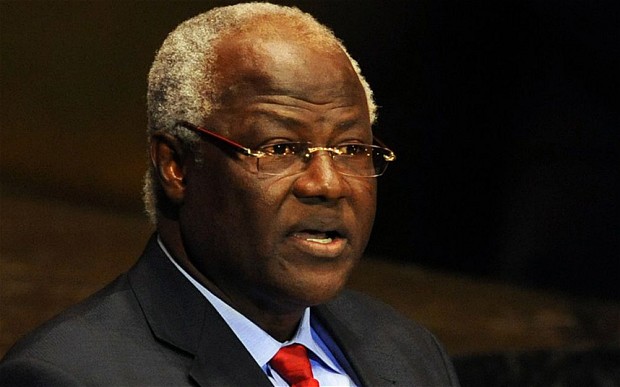

Sierra Leone is Africa’s Best Investment Destination- Koroma

Sierra Leone remains one of the best kept investment secret in the world. As one of Africa’s most stable democracies, having survived a ruthless civil war few decades ago, and recently had a transition from one political party to another political party in an election that was devoid of crisis. The country is open for business, so says the Chief Executive Officer of Sierra Leone Investment and Export Promotion Agency (SLIEPA) Sheku Lexmong Koroma. In this interview with Kelechi Deca, Mr. Koroma highlights the country’s comparative advantages within the West African Sub-region. Excerpts.

How would you describe investment climate in Sierra Leone?

Sierra Leone’s investment climate is evolving as the Government of Sierra Leone is implementing set of reform agendas to create the enabling environment and continuously improve on the investment climate in the country. This includes, but not limited to: taking concrete steps to open up the economy to private sector investments; automating the administrative procedures aimed at reducing the time, costs, and processes for investment entry; fast-tracking the issuance of permits and/or licenses, streamlining land access and clarity on tenure rights to ensure private sector participation; an agreed upon Standard Operating Procedure for the granting of fiscal and non-fiscal incentives; and effective and efficient institutional support, among others.

This is because, as a country, whilst we recognize the massive natural resources we have, we want to translate those from merely investment opportunities to investment projects for both standalone and/or Public Private Partnerships. These factors, together, form a strong basis for the achievement of further significant and sustained growth level in the economy in the coming decades.

Attracting investment is a cardinal objective of this government. What investment opportunities and incentives are in place to attract investors?

Sierra Leone’s economy is heavily dependent on its land endowment. Reports suggest that over half of the arable land is still uncultivated and available for large-scale agricultural production. The country’s underlying investment potentials in agriculture are especially in rice, oil palm, cocoa, livestock, vegetables, tropical fruits, cashew cultivation and processing. Generally, Government is embarking on increasing a sustainable and diversified production of food (especially tree crops and livestock) to ensure food sufficiency, gainful employment and preserving the environment.

The country’s 570-kilometer long coastline with a sizeable continental shelf covering an area of over 25,000 square kilometers is fed by substantial rivers containing considerable marine resources such as shrimps, cephalopods (cuttlefish and octopus), lobsters, demersal fish species, small and pelagic species–all of which have well-established global markets with high prices. Fish farming is an opportunity for investment. The marine sector also presents value addition opportunity for our domestic market and eventually export where there is increasing demand and consumption level for fish and other marine resources. The Government’s policy for the sector is to promote responsible and sustainable fisheries practices and management, improve handling of fish and fish products, and aquaculture development to contribute to poverty reduction and wealth creation.

The mining sector is one of the leading export sectors in the country. Sierra Leone has both metallic and non–metallic gem minerals. Huge investment potentials exist for value addition activities (for instance smelting of iron ore, cutting and polishing of diamonds, etc.) of our mineral resources to ensure optimal benefit to investors and for national development.

There are endless possibilities in the tourism sector given the diverse ecology of Sierra Leone. Its proximity to international hubs and an untapped natural beauty that can rival any location in the world. The country has unique and historic heritage sites for cultural tourism. Huge potential exists in the hospitality industry, especially along the stretch of beaches and other Eco-tourism locations across the country. To support the sector, Government is continuously improving the infrastructure and policy environment to attract more investment in the sector and also to support emerging sectors.

Our country is blessed with plentiful rainfall and sufficient topographic relief that creates substantial potential for hydro-power generation. It also has abundant sunlight which can seasonally complement hydropower sources, thereby creating strong opportunities in solar power generation. The energy sector offers a number of investment opportunities in terms of direct investment and Public-private partnerships such as harnessing untapped hydro potentials, opportunities for solar power generation. As the country strives to improve it industrial base, especially with the development of large-scale mines and agribusiness companies, overall energy demand is currently underserved and off-takers eventually ready to join the grid.

Sierra Leone offers fiscal and non-fiscal incentives to investors which include tax exemptions, tax deductions, reduced tax rates, tax credits, guarantees and protection of investments. These incentives have qualifying criteria and are legislated. The criteria largely depend on the (sub) sector, investment value and jobs (to be) created. That notwithstanding, the Government can enter into an agreement with investors depending on the strategic nature of the investment.

Many African countries still rely on export of commodities instead of value added processed products, what can be done to reverse this trend?

SLIEPA shall continue to leverage on current Government initiatives and programs in the agriculture, fisheries and light manufacturing sectors within the framework of it short to medium term development plan (2019-2013). As an agricultural-based nation, we have comparative advantage in the production of products in agriculture, fisheries and light manufacturing sectors.

For the agriculture sector, SLIEPA will promote investment for value addition in cocoa to produce chocolate, cocoa powder, coffee, timber products and plywood etc.

For the fisheries sector, SLIEPA will promote investment for value addition to produce sardines, salmon etc.

For the light manufacturing sector, SLIEPA will promote investment to produce products like matches, candles, plastic materials and beverage drinks.

Such initiatives will reduce our import bills on these essential products that we could produce as the Government continues to make the business environment for investors.

What role can SLIEPA play in helping to diversifying the economy?

Advocate for the speedy implementation of the Export Credit Guarantee Scheme at the Bank of Sierra Leone to militate against the financial challenge exporters’ encounter in exporting their products.

Work with stakeholders in the trade support sectors at local and international level to advocate for the establishment of more special export processing zones with the required infrastructure like energy, water and special processing incentives and duties to encourage investment into the zone. Such moves will not only create jobs for the locals but will also contribute towards revenue in terms of taxes and overall GDP growth in the country.

Which sectors of the economy is the government projecting for foreign investment presently?

The Government of Sierra Leone has identified priority sectors it wants to promote and attract private sector investments into. Cluster 2 of the National Development Plan, 2019-2023 speaks to Government’s targets, key policy actions and the strategies to diversify the economy and promoting growth. The sectors include: improving productivity and commercialize the agricultural sector, sustain the management of the fisheries and marine sector, revitalize the tourism sector, establish manufacturing outlets and provide enabling environment to support the service sector, improve and manage the mineral resources, and promote a more inclusive rural economy

Infrastructure is vital to attracting investment. What can be done to enhance infrastructure?

We are aware that infrastructure facilitates growth which the private sector drives or foster. Infrastructure is critical to stimulating economic stability and diversifying the economy. The Government has it in its plan to develop quality infrastructure across the country to support our longer-term development aspirations. Some of the planned infrastructural programmes are to have a stable and affordable energy supply; improved transport facilities to include rehabilitation of roads, reconstruction of major ports, development of rails; improving the ICT infrastructure. This is all geared to connect people to markets.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.