Baims Edges Towards Regional Dominance with Strategic Acquisition of Egypt’s Orcas in $11 Million Deal

Kuwaiti education technology company, Baims, has successfully completed the acquisition of its Egyptian counterpart, Orcas, in a comprehensive 100% deal. Established in 2017 by Bader Al-Rasheed and Yousef Alhusaini, Baims specializes in delivering online pre-recorded courses to university and high school students across Saudi Arabia, Kuwait, Bahrain, and Jordan. This strategic move aims to integrate Orcas’ personalized tutoring services into Baims’ existing platform, creating a synergistic and adaptable educational experience for learners in the MENA region.

Orcas, founded in 2019 by Hossam Taher and Amira El Gharib, provides tailored learning experiences to K12 students in international schools. The combined efforts of Baims and Orcas have attracted over $11 million in funding from prominent investors such as Access Bridge Ventures, Algebra Ventures, NFX Ventures, AlWazzan Educational Group, Rasameel Investment Company, Seedstars International Ventures, and AK Holding. This collaboration positions the newly consolidated entity as a leading EdTech player in the MENA region.

With the MENA education landscape evolving toward hybrid learning models, Baims and Orcas are committed to offering comprehensive education solutions that encompass both synchronous and asynchronous formats. Yousef AlHusaini, CEO of Baims, emphasizes the significance of the acquisition, stating, “By acquiring Orcas Tutoring, we are not just expanding our reach; we are redefining the EdTech landscape in MENA.” This consolidation aims to address the profound challenges faced by students in the region.

Baims, known for its online tailored recorded courses for university students, sees the acquisition of Orcas as a strategic move to enhance its offerings. The incorporation of Orcas’ personalized tutoring services into the platform aims to create a well-rounded and adaptable educational experience for students across the MENA region.

Hossam Taher, CEO of Orcas Tutoring, highlights the goal of establishing product and market synergies. The focus is on introducing personalized K12 tutoring services in the GCC and expanding the portfolio to cater to the diverse needs of university students.

While Baims plans expansion in the GCC, particular attention is given to the growing Saudi Arabian market. Recognizing Riyadh as a future startup hub, Baims aims to solidify its presence by launching specialized AI-driven test preparation products. The company also plans to expand its offerings by incorporating one-to-one tutoring services and reaching more universities in Saudi Arabia.

The newly consolidated company, leveraging the experience of both teams, seeks to achieve its objectives of product and market expansion, along with regional dominance. Seasoned professionals with over 35 years of combined experience in the EdTech space, including Hossam Taher and Amira El Gharib, join Baims’ leadership.

The strategic acquisition has gained support from investors who recognize the potential of the consolidated entity in transforming education in the MENA region. Issa Aghabi, Managing Partner at Access Bridge Ventures, expresses enthusiasm for the promising path ahead for EdTech in the Middle East.

Despite the immense potential, the $100 billion education market in the MENA region remains largely untapped. Baims aims to bridge the gap by offering a consolidated platform that fosters skill development and prepares students for success in the workforce.

Baims also envisions contributing to job creation in the MENA region. Yousef AlHusaini emphasizes the goal of not only solving the education problem but also creating more job opportunities in Saudi Arabia, Kuwait, Egypt, UAE, and Jordan.

The Orcas exit, led by CEO Hossam Taher, is seen as a positive development for the Egyptian startup ecosystem. In a challenging environment, Orcas’ focus on expansion serves as a beacon of hope for the region. Taher remarks, “Our journey with Orcas has been about empowering students and teachers, and with Baims, we see this impact expanding even further.”

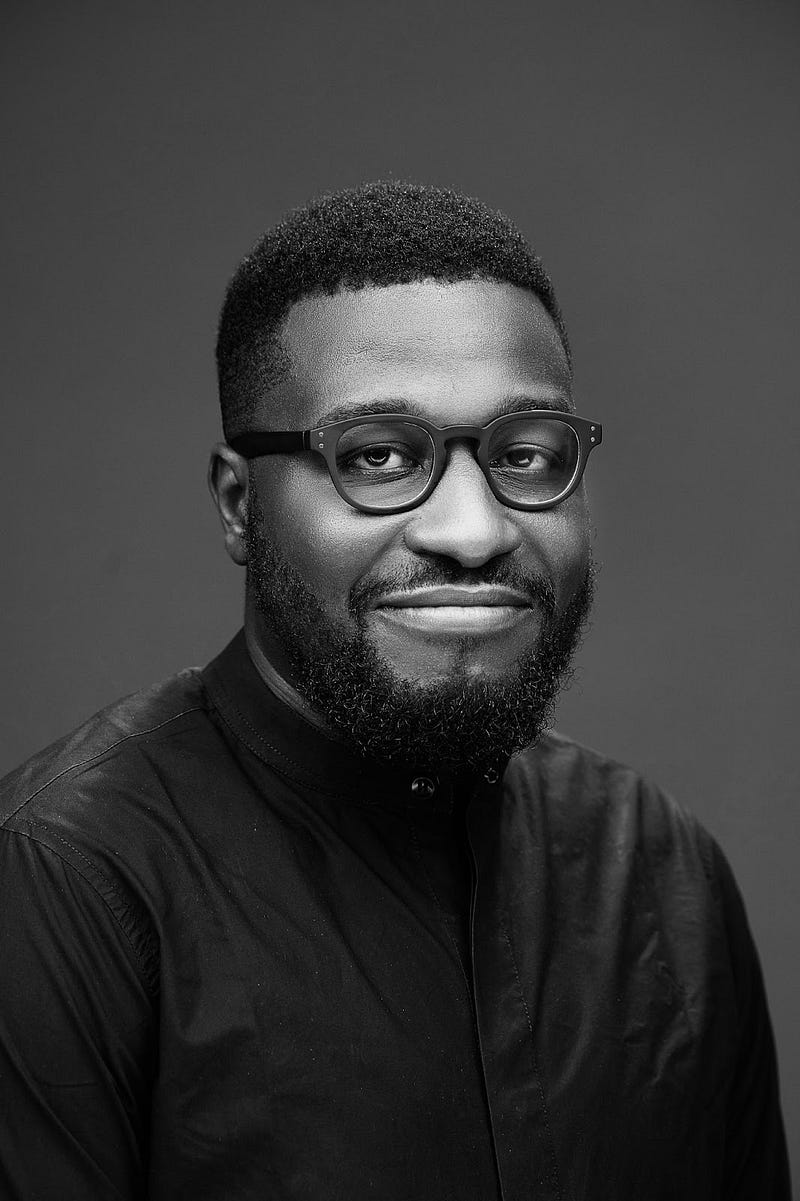

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard.