Canza Finance Secures $2.3M to Propel Cross-Border Payments for African Startups

Canza Finance, a neobank operating within the Web3 framework to facilitate cross-border payments for African startups, has successfully concluded a strategic funding round, securing $2.3 million. The newly acquired funds will be utilized by the company to obtain licenses from various financial regulatory bodies across the African continent, laying the groundwork for its revolutionary FX DeFi platform named Baki. This latest financing brings Canza’s total raised capital to $5.5 million, following a previous seed round that closed at $3.27 million last year. The primary contributors to the current round include Polychain Capital, Protocol Labs, Avalanche’s Blizzard Fund, 99 Capital, Stratified Capital, Hyperithm, among others.

In the context of African markets such as Nigeria, Cameroon, and Senegal, businesses requiring cross-border payment solutions often encounter challenges associated with slow and expensive traditional methods for international transactions. These obstacles impede their ability to secure favorable terms for international payments, engage in stock trading, or earn interest on their funds.

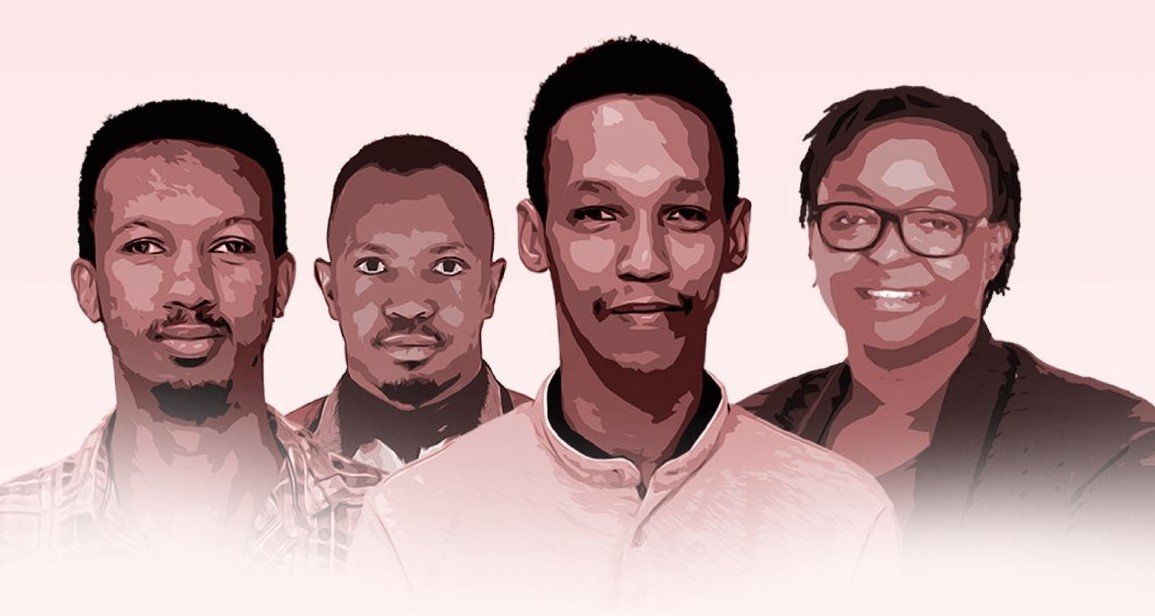

Pascal Ntsama, Co-founder and CEO of Canza, articulates the company’s mission to simplify access to financial services traditionally reserved for larger corporations. Canza collaborates with FX agents in these regions to offer a more efficient and cost-effective channel for sending and receiving money. The transaction process involves businesses submitting a valid invoice and completing the Know Your Customer (KYC) and Know Your Business (KYB) processes. Canza determines the exchange rate for the transaction, aiming to complete it within a 24-hour timeframe.

Canza generates revenue by applying a 1% fee to the processed transactions. The startup envisions reducing transaction fees to 0.2% with the introduction of Baki, its on-chain synthetic FX exchange protocol. This innovative system facilitates the digital exchange of different currencies without the involvement of real money.

Through Baki, Canza leverages stablecoins — digital currencies pegged to the dollar — to assist businesses in converting their currencies to the dollar without incurring substantial forex fees. By embracing stablecoins and decentralized finance tools like Baki, Canza empowers businesses to achieve dollar stability and overcome traditional forex challenges, thereby reducing transaction costs to a mere 1%.

Canza claims to process transactions worth $2,000,000 on a weekly basis and currently serves 150 clients. Oyedeji Oluwoye, Co-founder and CTO of Canza Finance, expressed the startup’s commitment to significantly enhancing infrastructure development in Africa, with a specific focus on expanding infrastructure and obtaining necessary licenses in suitable jurisdictions. He emphasized, “Additionally, we will drive the growth of our DeFi infrastructure products,” highlighting the company’s dedication to advancing decentralized finance solutions in the region.

Looking ahead, Canza aims to secure multiple licenses for virtual asset custodianship, broker-dealer services, and exchange operations in the coming months. Ntsama stated, “We aim to secure a Money Services Business (MSB) license in the United States, obtain a Foreign Exchange (FX) license in Nigeria, and acquire three crucial Virtual Asset Licenses from the Financial Service Commission of Mauritius.” This strategic move aligns with Canza’s broader vision of fostering financial inclusion and innovation across the African continent.

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard.