The more revenue you have coming in, the better the chances you can raise (and not waste) investor funds. At startups, the difference between survival and running out of runway always comes down to taking our eyes off revenue.

We don’t want to do this, and we certainly don’t do it on purpose. But when we’re in the middle of the startup run, it’s pretty easy to fall into a trap of wasting time on feel-good tasks that feel like progress but don’t bring in any money.

No entrepreneur is immune to this trap, myself included. It’s part of the drive that makes the successful entrepreneurs successful.

I’ve founded, worked at, and advised a ton of startups, and each one tends to make the same mistakes where revenue is concerned. Whether a founder is launching their first company or their fifth, there’s one universal fact they can’t ignore: The path to success starts with survival.

The odds of survival depend on how fast you can generate revenue. The key to getting to revenue fast is to do nothing else but seek it out. Here are the easiest traps to fall into and how to sidestep them.

“Remember: Raising money is not the same as generating revenue.”

Mistake #1: Raising money before you’re ready

No one joins a startup to do something ordinary. But if you want to do something extraordinary, you’ll need a shitload of money to get it all done.

That doesn’t happen overnight. It happens in stages — sometimes long, mostly boring, often very scary stages. The problem is that we usually see, hear, and read about startups as overnight successes: Some kid genius has a great idea, drops out of college, works on it for a couple months, and then raises a few million dollars at a $1 billion valuation.

This is the trap: Like the lure of the lottery but with pitch decks and spreadsheets instead of Powerball tickets.

Before you try to raise money, you need to establish that what you want to build will generate revenue. And remember: Raising money is not the same as generating revenue.

Here’s what I usually advise to avoid this trap: You might estimate that you need a few million dollars to take a serious run at your dream company. Break that number into small pieces, and raise just enough to get to that first revenue-generating piece. As a guide, think about how much of your own funds you can scrape together to put into your company. Multiply that by 10 and go raise that.

But even before that, figure out how you’ll get to your first dollar of revenue, and then build your deck, financial model, and pitch on repeating that process over and over. Because this is what almost all successful entrepreneurs do anyway — they just take bigger strides. It’s also the reason investors love repeat entrepreneurs, because those entrepreneurs can say, “Remember that time I made all that money? I’m going to do it again but a little different.”

Unless you have already built a track record, you can’t say that to investors — and believe me, it’s not that simple even when you do have a couple exits under your belt. The more definitive your proof that revenue will be coming in, the better the chances you can raise (and not waste) investor funds.

Mistake #2: Building out the company before the product

From business plans to business cards, founders can spend a lot of time dreaming and building their company before the first dollar is made. Here are some of the things startups don’t need before going after revenue:

- A website or social media presence.

- A mission statement, brand statement, or logo.

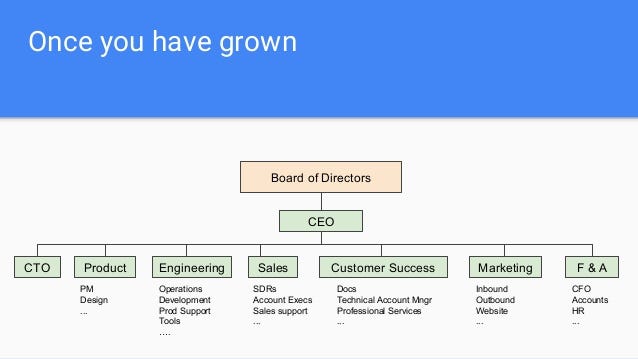

- A board of directors, advisory board, or management team.

- A financial plan or P&L statement.

- Office space, T-shirts, or stickers.

Read also: Before Letting People Mount Board Positions In Your Startup, Here Are A Few Things You Must Know

It’s not that a startup shouldn’t have these things. But how the initial revenue comes in will drastically alter not only whether those things are needed, but also what their true purpose is. A common example of this trap is building out an amazing web app and then realizing all the things paying customers actually need are three or four clicks deep.

I get that company and brand building are intended to establish legitimacy. The advice I usually give to avoid this trap goes like this: “You want to be an entrepreneur? Boom. You’re an entrepreneur. But no matter how cool your brand is or what your mission is or how far out your financial plan goes, you’re not really an entrepreneur until someone pays you money for something you’ve made.”

Everything will change when that happens, so make it happen early.

Mistake #3: Hiring or teaming up before the idea is fully formed

I can’t exaggerate the number of times a startup co-founder has come to me with the lack-of-revenue issue and it turns out there are a dozen people fighting over the strategy of a company that doesn’t have a single paying customer yet.

Look, running a startup can be hard to do alone. But for your own sanity, as well as for the integrity of your vision, it makes sense to get as far as you can down the revenue road on your own. You may not be a coder, but there are a number of SaaS tools that can get you to MVP. You may not be a financial expert, but most of us can wrangle a spreadsheet in the early days. You may not have sales magic, but if your idea is good enough, you’re probably the right person to get it into the hands of those first paying customers.

Yeah, it’s always easier building something with other people, except when it isn’t. There are priorities to juggle, schedules to wrangle, agreements to hammer out, decisions to get consensus on. Believe me, especially in the early days, it can be much less of a headache to go it alone.

Mistake #4: Mapping out the full infrastructure of the product before the first release

If we’re building a rocket, we first need to build something that manages to take off and land without exploding. How far it flies, its reusability, and what color it is don’t matter yet.

This is a trap that most repeat entrepreneurs get caught in, and I still fall for it. I know the true vision I want to build is not version one, but version five of my product, and the trap I fall into is trying to build all five versions at once. In other words, before I launch, I plan for every use case in every scenario with multiple features across multiple customer segments.

My advice to avoid this trap is something I still tell myself on a weekly basis: Narrow it down and get to a small feature set for a small segment with manual steps. Then collect money, figure out the priorities based on where the money comes from and what breaks, and move on to building the next feature.

Mistake #5: Focusing on innovation before execution

A startup without innovation is a small business. But innovation without execution is just a great way to earn a doctorate degree.

Obviously, the trap is worrying about innovation before building the product. Again, I raise my hand as having been guilty of this many times over, just not anymore. My advice is something I started doing about halfway through my career: If you want to innovate on a product, first you need to sell the product. If you have a new way to mow lawns, start by selling regular lawnmowers. If you can’t sell a lawnmower, you can’t sell the lawnmower of the future.

Mistake #6: Chasing a large number of customers before landing one

Almost everyone makes this mistake, especially during the early stages of their startup. The trap is trying to sell your minimum viable product to hundreds or thousands or even millions of customers at once, tailoring the marketing, the pitch, and the price to a target we think might be somewhere in the middle of the curve.

This seems like a good way to generate revenue quickly, but it’s really just a flawed way to try to generate a lot of revenue. It’s also crazy expensive. My advice is to start with one customer and sell the heck out of them. How that first customer gets sold, how they get onboarded, how they adopt the product, and when they stop using it will all be lessons to learn.

Learn from customer number one, then go to 10 customers. Learn from them, then do 20, and so on until you have definitive, repeatable, scalable revenue streams. Then go innovate, launch new versions, hire the team, build the company, and — if you’re still interested in growing — raise the money.

Joe Procopio is a a multi-exit, multi-failure entrepreneur. Building Spiffy, sold Automated Insights, sold ExitEvent, built Intrepid Media. M

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world