Maroc Numeric Fund Announces Its First Investment in Diaspora Startup Cypherleak

Cypherleak, a groundbreaking cyber risk monitoring and scoring startup, recently secured a substantial investment of US$750,000 through a seed funding round. The investors behind this infusion of capital hail from prominent locations, notably Abu Dhabi, Morocco, and Qatar. Notable contributors to this investment round include Maroc Numeric Fund II and Qatar Insurance Company. The primary objective of this substantial financial backing is to fuel Cypherleak’s expansion efforts throughout the Middle East and Africa.

Cypherleak’s core mission revolves around simplifying advanced risk monitoring for smaller enterprises, rendering extensive cybersecurity technical expertise unnecessary. Their innovative approach hinges on the analysis of domain names to track leaked passwords and sensitive data across both the Public and Dark web. By doing so, the platform aids companies in comprehending the full extent of their vulnerability landscape and pinpoints weaknesses affecting their infrastructure. Employing state-of-the-art Machine Learning and advanced risk models, Cypherleak crafts bespoke security ratings that consider various cyber risk factors for each client.

read also Mozambican Logistics Startup Appload Secures Investment for Logistics Revolution

Mohamed Amine Belarbi, the Founder and CEO of Cypherleak, affirmed that the injected funds would expedite their expansion efforts across the Middle East and Africa. This financial backing strengthens their position as a frontrunner in the rapidly evolving domain of cyber risk management and ratings. Supported by strategic investors, Cypherleak is poised to continue developing cutting-edge technologies and delivering unparalleled cyber risk insights to businesses and organizations worldwide.

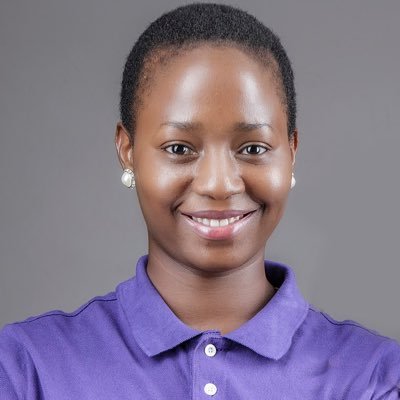

Dounia Boumehdi, the Managing Director of MITC Capital, which manages Maroc Numeric Fund II, emphasized the critical nature of the platform in addressing the cyber threats facing SMEs in the MENA region. She highlighted the need for such solutions and expressed enthusiasm for Cypherleak’s plans to open an African regional office in Morocco dedicated to research and development.

Why the Investors Invested

Investors have chosen to allocate substantial capital to Cypherleak for several compelling reasons, rooted in the platform’s robust value proposition and the evolving landscape of cybersecurity in the MENA region. The investors’ motivations are grounded in these observations:

- Addressing Cybersecurity Gaps for SMEs: The investors recognize that small and medium-sized enterprises (SMEs) in the MENA region face a growing cybersecurity threat but often lack the resources or expertise to adequately protect themselves. Cypherleak’s user-friendly and accessible approach to advanced risk monitoring directly targets this underserved market, aligning with the pressing need for cyber resilience in SMEs.

- Disrupting Cyber Insurance Underwriting: The innovative cyber risk scoring offered by Cypherleak presents a transformative opportunity for the insurance industry in the MENA region. Insurers can now assess cyber risks with greater accuracy, fundamentally changing how cyber insurance is underwritten. This forward-thinking approach aligns with the rising demand for cyber insurance, which is expected to surge in the region.

- Demonstrated Expertise and Traction: The track record of Cypherleak’s Founder and CEO, Mohamed Amine Belarbi, in the field of cybersecurity in the MENA region lends credibility to the venture. Moreover, the startup has already achieved significant traction with subscriptions from corporate clients across Europe and the MENA region. The company’s subscription offerings have garnered traction, with over 1000 corporate end-users across Europe and the MENA region, with a particular focus on SMEs. This early success signals the platform’s potential to address the pressing cybersecurity needs of the market.

Section 3: A Look at Cypherleak

Cypherleak, founded in April 2022, represents a pioneering force in the cybersecurity landscape. The startup, spearheaded by Mohamed Amine Belarbi, focuses its operations in the Middle East and Africa (MENA) region. Its primary objective is to simplify and democratize advanced risk monitoring, making it accessible to smaller companies without the need for intricate cybersecurity expertise.

read also Maroc Numeric Fund To Engage Diaspora January 26 Regarding Newly Launched Fund

The cornerstone of Cypherleak’s offering lies in its ability to analyze domain names, tracking leaked passwords and sensitive data across both the Public and Dark web. This distinctive approach empowers businesses to comprehensively assess their exposure to cyber threats and identify vulnerabilities within their IT infrastructure. Leveraging cutting-edge Machine Learning and advanced risk models, Cypherleak tailors security ratings to each client’s specific cyber risk profile.

Since its inception, Cypherleak has gained substantial traction, selling subscriptions to over 1000 corporate end-users across Europe and the MENA region. The startup’s primary focus remains on SMEs, bridging the cybersecurity gap by offering accessible risk monitoring solutions. The company’s strategic move to open an African regional office in Morocco underscores its commitment to expanding its footprint and advancing research and development in the cybersecurity domain.

In addition to its technical prowess, Cypherleak’s significance extends to the realm of cyber insurance underwriting. The startup’s cyber risk scoring capability revolutionizes how insurers assess prospective applicants in the MENA region, and it also empowers insurers to provide ongoing risk monitoring and mitigation services to cyber-insured customers.

Cypherleak’s success has been duly acknowledged, with the platform receiving accolades such as winning the MENA Insurtech Summit 2023 in Doha, Qatar. These achievements underscore the startup’s pivotal role in enhancing cyber resilience in the MENA region and beyond. As it continues to evolve, Cypherleak’s presence in the cybersecurity landscape promises to be transformative, particularly for SMEs facing escalating cyber threats.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard