Bank of Ghana is not toeing the path of Nigeria’s central bank. Although both banks have been keeping up with the explosion in innovations, the former is taking on a more progressive approach. To that effect, the highest bank in Ghana has done the unforeseen: encouraging previously unregulated financial technology companies, especially blockchain, remittance and crowdfunding products and services, to come forward and be issued licenses under a new regulatory and innovation sandbox pilot, which it is spearheading in collaboration with EMTECH Service LLC.

“This is in line with its commitment to evolve an enabling and inclusive regulatory environment that promotes FinTechs and supports innovation,” the bank said.

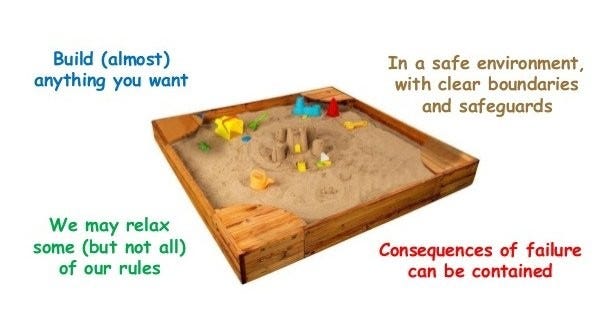

“Within the financial sector, a regulatory and innovation sandbox is a supportive and controlled policy environment that enables firms to test innovative products, services and business models under the supervision of a regulator. Effectively, the regulatory and innovation sandbox will provide a forum for financial sector innovators to interact with the sector regulator to test digital financial service innovations while evolving enabling regulatory environment,” it noted.

Who Can Apply For The License?

The new licensing regime will be available to:

- To banks, specialised deposit-taking institutions and payment service providers including dedicated electronic money issuers.

- Unregulated entities and persons that have innovations that meet the sandbox requirements.

However, the entities above still need to show that:

- Their digital business models are new and are not currently covered explicitly or implicitly under any regulation in Ghana.

- Their digital financial service technology is still new and immature; and

- Their Innovative digital financial services products have the potential of to address a persistent financial inclusion challenge.

“Within the broad categories outlined, the Bank of Ghana would give preference to products and services leveraging blockchain technology, remittance products, crowdfunding products and services, e-KYC (electronic know your customer) platforms, RegTech (regulatory technology), SupTech (supervisory technology), digital banking, products and services targeting women financial inclusion and innovative merchant payment solutions for micro, small and medium size enterprises (MSMEs),” the bank said.

What Is The Purpose Of The Regulatory Sandbox Regime?

With the new regulatory sandbox license, Bank of Ghana seeks to:

- Reduce time-to-market for unregulated products;

- Allow regulators to learn about innovations faster;

- Encourage innovators to formalize their business and incentivise incumbents to experiment with new ideas;

- Reduce the cost of innovation for innovators; and

- Provide valuable insight for regulators to evolve effective regulations.

Bank of Ghana’s latest move comes on the heels of the recent blocks placed by Nigeria’s central bank on cryptocurrency trading and the facilitation of international remittances by startup companies. Apart from Mauritius and Nigeria, Tunisia is has more recently launched a regulatory sandbox regime.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer