Within a remarkably short period of time, Nigerian API startup Mono has secured $500k pre-seed funding round to further build out its platform.

“We’re extremely proud of the team’s relentless work…and passion to get to this point. It’s really amazing seeing all the great things that can be achieved with a small, agile, passionate, talented and driven team,” the startup noted in a statement.

Here Is What You Need To Know

- Investors in this round include Lateral Capital ( Investors in Appzone, Asoko Insights), Ventures Platform (early backer of Paystack, Kudi etc) and Golden Palm ( Investors in Andela, Flutterwave), Rally cap, Idriss bello (Early investor in Flutterwave and Andela), Olumide Soyombo, and other amazing strategic investors.

- With this new funding, the startup will primarily invest in the following:

- Continue its product efforts to expand coverage of our Data API to include more sources (USSD) and countries; launch Direct debit in partnership with Payment gateways; develop new API verticals and developer tools; hire the core team.

Why The Investors Invested

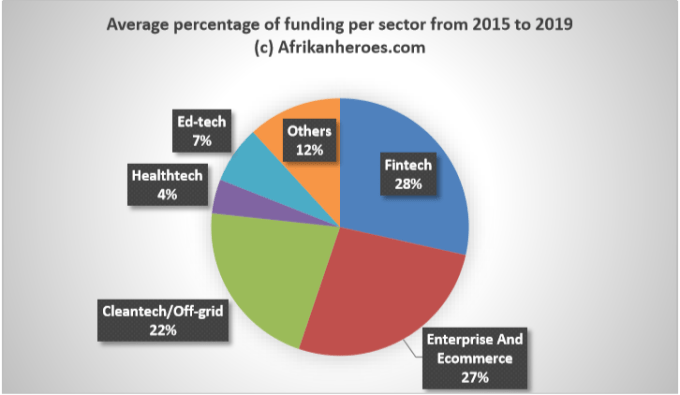

The first call of most VC investments in Africa has always been in the fintech sector. In 2019 alone, out of a total of 250 deals amounting to a record-breaking $2.02 billion reported by data firm Partech, financial technology companies (fintechs), at 41%, received the lion share of the whole investment sum. It is therefore no surprise that the investors chose Mono now. This is even strengthened more by the fact that a majority of the VCs in Mono’s latest round, including Lateral Capital, Ventures Platform and Golden Palm Rally cap have their portofolios mostly made up of successful fintech startups. Also strengthening its pitch to investors is the fact that even though the startup is playing in a relatively saturated ecosystem — fintech — it is carving out a niche for itself, by going the API way. In April 2020, Okra, a similar API fintech platform, led by Fara Ashiru Jituboh and David Peterside, became the first African API startup to raise $1 million from heavy weight VC TLcom Capital, which is also a previous investor in Nigerian edtech startup uLesson and Kenyan agritech startup Twiga Foods.

Again, the investment was also helped by the fact that Mono’s founders have themselves previously founded successful startups.

“This is the beginning of a love story,” Kyane Kassiri of Lateral Capital tweeted. “Excited to announce that @lateralcap is joining the @mono_HQ journey as its first institutional investor. @ijbkid and @whoisprakhar are tackling a massive opportunity in the API economy request beta access now -> http://withmono.com.”

A Look At What The Startup Does

Launched in August 2020 by Abdulhamid Hassan, ex-Product Manager, Paystack and the Indian Prakhar Singh, who previously founded Transferpay.ng, Mono enables companies and developers to access financial accounts for historical and real-time transactions, balances, bank statements, credits, and spending patterns of a customer.

“In past 2 months, we’ve been able to build our MVP, connect with over 16 financial institutions in Nigeria, launched the easiest way to retrieve bank statements with customers and work with amazing clients like Carbon, Anyihealth, Swipe and dozens of developers,” the startup further noted in the statement.

Mono claims to currently exist in Nigeria as well as testing its beta bank connections in Ghana and Kenya.

“Our mission has always been about making it easier access data in a simple, elegant and lightning-fast way. More API verticals (e.g. Intelligence insight API) coming soon,” it further noted.

The startup also noted that its team is currently made up of three people, spread across our HQ in Lagos and India.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer