MINDEX, a leading financial technology company, proudly announced the inauguration of Mauritius’ inaugural virtual assets marketplace, marking a significant milestone for the region’s financial ecosystem. The Financial Services Commission (FSC) recently granted MINDEX the Virtual Assets Marketplace license, further expanding its capabilities in the digital financial landscape.

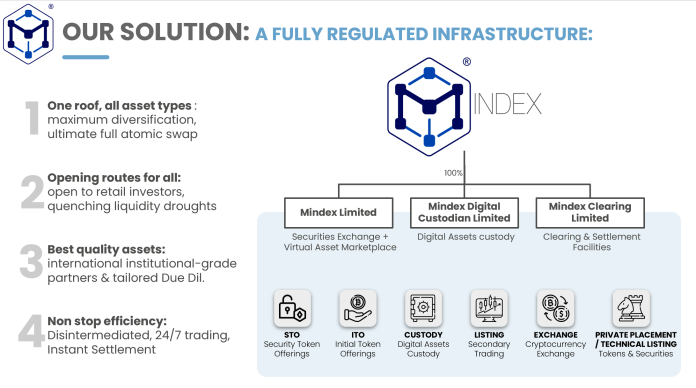

This achievement follows MINDEX’s previous approvals for the digital securities exchange and clearing house from the FSC in February 2023 and the MINDEX Digital Custodian in January 2022. The newly acquired license complements MINDEX’s existing digital securities exchange, digital custodian, and clearing house, creating a comprehensive ecosystem for users to exchange virtual assets, including tokenized real-world assets, stablecoins, and cryptocurrencies.

Manisha Dookhony, Chairperson of MINDEX Limited and Advisor to multiple African governments, expressed optimism, stating that this development positions Mauritius as a regulated center for virtual assets in Africa and beyond. She emphasized the positive impact of this step towards creating a unique marketplace for virtual assets, aligning with the vision of the African Continental Free Trade Area (AfCFTA).

Christian Angseesing, Chairman of the Board of MINDEX Digital Custodian Limited, praised the FSC’s forward-thinking approach, seeing it as a proactive endorsement of innovation and technology. He highlighted the potential for Mauritius to become a hub that unites investors from diverse African economies, fostering economic collaboration.

MINDEX leverages blockchain technology to facilitate regulated market access for both institutional and retail investors. The company aims to establish a comprehensive digital ecosystem for Africa, combining its digital custodian, exchange, clearing and settlement facilities, and now, a virtual assets marketplace. With three decades of success as an International Financial Centre (IFC), Mauritius is poised to retain its competitive edge by embracing the opportunities presented by financial technology.

Jessica T. Naga, CEO of MINDEX, emphasized the importance of providing investors worldwide with direct access to information for assessing investment opportunities. She highlighted MINDEX’s commitment to utilizing blockchain technology to optimize trade and enhance liquidity in Africa.

The government’s commitment to establishing Mauritius as a regulated FinTech hub of choice for Africa is evident in the FSC’s issuance of relevant licenses to MINDEX. The move signifies a strategic step towards leveraging local skills and capabilities to propel the jurisdiction to new heights in the evolving landscape of digital finance.

MINDEX’s aspiration is to build a fully regulated virtual asset ecosystem that spans Mauritius, Africa, and beyond. By harnessing blockchain technology, the company aims to streamline financial services and products, providing a comprehensive suite of services, including listings, automated transactions, collateralization, fund administration, asset management, and post-trade support.

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard.