The Société Tunisienne de Banques (STB) has become the first Tunisian bank to join the Dinar Digital network under “Central Bank of Tunisia Digital Currency” project. The network brings together member financial institutions, with the aim of using blockchain technology to fully digitalise the country’s fiat money (cash). The BCT Digital Currency project hopes to also improve efficiency and reduce the costs of financial transactions for Tunisians.

Société Tunisienne de Banques is doing this under the country’s regulatory sandbox licensing regime. Other banks, after STB, will most likely join the network. The Digital Dinar network consists of an interoperable network of money transfer and payments.

The Launch Of North Africa’s First Regulatory Sandbox For Fintech Startups.

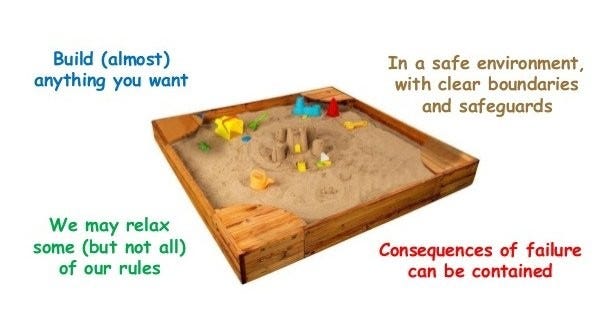

Last year, the Central Bank of Tunisia (BCT) launched a “regulatory sandbox” licensing regime which, among other things, aims to test technological innovations in the banking and financial sector.

“The Sandbox is an opportunity for dozens of fintech companies to test their technological solutions and understand the regulatory requirements in force, in order to promote a financial services’ offer adapted to the needs of the market,” Minister of Communication Technologies and Digital Economy Anouar Maarouf said last year.

Once STB concludes its tests as part of the BCT sandbox, the new digital payment infrastructure will be set up in Tunisia. The blockchain-powered payment infrastructure will offer Tunisian citizens and financial institutions a complementary solution to the already existing payment networks, namely electronic banking, transfers and checks.

Read also:Which Investors Invest In African Blockchain And Crypto Startups? Here Is A List.

TLedger is another Tunisian fintech startup labeled under the country’s Startup Act which has been selected by the BCT as part of the first cohort of the regulatory sandbox. TLedger will proceed to carry out tests with voluntary customers.

The Presence Of Stiff Laws And Regulations Has Stifled Innovative Financial Business Models

In Tunisia, credit cards are not approved for transactions in currencies other than the country’s dinar. Therefore credit and debit cards cannot be used for purchases on foreign commercial internet sites. This has resulted to most Tunisian banks only allowing account holders to use bank-affiliated credit and debit cards to make domestic online purchases denominated in dinars.

However, the passage of the Tunisian Startup Act by the country’s government has resulted in some sweeping regulatory changes to the Tunisian innovation landscape. For instance, the country’s central bank has recently outlined a procedure for qualified companies to open currency accounts.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer

Bank Tunisia blockchain Bank Tunisia blockchain