MTN Nigeria Acquires Additional 800MHz Spectrum

As the quest for its broadband penetration gains traction, Africa’s leading telco, the Mobile Telecommunications Network (MTN) through its Nigerian subsidiary has acquired an additional 10MHz spectrum in the 800MHz band from Intercellular Nigeria Limited. This acquisition was completed with the final approval from the Nigerian Communications Commission (NCC) which assigned the frequency. MTN said this acquisition will significantly improve its customer experience.

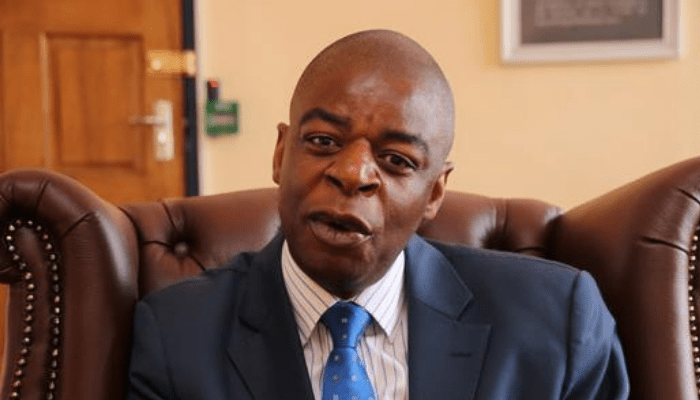

“Through this acquisition, we will be better positioned to support the deepening of broadband penetration in the country,” says Karl Toriola, CEO of MTN Nigeria.

Read also:MTN Nigeria Records Substantial Subscribers Growth

“The added resources will also greatly impact our customers’ experience providing even better internet connectivity. It is our goal to keep finding ways to grant everyone access to modern connected life.”

It could be recalled that the MTN Group announced recently, the addition of 29 Million Subscribers Despite a Challenging 2020 to reach a total of 280 million across 21 markets. The group also reported a 52% increase in adjusted headline earnings per share, a four percentage point increase in return on equity to 17% and a more than doubling in operating cash flow to R28,3 billion.

Read also:MTN Nigeria in a Mobile Network-Sharing Agreement with 9Mobile

“We continued to perform favourably against our medium-term targets,” says MTN President and CEO, Ralph Mupita. “In constant currency terms, service revenue grew 11,9% to R170 billion and EBITDA increased by 13,4%, maintaining our strong operating leverage. The Group’s EBITDA margin improved by 0,9pp to 42,7%, benefiting from the execution of our expense efficiency programme.”

Read also:Egyptian Fintech API Startup Dayra Raises $3 million In Pre-seed, Backed By Y Combinator

The solid results were supported by growth in MTN’s larger operations as well as a broad-based improvement across all regions. As well as managing the risks of COVID-19, the telco is reportedly alive to the opportunities presented by the pandemic – particularly the accelerated need for digitalisation evidenced in the greater adoption and usage of MTN services.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry