Explaining China’s Economic Resilience

By Zhang Jun

Widespread lockdowns and border closures aimed at combating the COVID-19 pandemic have interrupted global supply chains and largely paralyzed the global economy. Yet, the real weakness of today’s global economy is not the vulnerability of its globalized production networks, but rather souring attitudes toward globalization – and toward China in particular.

Fear of China’s growing economic clout drives many countries’ foreign-trade and investment decisions these days, and not only in the United States. Concerns about the dependence of global manufacturing on China have prompted calls to reshore production and cut the country out of global supply chains. And the US is even threatening to stifle the Chinese economy through technological decoupling.

But China’s critics are mistaken in assuming that the country’s continued economic growth depends almost entirely on the maintenance of the global free-trade system and access to Western technology. Although China is undoubtedly an important global manufacturer, the real drivers of its economic performance over the last decade or so have been rapid growth in its huge purchasing power and fixed-asset investments – including in the country’s thriving technology sector.

The world has not yet fully appreciated the significance of the country’s inward shift of economic gravity away from “external circulation.” This is partly because many economists have instead been busy criticizing China’s investment expansion and highlighting the potential debt risks arising from it. As a result, politicians in America and many other countries still think that the most effective way to contain China is to target its position in global trade and supply chains.

To be sure, China has so far been the largest beneficiary of economic globalization over the past decades, mainly because of its integration into the global free-trade system before and after joining the World Trade Organization in 2001. Indeed, by the late 1980s, Chinese policymakers were advocating that the country use global supply chains and international markets to help it industrialize and accumulate capital. China thus took advantage of its abundant cheap labor and adopted a “both ends out” approach, importing parts and components in order to assemble finished products for export.

Read also : https://afrikanheroes.com/2020/06/26/covid-19-pandemic-leads-to-decline-in-africas-smartphone-shipments/

But Chinese policymakers have long since understood that this growth model could not turn China into a fully developed, high-income economy. In particular, the severe impact of the 2008 global financial crisis on Western economies forced China to accelerate its “change of focus” by developing a more closely integrated huge domestic market and promoting growth driven by “internal circulation.” Such efforts have gained further momentum in recent years as a result of escalating trade frictions with America, and a recognition that China’s continued economic expansion requires overcoming structural imbalances.

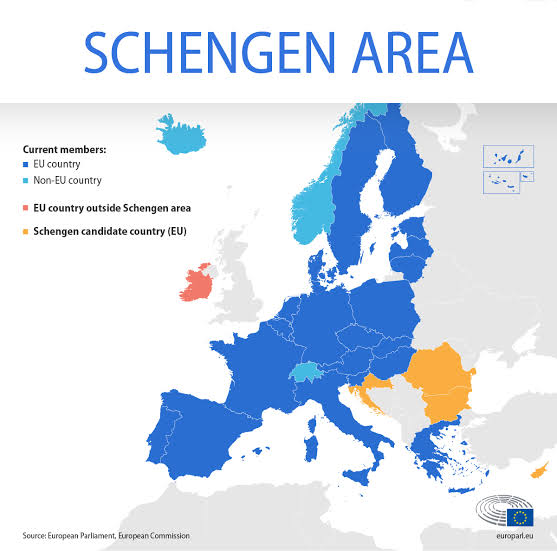

China has taken several steps to correct these imbalances and boost domestic demand. For starters, it allowed the renminbi to appreciate against the US dollar for at least a decade after 2005, and began to open up its protected market to foreign firms in line with its WTO entry commitments. The government not only liberalized imports, especially of intermediate and capital goods, but also started allowing foreign penetration in financial markets and other non-tradable sectors. And by establishing an increasing number of free-trade zones, China has honored its commitments regarding foreign-portfolio investment and facilitation of cross-border capital flows.

Second, China has increased physical infrastructure and logistics investments at a rate of over 20% annually over the last 15 years, resulting in new and improved domestic highways, railways, airports, and harbor facilities. During the last decade, for example, the country has built a high-speed railway network of more than 35,000 kilometers (21,748 miles).

Third, since the beginning of this century, the Chinese authorities have consistently supported the construction of large-scale information and communication infrastructure networks, and encouraged private enterprises to innovate in cutting-edge sectors such as mobile payments, e-commerce, the Internet of Things, and smart manufacturing. This has helped to foster the emergence of many locally based international technology firms, including Alibaba, Tencent, and JD.com. And at the beginning of 2020, the government decided to launch a new round of large-scale investment in 5G base stations.

Finally, the Chinese government has actively promoted national strategic plans aimed at integrating domestic economic mega-regions and generating domestic demand. This includes the construction of the Xiong’an New Area, where non-core functions of the capital will be moved from Beijing, and which will accelerate the development of the Beijing-Tianjin-Hebei triangle. In addition, the government has been developing the Guangdong-Hong Kong-Macau Greater Bay Area and is encouraging closer cooperation among 16 cities in the Yangtze River Belt. The Yangtze River Delta has been leading the economic integration process among mostly industrialized provinces, headed by Shanghai.

Likewise, two of southwest China’s most important urban centers – Chengdu, the capital of Sichuan province, and Chongqing, the main city on the upstream section of the Yangtze River – have been given incentives to create a “double-city circle” through closer economic cooperation. Furthermore, the freight railway to Europe from China’s west and southwest, and the “new land-sea channel” to the south, will not only boost the mainland Chinese economy but also help to stabilize global supply chains.

Indeed, despite the ongoing shift in its economic gravity, China will certainly not have an incentive to disengage from global technology supply chains or retreat into isolation. On the contrary, it will remain an active participant in and contributor to global trade and investment. And in opening up more access to its domestic market to foreign investors, China will further support globalization by helping to correct global trade imbalances. Efforts to stimulate domestic demand will create further expansion and opportunities for domestic and foreign investors, thus boosting future global economic growth.

It is therefore naive to believe that forced technological decoupling, trade sanctions, or forced changes to global supply chains will put an end to China’s future economic expansion. If critics are too short-sighted to see this, it will be their loss.

Zhang Jun is Dean of the School of Economics at Fudan University and Director of the China Center for Economic Studies, a Shanghai-based think tank.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry