The Coronavirus has not gone but African startups are laughing last. Streams of funds are still pouring in and Jeff Bezos, the world’s richest man has just shown his first investment interest in an African startup. And this would mean many things, going forward. But in the meantime, Cross-border fintech startup Chipper Cash has announced it has raised $30 million in Series B funding round.

“It’s a big deal when a world class investor like Bezos or Ribbit goes out of their sweet spot to a new area where they previously haven’t done investments,” Chipper Cash founder Ham Serunjogi said. “Ultimately, the winner of those things happening is the African tech ecosystem overall, as it will bring more investment from firms of that caliber to African startups.”

Here Is What You Need To Know

- This round of investment is a first in an African startup by the richest man in the world, Jeff Bezos, whose personal VC fund Bezos Expeditions participated in the round. The round was, however, led by Ribbit Capital.

- Chipper Cash plans to use its Series B financing for additional country expansion, which the company will announce by the end of 2021.

“We’ll launch [the stock product] in Nigeria first so Nigerians have the option to buy fractional stocks — Tesla shares, Apple shares or Amazon shares and others — through our app. We’ll expand into other countries thereafter,” said Serunjogi.

The startup also plans to offer more API payments solutions.

“We’ve been getting a lot of requests from people on our P2P platform, who also have business enterprises, to be able to collect payments for sale of goods,” explained Serunjogi.

- In June this year, $13.8 million was invested into the startup by Deciens Capital and Raptor Group, with repeat support from 500 Startups and Liquid 2 Ventures .

- Barely two years, the startup has raised $52 million in total funding, from investors such as, Australia-based Transition Level Investments, US-based VC firms Liquid 2 Ventures, One Way Ventures, 500 Startups, Deciens Capital andCatalyst Fund.

Why The Investors Invested

This is the first investment in an African startup by Bezos Expeditions, the personal VC fund of Amazon founder, Jeff Bezos, which was founded in 2003. The fund has previously invested in leading startups such as AirBnB, Twitter, Business Insider, Uber, FundBox, BaseCamp, among many others. Although this is the fund’s first investment in Africa, it doesn’t look like there are plans to back more African startups any time soon.

On its part, Ribbit Capital,is a Palo Alto, United States-based VC fund founded in 2012. The fund invests mostly in financial ventures and has previously invested in companies like Coinbase, Epifi, Credit Karma, Tala, among others.

“Consumers everywhere are waiting expectantly — and often with mounting frustration — for financial services providers to finally bring them true efficiency, transparency, and radical simplicity. The next generation of consumers has about as much patience for Big Finance as they do for Big Anything,” the VC mantra reads on its website.

“Driven by this, we will help create and nurture a thriving, bustling new world in lending, personal finance, insurance, financial software, bitcoin, and more,” it adds.

Perhaps, the single greatest factor that helped Chipper Cash to raise the funds easily is the fact that its founders have strong presence in the United States. The startup, too, is based in San Francisco, and thus more exposed to Silicon Valley funds than their peers elsewhere. Founders Ham Serunjogi and Maijid Moujaled, came to America for academics, met in Iowa while studying at Grinnell College and ventured out to Silicon Valley for stints in big tech: Facebook for Serunjogi and Flickr and Yahoo! for Moujaled.

A Look At What Chipper Cash Does

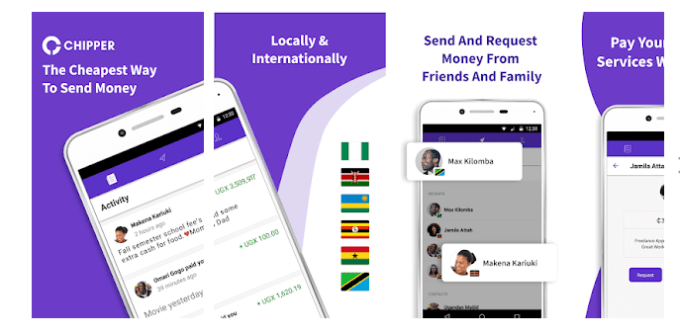

Founded in 2018 by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled, (two college students brought together by their academic adventures at Grinnell College, Iowa, USA) Chipper Cash provides free, interoperable payments in and between Ghana, Kenya, Uganda, Tanzania, South Africa, Rwanda, and Nigeria.

It accomplishes this by allowing customers to link their mobile money accounts (regardless of provider) to Chipper and make P2P transfers via its simple smartphone application.

After launching in October 2018, Chipper has averaged 40% month-on-month growth and already serves hundreds of thousands of users, attesting to its powerful value proposition and customer-focused design. The company has scaled to 3 million users on its platform and processes an average of 80,000 transactions daily. In June 2020, Chipper Cash reached a monthly payments value of $100 million, according to CEO Ham Serunjogi .

Parallel to its P2P app, the startup also runs Chipper Checkout: a merchant-focused, fee-based mobile payment product that generates the revenue to support Chipper Cash’s free mobile-money business.

On how the startup will compete in Africa’s crowded fintech ecosystem, Serunjogi pointed to Chipper Cash’s gratis-payment structure, among other factors.

“Money doesn’t buy product market fit. It doesn’t buy ultimate success in this space,” he said.

“By offering our product for free, we’re not in a pricing war or competing on a dollar-to-dollar basis. We’re in a pure utility war on who can provide the most value to our users. We’re quite comfortable with our position, and our long-term value proposition will speak for itself over time,” Serunjogi added.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer