Why Safaricom’s Spark Accelerator is Focusing on Fintech and Content Startups for its First Cohort

In a groundbreaking collaboration, Safaricom, M-PESA Africa, and Sumitomo Corporation, a Fortune 500 global trading and business investment giant, have unveiled the Spark Accelerator program. This initiative is designed to propel early-stage startups into growth and scalability, offering a unique blend of training, mentorship, funding, and market support.

The three-month accelerator program represents a strategic move by Safaricom, signaling its commitment to being a purpose-led technology company. CEO Peter Ndegwa emphasized that the revamped program goes beyond mere capital injection, aiming to address challenges that often hinder the growth of early-stage startups.

Focusing on Fintech and Content startups in its inaugural phase, the Spark Accelerator adopts an ecosystem-based approach. Leveraging expertise in market dynamics and emerging technology, a team of experts will guide and accelerate the selected startups, laying the foundation for continuous innovation.

Sumitomo Corporation, with its extensive business experience, joins the initiative to foster innovative businesses and contribute to the expansion of the startup ecosystem. Katsuya Kashiki, General Manager of the Smart Communications Platform Business Division, expressed the corporation’s commitment to supporting African economic development and human resource growth through the program.

Participating startups stand to benefit significantly, gaining access to technical support for developing mini-apps embedded into Safaricom’s M-PESA Super App. This opportunity opens doors to over 4 million customers using the app, as M-PESA already connects over 60 million customers and 5 million businesses across eight countries.

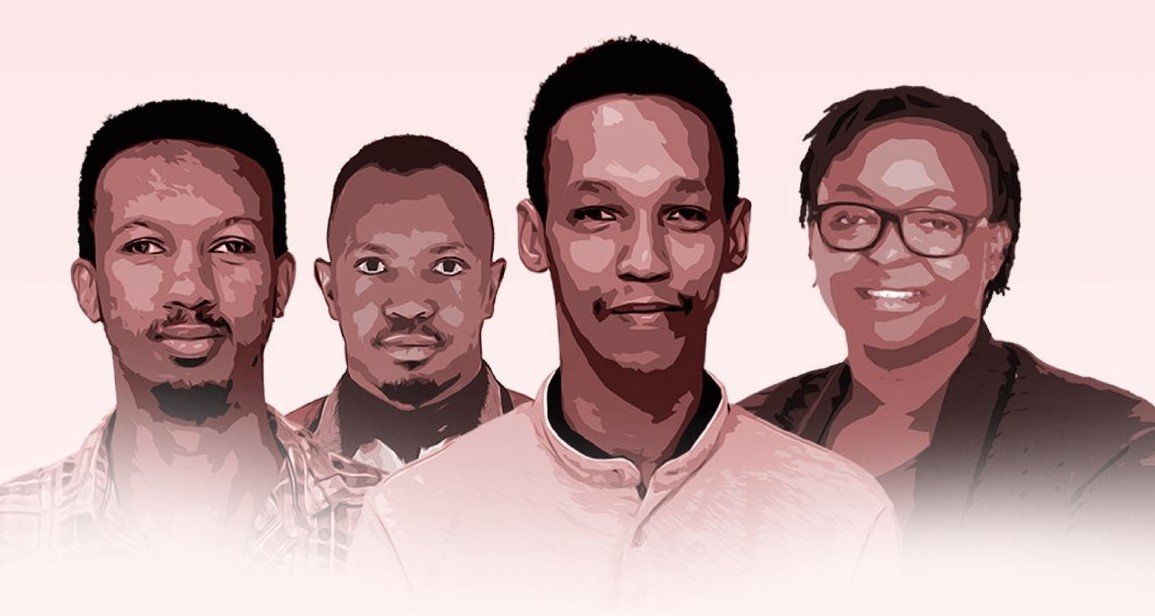

Sitoyo Lopokoiyit, Managing Director of M-PESA Africa, highlighted the potential for startups to create innovations that connect customers and businesses on M-PESA to more opportunities. The accelerator program aims to provide funding, technical expertise, resources, and mentorship to propel the next generation of tech startups in Africa.

Moreover, M-PESA Africa will offer expertise, market research, and insights, along with capacity support for startups seeking to expand beyond their borders. This support will extend beyond the initial three-month program, enabling startups to tap into the vast network of over 60 million customers and 5 million businesses across M-PESA’s eight markets.

The culmination of the accelerator program will be an investor demo day, providing startups with the opportunity to pitch for investment from Safaricom and partner venture capital firms. The implementation of the Spark Accelerator will be in collaboration with iHUB, a leading force in Kenya’s startup ecosystem and a subsidiary of Africa’s premier innovation hub, Co-Creation Hub (CcHUB).

Ojoma Ochai, Managing Director of CcHUB, expressed excitement about spearheading this collaborative effort. The Spark Accelerator, she noted, serves as a launchpad for forward-thinking founders to shape and scale their enterprises. Ochai encouraged startups with dynamic and impactful solutions to join the journey, emphasizing the collective effort to catalyze innovation and empower digital ecosystems.

The program has garnered support from additional partners, including Vodacom and AWS, further solidifying its potential to drive meaningful impact in the African tech startup landscape.

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard.