$2m Jua Fund Backs African Tech Startups

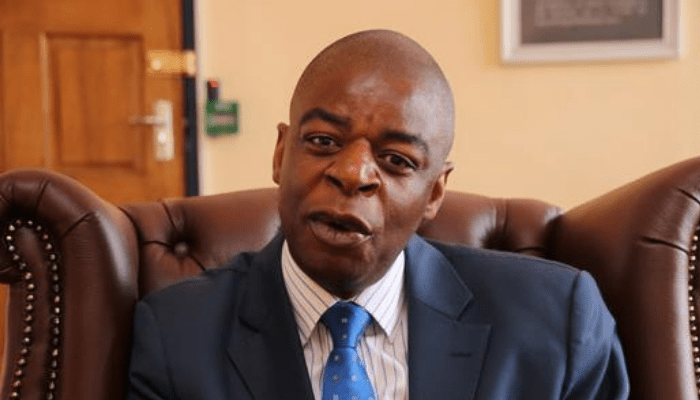

About Seven African tech startups have secured backing from the US$2 million Jua Fund which will also provide them with mentorship and advisory support. It could be recalled that industrialist Adam Molai had launched the US$1 million Jua Kickstarter Fund late last year to provide successful applicants with funds to launch or grow their businesses, as well as mentoring and guidance, with the fund then doubling in size by the end of January. Three enterprises from Kenya, two from Nigeria and one each from Madagascar and Zimbabwe have now been selected as the recipients of the inaugural fund, with all having agreed to deals following a week-long “Kickstarter Olympics” during which they pitched their ideas to a high-profile panel of judges.

The final deal closure and disbursement will be contingent on the enterprises passing due diligence and other agreed terms and conditions, with the fund also providing mentorship and advisory support as well as putting them in touch with other investors.

Read also:IFC Extends $15 million to South Africa’s Fintech, Adumo

Kenya’s three selected startups were GrowAgric, a crowd-farming platform that connects farmers to much-needed working capital; Side, an e-commerce distribution channel that leverages the power of “community” or “group buying” to provide goods to end customers more cheaply; and Xetova, a technology solutions provider to the procurement ecosystem.

Nigeria was represented by Powerstove Energy, which uses advanced technology to deliver a superior smokeless, IoT-enabled cookstove that generates electricity, and Whispa Health, a mobile app that provides young people with non-judgmental access to Sexual and Reproductive Health information, products and services.

Read also:Three Cybersecurity Resolutions for Businesses in 2021

Zimbabwe’s Bryt-Knowledge, a multifaceted online educational platform that connects students with subject matter experts using technology, and Madagascar’s Jirogasy, which manufactures, assembles and designs solar home systems and communication systems for solar, were the other two companies backed.

According to Molai, the exercise had over-delivered on his expectations. Adding that the Jua Fund is a tiny drop in the ocean, “in our effort to unite African grey hairs with our bright young future through funding and mentorship support, after listening to the pitches and presentations during the Kickstarter Olympics, my faith and hope has more than been repaid. We have brilliant entrepreneurs on this continent. I and my fellow judges were immensely impressed by all our finalists, even those that fell away during the week.”

Read also:Will Technology Reinvent ‘the New Normal’ in 2021?

Molai says he was especially delighted that the recipients would deliver the impact that he wanted Jua Fund to have.

“We targeted enterprises that are scalable across the continent and actually address the challenges that are hobbling Africa’s development, and the selected enterprises all do that. Jirogasy and Bryt will be furthering education, one through hardware the other through software; Side and GrowAgric are disrupting the value chain of goods from farm to table; Powerstove Energy is saving the environment with their cooking stove innovation, Whispa Health is taking care of wellbeing, and Xetova is adding African flair to procurement. We look forward to a long and productive future for all of them,” he said.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry