Joliba Capital’s Debut Fund Surpasses $96.5M, to Back Francophone African Businesses

Joliba Capital, an African private equity firm, has achieved a significant milestone with the first close of its inaugural fund, Joliba Capital Fund I, securing commitments exceeding EUR 33 million from the U.S. International Development Finance Corporation (DFC) and Swedfund as part of a successful Rolling First Close. The fund, which has reached a total of EUR 89 million (USD 96.5 Million), aims to target investment opportunities across Francophone countries in Western and Central Africa.

This strategic move reflects the strong confidence and trust investors have placed in Joliba Capital’s vision and strategy. The fund will primarily focus on developing a diversified portfolio comprised of small and mid-cap regional champions seeking growth capital and operating expertise across various consumer-driven sectors, including agribusiness, manufacturing, FMCG, education, healthcare, financial services, and logistics.

In a market that remains largely undeveloped from a private equity perspective, Joliba Capital intends to play a crucial role in supporting SME financing and strengthening environmental, social, and governance (ESG) and impact standards across the region. The firm is committed to increasing awareness of the benefits of private equity investments in the region.

Joliba Capital Fund I is proud to be 2X Challenge qualified, showcasing its dedication to maximizing impact while delivering superior returns for its investors. LBO France, a multi-specialist and multi-country investment platform and majority owner of Joliba Capital, expresses its commitment to supporting local communities and entrepreneurs to unlock the full potential of the continent.

Robert Daussun, Chairman of LBO France, and Stéphanie Casciola, CEO of LBO France, state, “We are happy to welcome DFC and Swedfund in Joliba Capital’s inaugural fund. Their commitment is a strong endorsement of the high value that African companies can create with the help of professional investors while addressing very concrete development challenges.”

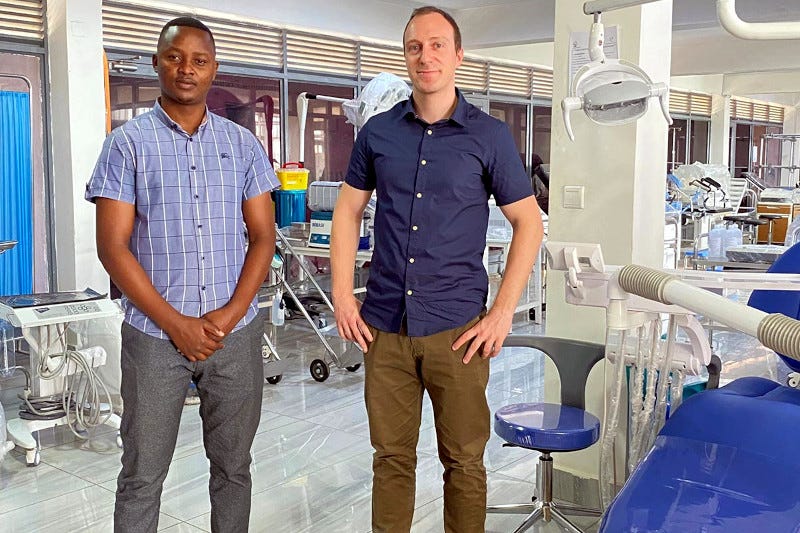

The founders of Joliba Capital, Hamada Touré and Yann Pambou, express their gratitude, stating, “We are pleased to count on the trust and support of DFC and Swedfund on our mission to boost the Francophone Africa private sector and create sustainable jobs. We sincerely thank our partner LBO France and our initial anchor investors Proparco, FMO, and IFC for their confidence and support.”

Mateo Goldman, Acting Vice President of DFC’s Office of Equity and Investment Funds, emphasizes DFC’s pride in supporting Joliba Capital’s expansion, stating, “DFC’s support will provide vital access to capital in these regions to support small businesses facing barriers to financing.”

Sofia Gedeon, Investment Director Sustainable Enterprises at Swedfund, highlights the opportunity to strengthen the private sector and contribute to socio-economic development, stating, “This gives Swedfund the opportunity to strengthen the private sector and to contribute to socio-economic development via increased decent job opportunities and enhanced gender equality.”

Joliba Capital, in collaboration with DFC and Swedfund, is poised to make a significant impact on small and medium-sized businesses in Cote d’Ivoire, Senegal, Cameroon, and other Francophone West and Central African countries. The investment will not only support these businesses but also contribute to improved access to goods and services for the underserved in the region.

A pioneer in private equity in France, LBO France is today a leading multi-specialist and multi-country investment platform. Active in Private Equity, Real Estate, Venture, and Listed Investment, the Company has been expanding its activities in Europe and on the African continent. Wholly owned by its managers, LBO France is one of the founding members of the International Climate Initiative and one of the first signatories of the France Invest charter for parity.

Joliba Capital is a private equity firm, founded by two seasoned African investment professionals, Hamada Touré & Yann Pambou, in partnership with LBO France, to target investment opportunities across Francophone countries in WAEMU and CEMAC regions to develop small and mid-cap regional champions seeking growth capital and operating expertise.

The U.S. International Development Finance Corporation (DFC) is the U.S. Government’s development finance institution, partnering with the private sector to finance solutions to the most critical challenges facing the developing world. DFC investments adhere to high standards and respect the environment, human rights, and worker rights.

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard.