Okra, a Nigerian API fintech startup, has raised $3.5 million in a seed round from a diverse group of international investors. It previously raised $1 million in a pre-seed round in 2020.

“We want to ensure that we’re solving our customers’ problems as fast as possible and give the clients the support they need. We want to make sure our hiring speed is the same as the speed of our growth and I think being able to raise capital is one of the solvers of that problem… making sure we’re bringing great talent and building a great team,” said Ashiru Jituboh, CEO of Okra.

Here Is What You Need To Know

- Susa Ventures, based in the United States, led the seed round, which included early VC investments in global companies such as Robinhood and Flexport. Its investment in Okra is its second in an African startup, following Andela.

- TLcom Capital, which was the sole investor in the company’s initial pre-seed round, Accenture Ventures, a Fortune Global 500 company, and some angel investors are among the other investors in the round.

- The money will be used to develop the company’s data infrastructure across Nigeria, and a significant portion of it will, also, go into talent acquisition.

- The API company has now raised a total of $4.5 million with this latest round, meaning that it is currently Africa’s most funded API fintech startup.

Why The Investors Invested

There seems to be a lot of reasons why TLcom Capital and other investors settled for the startup. Although TLcom’s managing partner, Maurizio Caio, had in 2019 hinted that TLcom was steering more toward investments in infrastructure oriented tech companies and away from Africa’s more commoditized payments and lending startups, the VC firm said it was attracted to Okra for its ability to serve the continent’s broader financial sector.

Read also:Why Ghanaian Startup, Zeepay, Acquired 51% Stake In Zambian Fintech Mangwee

“It’s a service that other fintechs can plug into and utilize, so it’s accelerating the growth of fintech across the continent…That to us was a big hook,” TLcom’s Andreata Muforo said in an interview last year.

Another major factor that might have attracted the VC to the startup is its co-founder Fara Ashiru Jituboh.

“We found her to be very strong and also liked the fact that she’s a technical founder,” said Muforo.

Again, the coming back of TLcom to invest in the startup after solely investing $1m in its pre-seed round in 2020 is tell-tale of the startup’s continued growth.

The company claims to have logged over 150,000 live API calls, with a 281 percent increase in API calls month over month. It also said it has analysed over 20 million transactions, analyzing over 5.5 million transactions in the last month alone.

Susa Ventures is an early-stage venture capital firm investing primarily in seed rounds. The firm was founded in October 2013 and is headquartered in San Francisco, United States. The VC closed two new funds in January 2019, including a $90 million early-stage fund — its third flagship fund — and the first opportunity fund, to which investors contributed $50 million.

Read also:Appzone to Expand Banking Technology Across Africa With New Funding

Accenture Ventures is Accenture’s corporate venture capital arm, and it prefers to invest in growth-stage companies that use an open innovation strategy to develop new business technologies. Based in the United States, the VC invests mostly in artificial intelligence, big data, blockchain and cybersecurity.

A Look, In Simple Terms, Of What Startup Okra Does

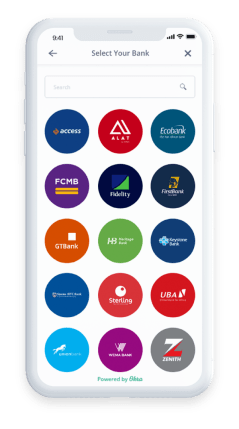

Okra, a motherboard for Africa’s 21st century financial system, was founded in June 2019 by Nigerians Fara Ashiru Jituboh and David Peterside. You can link all your African bank accounts to an app using the Okra app.

“We are building the industry’s “super-connector” by creating a secure portal and process to exchange financial information back and forth between customer, applications, and banks,” the startup says on its website.

Nigeria is Africa’s largest financial center, with a population of 200 million people, but there is still a disconnect between fintech apps and banks, according to Okra’s Ashiru Jituboh.

“Here in this market there’s no way to directly connect your bank account through an API or directly to an application,” she said.

Okra sells multiple paid integration packages and makes the code for its five product categories — authorization, balance, purchases, identity, and accounts — available to developers.

Okra already has a diverse client list that includes PalmPay, a mobile payments startup, Axa Mansard, and Renmoney, a Nigerian digital lender.

According to Ashiru Jituboh, the startup earns money from product fees and each time a user links a bank account to a client.

“The response is we’re not doing payments, but what we’re doing is making processes with [payment providers] much smoother,” she said when asked how Okra varies from other well-funded fintech companies in Nigeria, such as Flutterwave or Interswitch.

okra API Okra API

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer