Lessons From How Ghanaian eHealth Startup, mPharma, Is Conquering Older Incumbents In Africa

April 2019. Gregory Johnson, the co-founder of mPharma, a startup that runs inventory management for healthcare practitioners, was at one of the highest peaks of his life. An important deal was about to be sealed in Kenya with Haltons Pharmacy, just six years after he ditched the last lap of a series of employee interviews with the global tech giant, Google.

A major trail blazer, the deal is one of the very rare occasions when a six year-old startup would be swallowing a major pharmacy chain, Kenya’s second largest to be precise.

Read also:Uganda-based Healthtech Startup, Neopenda, Raises $1.4m Funding

It didn’t last up to two more years before Rockson returned to Ethiopia, Africa’s second-largest country by population size and a country he had visited four years ago in 2018, again, to seal a follow-up, backed by a humongous $17m in funding raised at the peak of the coronavirus pandemic a year before in 2020.

Ethiopia’s deal was easy but symbolic in many ways. It was easy because the coast had been cleared and insights gleaned from Haltons’ success in Kenya. In fact, Rockson’s mPharma noted that since the acquisition of Haltons, the number of Haltons’ pharmacy outlets in Kenya had increased from 20 to 30, a figure more telling when it is remembered that before mPharma’s acquisition, the Kenyan pharmacy chain had sliced the number from 50 to 20 as a result of poor financial standing.

The symbolism in mPharma’s Ethiopian inroad stems from the fact that in a notoriously closed economy, a smart strategist must find a wide gaping hole in the legal system to wing on. And so, Belayab Pharmaceuticals, a subsidiary of Belayab Group, one of Ethiopia’s biggest and most diversified conglomerates, presented a partnership opportunity for mPharma to hammer a bolder franchising presence in the country.

Read also:Airtel Leaves Ghana, Sells Business To Ghanaian Government

But perhaps what is even more surprising is that mPharma meanders through Africa acquiring, partnering and launching out new products with relatively meagre funding.

Doctolib in France, comparably, has a war chest of $267m in equity funding. mPharma has less than $50m, to-date. And even more surprising is the fact that with Ethiopia’s latest addition, mPharma is now present in eight African countries, of Zambia, Zimbabwe and Rwanda (via the Kumera pharmacy retail chain), Nigeria (via GoodHealth pharmacy chain) as well as Kenya, Cote d’ivoire, and of course Ghana, its home country.

While the seven year-old company continues its high-growth explosion on the continent, a few insights may be gleaned from its journey so far.

Replicating The Franchise Model In A Sector As Closed And Unpenetrated As Healthcare

Perhaps, mPharma’s most notable signature model is not its vendor-managed inventory of prescription (although it is part of the entire story) but its retail pharmacy operations, most notably done through the QualityRx franchise model.

Launched in November, 2018, QualityRx (which goes by GoodHealth in Nigeria) has single-handedly ensured that the startup has been on a rollercoaster ride of international expansions.

The QualityRx franchise model, which repeats similar features seen with co-operative retailers in the US and Europe, employs common branding, inventory systems and collective purchasing for all pharmacies enlisted in the QualityRx franchise chain.

To tell a better story of how the QualityRx franchise model works: in 1996, Mr. Amankwah founded Fresh Spring Chemists in Tema, Ghana. It used to be Tema’s largest pharmacy, but it went through a difficult time in which it lost business to new pharmacies. Mr. Amankwah was on the brink of shutting his pharmacy when he learned of mPharma’s new QualityRx programme for neighbourhood pharmacies. Fresh Spring was refurbished and restocked at no expense to Mr. Amankwah thanks to QualityRx. As a result, Fresh Spring is now regaining all of its lost clients and supplying them with decent service.

From a more complex and profit-making perspective, mPharma takes over inventory procurement of retail pharmacy and hospital chains within its franchise using its supply-chain software while remotely running pharmacy operations using proprietary technology infrastructure.

The software generates data that is then used to forecast demand. Because it owns a large network of hospitals and pharmacies, the information helps it negotiate lower prices with suppliers (distributors and manufacturers).

Aside from that, mPharma provides medications on consignment to all of its franchised clinics. As a result, income is determined from direct prescription purchases to customers rather than what is sold to hospitals on a regular basis. Because it differs from the traditional “pay-for-supplies” model offered by distributors, this creates a disruptive business model for hospitals and pharmacies.

mPharma makes money by charging a fee on the medications it buys. It also sees an opportunity to benefit from the selling of its data on drug use.

This explains why the startup was on an acquisition expedition in Kenya recently, and why it launched out the Haltons Brand in Ethiopia. Ownership of its own pharmacies will give it a bigger shot at profitability. To show the extent of the profit it could make if it runs its own pharmacy chain, Kenya’s Haltons, for instance, raked in $1.5 million in revenue in 2018, alone.

“We’ve not always been able to control the customer experience and fully address the issue of drug affordability with our pharmacy clients particularly because they manage their profit margins,” says Greg Rockson.

“Through our QualityRx service, we’re starting to invest in improving the customer experience and pricing that patients get from pharmacies. Haltons will serve as a testing ground for us to develop patient-centered services we can provide to our franchise pharmacies. This way we can encourage lower margins and pass the savings on to the customers.”

Raising Enough Funds At The Beginning, Then Raising Only Strategically When There Is Need For It And It Has Become Relatively Easier To Raise

mPharma seems also to be strategic with its funding, only raising on major acquisition, partnership or expansion needs. For instance, the $9.7 million Series B round it raised in January, 2019 from investors such 4DX Ventures, an Accra/San Francisco venture capital firm, and Nairobi-based Novastar Ventures, was used for the acquisition of Kenya’s Haltons later in April that year. And although, Rockson described its $17m fundraising in May, 2020 as “opportunistic”, the startup had already drawn out detailed plans on how to launch operations in Ethiopia, launching there only in March this year, immediately countries began announcing extensive Covid-19 vaccination programmes.

It could be argued that while mPharma spent its earlier fundraising of $6.6 million raised in Nov, 2017 and a seed round of $5 million raised in 2015 on building out and scaling in Ghana, Rwanda, Zambia and Zimbabwe, its subsequent fundraising had been driven by expansion or partnership plans.

Courting In Strategic Investors After Series B Round

Another interesting insight into mPharma’s funding activity is that while its earlier investors had stemmed from the need to just bring in investors, its subsequent fundraising tilted towards strategic investors. For example, although the startup had settled for investors such as 4DX Ventures, Gold Palm Investments, Breyer Capital, Olive Tree Ventures, Social Capital, The Skoll Foundation, etc. for its earlier fundraising, its subsequent fundraising, especially its last funding in May 2020 had seen it bring in key industry leaders such as the CDC Group (the UK’s development finance arm); ex-chief executive of Novartis, Silicon Valley investor Jim Breyer; and Dompe Holdings, the family office of the Italian pharmaceutical giant.

Predictably, the strategic investors may play huge roles towards the startup’s exit.

Filling The Company’s Board With Influence, Experience And Leadership, And Then Using Those To Its Advantage

mPharma has also been strategic about who it brings onto its board. Last year, when it raised its $17m, it announced the appointment to its board of Helena Foulkes, former president of CVS, the largest pharmacy retail chain in the United States. The appointment to the board added to existing board members such as early Facebook investor Jim Breyer.

Disrupting The Supply Chain Is Key In An Industry As Secretive As Healthcare

Perhaps mPharma’s biggest industry is participating in each of the levels of African healthcare supply chain. Even Rockson was quick to admit that his startup would have been long dead if they had not pivoted to different products targeting the entire healthcare industry.

“We processed almost 6000 prescriptions in our database in the past three months,” Rockson said in an interview with Eva Nean of Startupbrics. “But our mission is much more complicated than just giving software. We invest in the hospitals we select. We realized that if we wanted to bring onboard health facilities we had to go beyond just thinking about software; we had to look at the whole ecosystem. So we connect hospitals and pharmacies to our network and we bundle connectivity, device and the application as a service.”

Its sudden orientation towards a more comprehensive coverage of the entire African startup ecosystem led it to launch its famous QualityRx franchise model in 2019. It also launched a pharmacy management software called Bloom (as AWS is to Amazon). The Bloom technology creates an operating system that can enable the startup to transform community pharmacies into primary healthcare providers. It also now allows shop owners to monitor daily revenues and keep track of inventory.

“We want QualityRx to represent the best pharmacy in the neighbourhood. To do this, we are challenging what it means to be a pharmacy by enabling QualityRx members to proactively provide basic healthcare services in their neighbourhoods,” Rockson noted in a Medium article he wrote at the launch of QualityRx.

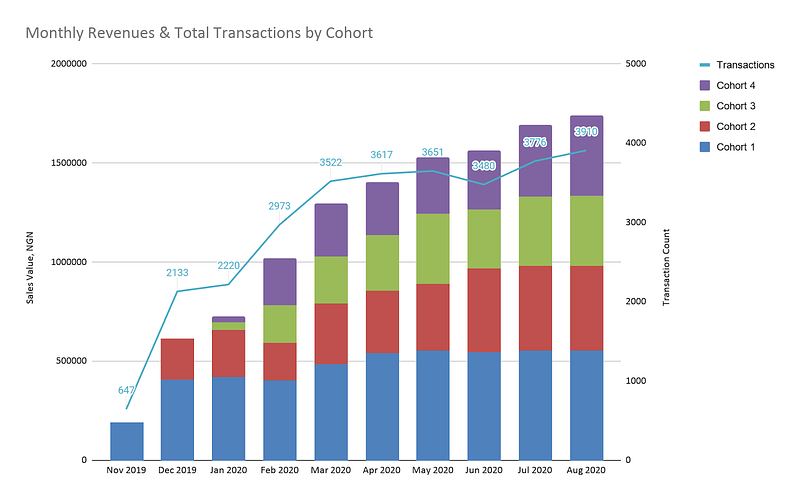

The QualityRx model also goes by the name GoodHealth Shops in Nigeria where it is funded by the Bill and Melinda Gates Foundation. The GoodHealth Shops pilot scheme, launched in 2019, hoped to expand mPharma’s QualityRx model to 20 Patent and Proprietary Medicine Vendors (PPMVs) in Lagos, Nigeria. The model had been largely successful as indicated, partly in the diagram below.

“I have opened my shop for over 30 years, but only a few people in my area patronize me. My business wasn’t growing and there were days when I didn’t make any sales at all. Partnering with mPharma changed everything for me. I became more popular, and a lot of people now patronize me’’ —said Bolanle, a Patent and Proprietary Medicine Vendor (PPMV) based in Lagos, Nigeria.

Apart from enlisting retail pharmacies, mPharma sought a way to significantly alter the customer experience previously available in the healthcare industry.

To that effect, it launched Mutti, a health membership programme. Mutti members receive discounts on their medications as well as funding options to assist with healthcare expenses. Mutti is particularly beneficial to uninsured patients who pay for their medications out of pocket and therefore bear the brunt of high drug prices. For every pharmacy chain mPharma maintains, it attaches the Mutti brand to it.

“The significant revenue growth at the GoodHealth Shops have been driven by Mutti members who account for 65% of total sales,” noted Weiwei Bi — Country Lead, QualityRx Retail (Franchising) at mPharma.

The success of the QualityRx franchise model has been phenomenal for mPharma, and with the launch of its own retail pharmacy chains — either by acquisitions (Kenya’s Haltons) or otherwise (Zambia and Rwanda’s Kumera and Ethiopia’s Haltons) — the startup now looks fully set to conquer its last territories in the African healthcare industry.

Finally, mPharma’s entire coverage of the healthcare industry may not be complete if it does not include hospitals in its chain of focus. Through its mClinic, doctors prescribe medication and send a prescription code to a pharmacy and the patient’s mobile phone. Once a patient is registered in the system, their doctor can easily access their information and prescription history. Doctors may also view stock details for all of the partner pharmacies, allowing them to avoid sending patients to pharmacies where medications are not accessible. Lastly, mPharma’s messaging system allows doctors and pharmacists to communicate directly.

mPharma lessons mPharma lessons mPharma lessons mPharma lessons mPharma lessons mPharma lessons mPharma lessons mPharma lessons

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer