Innovative startup SunCulture has raised $ 14 million in funding, a sum that will allow it to expand its activities across Africa. Created by Samir Ibrahim and Charlie Nichols, the start-up provides solar irrigation systems that would allow farmers on the continent to earn five to ten times more income.

Here Is What You Need To Know

- The $14 million funding came from investors including Energy Access Ventures (EAV), Électricité de France (EDF), Acumen Capital Partners (ACP) and Dream Project Incubators (DPI).

- Armed with the investment, SunCulture will expand its footprint in Kenya, Ethiopia, Uganda, Zambia, Senegal, Togo and Cote D’Ivoire.

Why The Investors Invested

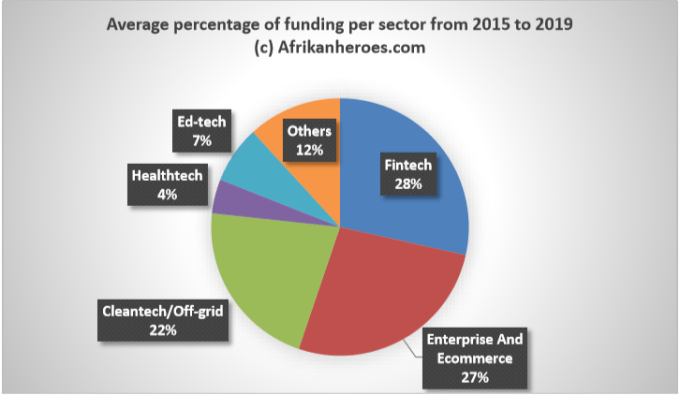

Investment into SunCulture is merely following a pattern. Investors have poured nearly $1 billion into the development of off-grid solar energy and retail technology companies in Africa such as M-kopa, Greenlight Planet, d.light design, ZOLA Electric and SolarHome. Apart from this, all the investors in this round are strong players in the renewable energy sector.

Investment into SunCulture is remarkable. France-owned multinational electric utility company Électricité de France has been active in the African renewable energy sector. In 2018, the company invested took 50% stage in UK off-grid power company BBOXX’s operations in Togo.

Energy Access Ventures is a Paris-based private equity and venture capital firm specialising in the technology and energy sectors, including hydro-electricity, biomass, solar, wind, and thermal power. Energy Access Ventures Fund (EAVF) specialises in early and growth capital for businesses active in the energy value chain that focus on underserved households and businesses. In 2017, CDC, through the Impact Fund, closed a €5 million top-up commitment to EAVF, bringing the total fund size to €75 million. This follows an investment of €16.5 million in 2015. Schneider Electric Industries sponsors the fund, providing investment as well as technical support, alongside investments from French DFI Proparco, Dutch DFI FMO, Fonds Français pour l’Environnement Mondial and the OPEC Fund for International Development.

The Dream Project Incubators (DPI), on its part, aims to develop renewable energy projects that contribute to the improvement of energy self-sufficiency for the future of Asia Pacific, providing eco-friendly global environment, and assisting in the development of local infrastructures and communities.

Last year, the Kenya-based investment fund, Acumen Capital Partners, announced an approximately $70m close of its for-profit fund, KawiSafi Ventures. KawiSafi aims to deliver clean, affordable energy to 10 million people, at least half of whom live in poverty, and displace more than one million tons of carbon dioxide in the next 10 years, to address energy poverty and help avert the current climate crisis. KawiSafi is managed by Acumen Capital Partners, an Acumen-owned subsidiary that structures and manages funds investing in social enterprises poised to scale to transform the lives of low-income people everywhere and solve some of poverty’s greatest challenges.

A Look At What SunCulture Does

Founded in 2013, by Samir Ibrahim and his co-founder Charlie Nichols, SunCulture who met at a business degree programme at the New York University, SunCulture is a pay-as-you-grow company that offers a range of products which include RainMaker2, a solar-powered irrigation solution that supports farmers who want water-pumping solution for farming.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer