Startups have enjoyed a bull run in the last decade with record highs across the board. After all, some of the biggest tech companies in the world have breached the trillion-dollar market capitalization in the last few years (Apple, Microsoft, and Alphabet).

However, with COVID-19 and oil wars escalating, the markets took a turn for the worst with the DOW dropping a sharp 2000 points, one of the worst days of trading since 2008.

Many believe that this could mean an upcoming recession or downturn that has been forecasted years ago.

But with all this news, what will happen to startups?

When you put startups and recessions together, the first thing you usually assume is a whole bunch of negative things due to risk and volatility.

But this isn’t entirely true.

Let’s go through some scenarios related to startups and funding.

Amount of Angel & Seed Deals Remain Constant

In a downturn, one of the first things expected is startups getting less funding opportunities in the market, especially for early-stage ones.

Looking at historicals, however, the most surprising thing is the number of deals angels and seed investors made during the global financial crisis (GFC) remained constant and actually rose.

As seen above, following the dark navy line, you can see an increase in deals over the GFC period since 2007.

But why would this occur?

One of the biggest reasons that this could be the case are angels, and seed investors generally have much riskier profiles. This means they are willing to take a bet for a higher return so if they don’t think a recession would put the startup out of business, there is no reason not to make an investment.

Additionally, angel investors usually invest in a specific startup as they believe in the product itself due to a personal reason or if they have directly seen the pain point themselves.

The factor that did change, however, was the investment amounts.

During the GFC, the amount an angel or seed investor put in did decrease, which probably indicates some risk management measures, as seen in the graph above.

Read also: Would The Coronavirus Epidemic Affect Fund Raising For African Startups In 2020?

Venture-Backed Funds See A Drop In Demand

If you think about how VC funds like Andreessen Horowitz, Benchmark, Index Ventures, and Sequoia Capital raise significant amounts, it’s done so by pooling large amounts of money from investors.

Typically, these funds raise approximately every few years and, in recent years, have been successful in raising record amounts.

In a downturn, however, as investors become more risk-averse, their willingness to invest decreases.

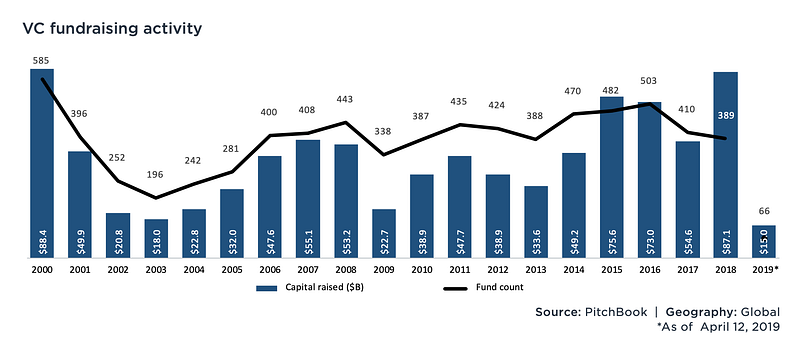

As seen in the graph above, the significant years to look at are 2000–2001 (2000 stock market crash off the .com bubble) and 2008–2009 (GFC). Both periods of time had major crashes, and both showed huge drops in capital raised from a VC fund point of view.

Subsequently, this scenario will most likely play out again.

This will result in VC funds having less money, which means bad news for startups overall.

This means Venture Capital will be harder to access, and the following might occur for startups:

- Startups are forced to give out more equity during rounds

- Rounds might become smaller than historical averages

- Valuations for a company might be smaller

- Startups need to prove themselves, even more, to get funding (be profitable from early on)

Early Stage Startups — Are You Default-Dead?

Typically, anything at a Series A or prior may struggle to keep afloat during a recession.

As businesses cut costs, startups may find it hard to get deals inside the door, especially as companies cut budgets.

This includes the ability to raise subsequent rounds at a large enough scale to support the startup.

The concerned startups, however, are ones that need to raise more money to survive. These are startups that are not profitable yet, and if they cannot get access to cash, this could mean potential bankruptcy and closing shop.

These startups are what Paul Graham coins “default-dead” startups.

“Assuming their expenses remain constant and their revenue growth is what it has been over the last several months, do they make it to profitability on the money they have left?” — Paul Graham

This doesn’t necessarily mean these startups stay ‘dead’ forever as many need to reach a specific scale before switching the dial to turn profitable.

Many of these startups need to generate enough growth and worldwide coverage (think of your Ubers, Airbnbs, etc.) and are more likely within a non-software play.

However, since there is now a possibility of a recession, time is more limited for these startups to reach that point of profitability.

Some of these were massive giants that took in billions (WeWork!) and remained default-dead to this very day.

This means it’s never been so important to become lean and turn the profitability switch to remain in business, especially as an early-stage startup.

It’s not all bad news though

Just as some investors are waiting to buy-in during a dip, there are similar opportunities within the startup world.

For later-stage or well-funded startups, recession can be a golden opportunity to buy out competitors who may be struggling.

Other things also become cheaper such as office space (especially during this coronavirus period) as well as travel expenses.

Businesses within specific spaces such as collaboration also have opportunities to expand within the current market.

The most redeeming note, however, is, there were still many startups that became huge unicorns from the last recession in 2008.

Here is a list from 2008 and 2009:

2008:

- Airbnb (private; $38B, 2019)

- Pinterest (public; $14B, Oct 2019)

- Cloudera (public; $2.5B, Oct 2019)

- Beats (acquired by Apple for $3B in May 2014)

- Yammer (acquired by Microsoft for $1.2B in July 2012)

2009:

- Uber (public; $54.6B, Oct 2019)

- Square (public; $26.9B, Oct 2019)

- Slack (public; $12.5B, Oct 2019)

- Nutanix (public; $4.9B, Oct 2019)

From this list alone, we can see that even if a recession does occur, it doesn’t stop startups on the road to being a unicorn.

Richard Liu is a Co-Founder @ www.yought.com

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.

He could be contacted at udohrapulu@gmail.com