Hormuud Telecom, the largest telecommunications network in Somalia, has got a lot of things going for it, including having one of its towers reportedly bombed into pieces by Kenya Defence Forces (KDF) in 2019. But perhaps its biggest achievement so far is not only picking the country’s first mobile money license, but also being the first to proceed to launch the country’s first indigenous mobile money app, a benign way of mocking neighbouring Kenya’s Safaricom for accusing it of a heinous crime that necessitated the KDF’s retaliatory bombing.

Dubbed WAAFI, the fintech app will offer Somalis access to a variety of digital services on a single platform for the first time in an official manner. Consumers can use the WAAFI app to access their bank accounts, conduct online transactions, submit foreign remittances, and make international and domestic phone calls.

“Somalia is a unique example of a country where digital adoption is widespread among all age ranges and demographics. We are continuing to see a move towards a position where Somalia can claim to be the world’s first truly cashless economy, and the roll out of WAAFI is an important step on that journey. Providing businesses and customers with more efficient technology is going to be a driving force behind the development of the Somali economy and its integration with the wider international community,” Hormuud CEO and Chairman Ahmed Mohammed Yuusuf said.

What Difference Does WAAFI Make Since Somalia Is Already A Large Mobile Money Market?

WAAFI is a fully integrated mobile money service that replaces the existing USSD technology used by many Somalis. In Somalia, USSD-enabled mobile money technology is widely used, with penetration rates of up to 80% in urban areas and up to 55% in rural areas.

WAAFI also allows people to make in-country bank transfers using their phones, which is a first in Somalia. This helps Somalia achieve its goal of becoming a cashless economy and combats fraud, as over 95 percent of the Somali shilling in circulation is estimated to be counterfeit.

Read also:South African Fintech Startup, Payflex, Secures New Funding Round

WAAFI helps users to deposit and withdraw money from their bank accounts using their EVC Plus wallet. Businesses can use this to produce QR codes that enable customers to deposit funds directly into their bank accounts.

“The WAAFI app has transformed how I do business. Having important digital services all housed under one app makes it easier to pay my employees and trace transactions quickly. Even when I’m abroad or cannot be physically present, with this app I can check on my business and address any problems. Operating throughout the pandemic, this app has allowed me to keep my customers and my employees safe. With contactless payments, we can reduce physical contact and the spread of the virus in our communities,” Abdulaziz Mohamed Nurani, the founder of premier fashion retailer Tik, was quoted as saying.

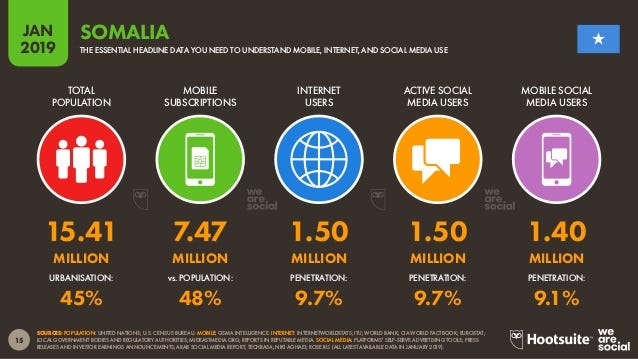

Hormuud continues to expand its high-speed digital infrastructure across Somalia with the launch of the app. According to Hormuud, roughly half of Somalia’s urban population has access to 4G internet, with slightly more than 60% having access to 3G, both of which are considered broadband-level services in frontier economies.

The telco received the first mobile money license from the Central Bank of Somalia in February 2021, indicating that its mobile money network EVC Plus is now officially controlled and authorised by the Central Bank. In Somalia, Hormuud Telecom has 3.6 million customers, with 3 million of them using EVC Plus.

However, granting the mobile money license does not mean that mobile money operations have not been going on in the country. For every month in the year 2018, the country recorded approximately 155 million mobile money transactions, worth $2.7 billion. Similar transactions have also been going on in the country for the past 10 years.

What the Central Bank of Somalia merely did was to issue the country’s first ever money license to an entity, thereby ending the era of unregulated mobile money services in the country.

Hormuud Telecom Sticks Out Of The Competition

CBS’ license to Hormuud Telecom is a major achievement for the telecom company as it helps it to partially heave some sighs of relief from the country’s crowded telecoms market, currently made up of 11 licensed local operators.

Although Hormuud’s new license may not make much difference as there are already numerous unregulated services in operations, it may however help the telco to position itself early for post-regulation market share.

According to the World Bank 2017 report, mobile money service in Somalia has reached a penetration rate of 73% (83% in urban areas), compared to a penetration rate of 15% for formal bank accounts. Somalia’s Dahabshiil is one of the largest money transfer companies in Africa, operating in 155 countries.

Majority of Somalian households (58%) make one to four transactions each month and tend to use mobile money over cash for purchases between US$2 and $300. A mobile money account must be linked to a bank account for transactions over $300. As a result, digital money is an excellent cash replacement, and it can be used for everyday transactions such as bill payments, paycheck receipts, and merchant transactions. Nevertheless, a study by Hormuud Telecom revealed that cash-out rates on mobile money platforms in Somalia are less than 5%, indicating a greater number desires to keep money in mobile wallets rather than cash it out.

In contrast to Kenya’s well-known Mpesa mobile money transfer service, Somalia’s transactions are mostly in US dollars. Though mobile money providers are mobile network operators, they are increasingly becoming part of large conglomerates that also provide banking and money transfer services, as in Kenya.

Generally, the East African region has a booming mobile money market. As of 2019, the total value of mobile money transactions reached $17 billion in Kenya, $12 billion in Tanzania and $5.9 billion in Uganda.

WAAFI Mobile Money Somalia WAAFI Mobile Money Somalia

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer