U.K.-based CDC Group has signed a Memorandum of Understanding (MoU) with the Nigeria Sovereign Investment Authority (NSIA). The strategic investment partnership is designed to facilitate long-term inclusive growth and encourage private capital to scale up their participation in high-impact sectors of the Nigerian economy.

“The agreement includes information sharing on prospective projects in Nigeria and Africa at large with the ambition to co-invest in sectors such as healthcare, agriculture, infrastructure and climate-resilience. The partnership will foster collaboration on areas of knowledge sharing with an explicit objective of creating jobs and generating impact in Nigeria and across Africa,” a press statement read.

Here Is What You Need To Know

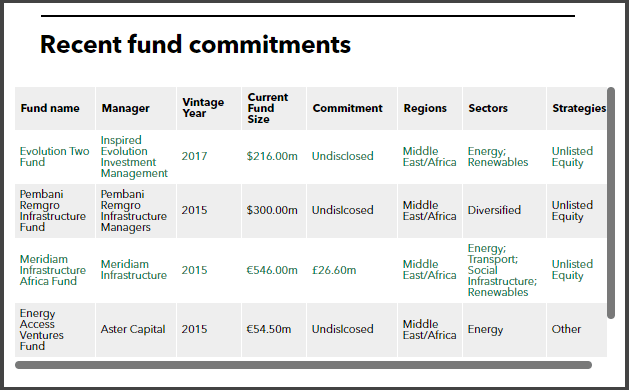

CDC Group and NSIA have both invested in Africa-focused private equity funds managed by CardinalStone, Helios, and Sahel Capital. The announcement builds on CDC’s January 2020 commitment to invest an additional £2 billion in African companies between 2020 and 2022.

NSIA’s US$ 685 million Future Generations Fund invests in a diversified portfolio of asset classes, including private equity and venture capital, in order to provide future generations of Nigerians a savings base in the context of declining domestic oil reserves, mirroring CDC’s long-term commitment to sustainably investing in Nigeria.

CDC is funded by the U.K. government.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer