Lagos Now Has Its Own Commodity Exchange

Good news for investors in Nigeria, particularly in Nigeria’s most populous city, Lagos. A few months from now, trading would fully begin on the newly approved Lagos Commodity Exchange. Nigeria’s Securities and Exchange Commission, the highest securities regulator in Nigeria has granted final approval for Lagos commodity exchange.

“In the exercise of the power conferred on it by the Investment and Securities Act (ISA) No 29 of 2007 and the Rules and Regulations made there-under, the Commission has granted your Company, registration to perform the function of a Commodities and Futures Exchange in the Capital Market with effect from June 14, 2019. By virtue of this registration, you are authorised to perform the function for which you are registered,” these are the words from SEC that changed the game.

A Look At Lagos’ New Commodity and Futures Exchange, LCFE

- The Lagos’ New Commodity and Futures Exchange, LCFE will be the first by any state in Nigeria, apart from Nigeria’s national Commodity Exchange.

- At present, only two commodity exchanges are registered by the Securities and Exchange Commission in Nigeria: the privately-owned AFEX Commodity Exchange, registered in 2014, and the much older government-owned Nigeria Commodity Exchange (NCX).

- The LCFE is promoted by the Association of Securities Dealing Houses of Nigeria (ASHON).

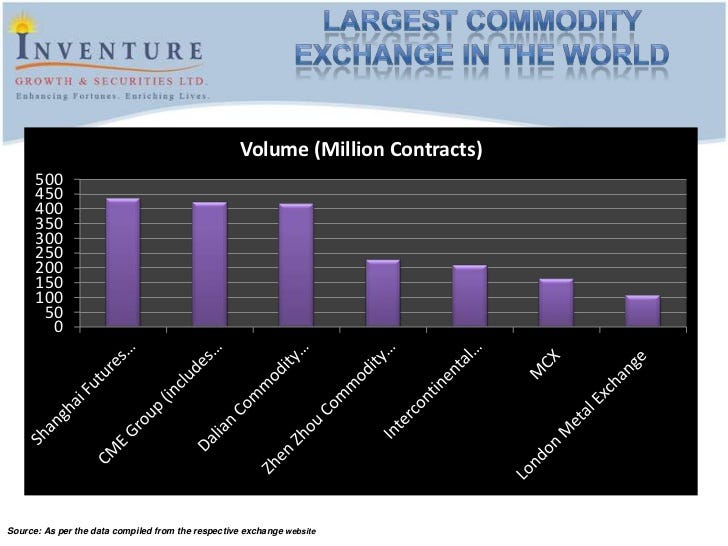

- A commodities exchange is a legal entity that determines and enforces rules and procedures for trading standardized commodity contracts and related investment products. A commodities exchange also refers to the physical center where trading takes place. The commodities market is massive, trading more than trillions of dollars each day.

- Traders rarely deliver any physical commodities through a commodities exchange. Instead, they trade futures contracts, where the parties agree to buy or sell a specific amount of the commodity at an agreed upon price, regardless of what it currently trades at in the market at predetermined expiration date. The most traded commodity future contract is crude oil, gold, natural gas, diamond, etc.

- The Lagos Commodity and Futures Exchange according to the letter of approval from SEC will fully take effect from June 14, 2019.

“SEC has shown a commitment to open up the commodities market ecosystem for ASHON’S initiative of floating LCFE to come to fruition. Congratulations to the market, the operators and the economy. We are really grateful to SEC, shareholders, and all our partners NSE, CSCS, technology providers etc that collaboratively bathed this new baby,” ASHON’s Chairman, Chief Patrick Ezeagu said

Will The New Commodity Exchange Be A Different Success Compared To Nigeria’s Struggling Commodities Exchanges?

Although there are already two commodities on the ground in Nigeria, Uche Uwaleke, Nigeria’s first Professor of Capital Market and President of the Association of Capital Market Academics of Nigeria notes that:

The sub-optimal performance of Nigerian Commodity Exchange, despite its potential to transform the agriculture sector, has been blamed on several factors including the fact that the conversion from a stock exchange to commodity exchange was done without due regard to the availability of the necessary conditions. The requisite infrastructure for physical trade including warehouses and grading laboratories is deficient.

Although, the cheery news of the approval has elicited jubilation among stockbrokers with torrents of congratulatory messages to ASHON and the management of LCFE. Analysts were quick to say that Nigeria’s capital market was long overdue for a thriving commodities exchange in view of the ongoing occasional shocks in the international oil market and the federal government’s resolve to give agriculture a pride of place as the country’s major income driver.

Perhaps The New LCFE Would Beat Ethiopia’s Commodity Exchange (ECX) Considered A Success Story In Africa

In a 2015 study on ‘Commodity Exchanges and Market Development’ Shahidur Rashid, of the International Food Policy Research Institute, noted that ‘although the ECX was launched in 2008 with a mandate to trade cereals, it was soon realized that its trade volumes were insufficient.

In late 2008, the government, therefore, passed a proclamation requiring all coffee and other export crops grown in Ethiopia to be exported through the ECX. At one point in late 2008, the government had to confiscate 17,000 tons of coffee from 80 exporters attempting to bypass the ECX’.

As documented in the study, this measure was positive for the ECX which generated over US$1.0 billion in revenue in 2012, sufficient to defray the cost of its own operations.

In all, the government piper performs according to how the government wants the tune to be dictated.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.