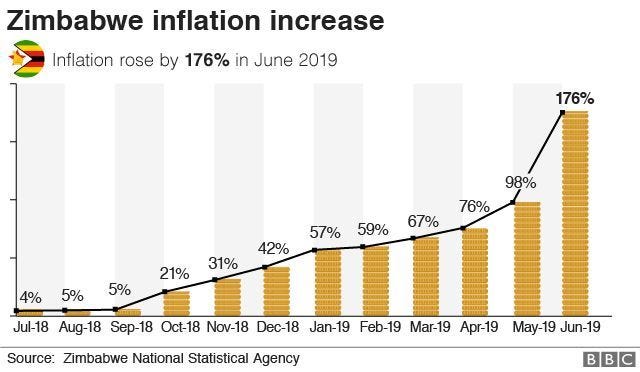

- The Zimbabwe dollar has weakened to 72.14 per U.S. dollar on its new foreign currency auction system after a currency peg of 25 was dropped last month. Rates on the parallel market are weaker in the southern African nation, where inflation has climbed to 737% and food and fuel are in short supply.

Read also: Zimbabwe Suspends Mobile Banking, Stock Exchange Trade

- John Mangudya, the central bank governor, has previously said some businesses were using parallel exchange rates of as much as 100 per U.S. dollar when pricing goods and services, even after getting foreign exchange through the weekly auction.

- On June 26, government announced the suspension of transactions on phone-based mobile money platforms and suspended trading on ZSE as part of a series of “prudent and coordinated interventions to deal with malpractices, criminality and economic sabotage” amid allegations the platforms were fueling the rout of the local currency.

- Government spokesperson Nick Mangwana alleged there were “fake counters” on ZSE which are epitomized by the Old Mutual Implied Exchange rate (OMIR).

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer