Manufacturers Urged to go for the Highest Standards

Manufacturers Urged to go for the Highest Standards

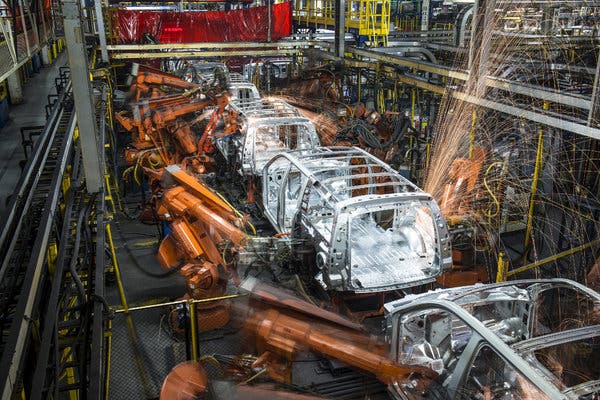

The only way local manufacturers can remain competitive in a fast changing world is go for highest standards; this was the submission of business analysts at a one day seminar on ways to get African exports to compete favourably in the international market. The event which took place in Cairo Egypt had in attendance manufacturers from different parts of the continent. The event jointly hosted by the African Organisation for Standards (ARSO), the United Nations Economic Commission for Africa (UNECA) and the African Union (AU) gave insight on the best way to go. To this end, efforts are being made to that more of such seminars led by the Workshop on Harmonisation of Trade Standards to facilitate intra-African trade in the context of the AfCFTA will come on-stream soonest.

Professor Ameenah Girub-Fakim, former President of Mauritius says standards harmonisation will create a quality culture in manufacturers and SMEs to boost market competitiveness. She, however hinged this on the provision of quality infrastructure. She notes that standards have become the default form of trade barrier which she traced to the rise of non-tariff barriers to trade replacing overt trade quotas and tariffs.

Some countries are emulating rich, advanced economies that have perfected the use of standards as barriers to trade, which hurt the least developed countries. Prof. Girub-Fakim says specifications are so designed to be so complex that African businesses and exporters wishing to comply are forced to embark on product modification and adjustments which take several months or years to accomplish. “Such tactics become market entry barrier, especially when they are not required of domestic firms,” she says.

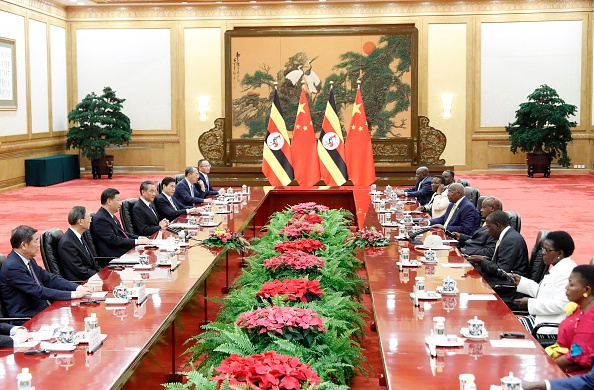

Ambassador Albert Muchanga, African Union (AU) Trade Commissioner stressed the importance of intra-African trade as a public good. He argued that trade can be facilitated by the harmonization of standards subscribed to by all players in the envisaged broader, pan-African unified market. Standardization, he contended, would smooth the flow of trade within the continent. “How else would we trust our goods and products?” he asked, rhetorically.

The AU, he said, would get its members on board to implement agreements reached on standards while also working with the ARSO. For Dr Eva Gadzikwa, ARSO President, momentum is on the side of the AfCFTA. She however reminded panelists that success would rest not only on the standardization of goods but also on free movement of persons.

Speakers at the various sessions emphasized the buy-in of the private sector, especially SMEs which do not have the financial muscle and the technical resources to meet rigorous and stringent conditions. Gerald Masila, Executive Director and Board Secretary, East African Grain Council identifies the challenges as “testing and certification”. He gave an account of how the council is dealing with capacity building and technology to achieve results. The council has taken to two-way communication with farmers and businesses in agro-allied industry to sensitize them about the inevitability of standards in the export sector. More important, the council is investing in technology to provide facilities for such processes as hermetic sealing of packed, stored grains to preserve them, thus obviating the need for application of pesticides.

Sandra Uwera, CEO, COMESA Business Council was on the same page as Masira. She agreed that the stakeholders had to have the right information about the right products and the right processing systems to adopt. She urged member-countries to consider the introduction of precision agriculture since a majority of African exports are agricultural commodities.

Afreximbank’s Director, Project Finance, Kofi Adomakoh, fittingly, supplied the finance angle to the debate. He, like his co-panellists, saw the challenges of testing and certification of African exports as daunting, noting, rather unhappily, that many exporters have had their goods rejected for falling short of some standard or requirement. In response, Afreximbank is helping countries to develop testing, inspection and certification centres such as the on-going one in Nigeria. The bank believes that such centres would soon be established around the continent to facilitate not only intra-African trade but Africa’s trade with the world at large.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.

Facebook: https://web.facebook.com/Afrikanheroes/

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.