Chipper Cash, an African cross-border payments firm, has raised $150 million in a Series C expansion round headed by FTX, a cryptocurrency exchange platform founded by Sam Bankman-Fried. The investment comes just six months after Chipper Cash secured a $100 million Series C financing funded by SVB Capital, SVB Financial Group’s corporate venture capital arm.

SVB Capital, as well as other previous investors such as Deciens Capital, Ribbit Capital, Bezos Expeditions, One Way Ventures, and Tribe Capital, reinvested in this extension round.

The investment, according to co-founder and CEO Ham Serunjogi, is a critical repricing event for the company, providing it with a robust balance sheet that will allow it to continue scaling and “keep our dominance in the space.”

Why The Investors Invested

The traction the startup has generated has been remarkable. Chipper Cash has over four million users, and has entered the already crowded US-Africa corridor last month, joining established companies such as Wise, MoneyGram, Sendwave, and Remitly. It’s presence in the United States is a major turning point for the startup as the country accounts for about 30% of international remittances to Sub-Saharan Africa. Chipper Cash has also extended to the United Kingdom in May of this year, allowing individuals to send money from the European country to Chipper Cash’s African markets.

Read also South Africa’s API Fintech Stitch Forays Into Nigeria Market.

FTX is one of the world’s biggest bitcoin derivatives exchanges. The company received $420 million in a round last month, valued at $25 billion.

Sam Bankman-Fried, the company’s CEO and co-founder of Alameda Research, a quantitative trading platform, is also the company’s co-founder. He has invested in a variety of companies through FTX, including blockchain startups Sky Mavis and Circle, as well as brokerage trading platform DriveWealth (Chipper Cash recently partnered with DriveWealth to offer U.S. stocks to Ugandans).

Chipper Cash is FTX’s first investment in Africa, and it adds to a growing list of indicators pointing to serious crypto adoption on the continent. According to Chainalysis, crypto adoption in Africa increased by more than 1,000 percent in the last year, with peer-to-peer transaction volume totaling $105 billion.

Bankman-Fried, on the other hand, believes there is still room for adoption. “Despite Africa’s recent expansion, transporting money across the continent remains slow and costly. It’s unsurprising that it’s the fastest-growing market for crypto acceptance at the grassroots level,” he said.

Read also NMB Bank Launches New Seed Fund For Sandbox Fintech Startups In Tanzania

The goal of FTX’s relationship with Chipper Cash, according to the CEO, is to “make money transfer as simple as sending a text message and speed the adoption of cryptocurrency throughout Africa and beyond.”

Given Bankman-Fried’s remark and Chipper Cash’s crypto experiments in Uganda and South Africa, it’s difficult to imagine the company not employing crypto to facilitate peer-to-peer money transfers within and outside Africa.

Through the new investment, FTX users in Africa will be able to “Pay using Chipper Cash” on the crypto trading platform.

“That’s going to be a compelling use case for both of our companies as we keep scaling and as FTX keeps scaling their geographical coverage,” the CEO said. “They do some of the most innovative work in the crypto space, so working with them is going to be quite exciting.”

A Look At What Chipper Cash Does

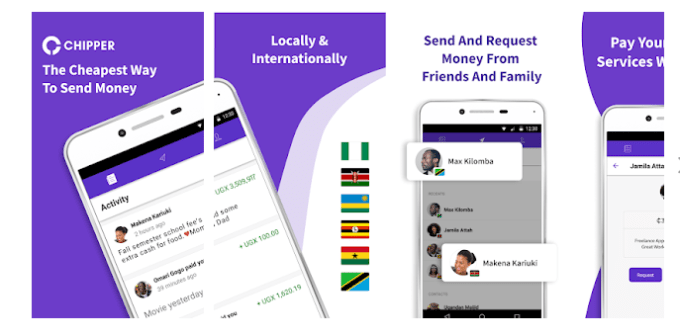

Founded in 2018 by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled, (two college students brought together by their academic adventures at Grinnell College, Iowa, USA) Chipper Cash provides free, interoperable payments in and between Ghana, Kenya, Uganda, Tanzania, South Africa, Rwanda, and Nigeria.

Read also National Bank Of Egypt Adopts RippleNet Blockchain Technology

It accomplishes this by allowing customers to link their mobile money accounts (regardless of provider) to Chipper and make P2P transfers via its simple smartphone application.

After launching in October 2018, Chipper has averaged 40% month-on-month growth and already serves hundreds of thousands of users, attesting to its powerful value proposition and customer-focused design. The company has scaled to 3 million users on its platform and processes an average of 80,000 transactions daily. In June 2020, Chipper Cash reached a monthly payments value of $100 million, according to CEO Ham Serunjogi .

Read also:Fintech Startup, Chipper Cash Strengthens Presence In Rwanda

As of the end of May 2021, the startup is represented in a number of African countries, including Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya.. Chipper Cash also managed to expand to the UK. The country became the first market for the project outside of Africa.

Chipper Cash services are used by 4 million people. The startup noted that its user base grew by 33% over the coronavirus year 2020.

Parallel to its P2P app, the startup also runs Chipper Checkout: a merchant-focused, fee-based mobile payment product that generates the revenue to support Chipper Cash’s free mobile-money business.

On how the startup will compete in Africa’s crowded fintech ecosystem, Serunjogi pointed to Chipper Cash’s gratis-payment structure, among other factors.

“Money doesn’t buy product market fit. It doesn’t buy ultimate success in this space,” he said.

Read also:National Bank Of Egypt Adopts RippleNet Blockchain Technology

“By offering our product for free, we’re not in a pricing war or competing on a dollar-to-dollar basis. We’re in a pure utility war on who can provide the most value to our users. We’re quite comfortable with our position, and our long-term value proposition will speak for itself over time,” Serunjogi added.

Chipper Cash has also been experimenting with social payment systems. Twitter released its Tips feature, also known as Tip Jar, earlier this year to allow authors to earn money on the network. To make it available in diverse locations, the social media company linked with some payment platforms.

Chipper Cash crypto Chipper Cash crypto

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning write