Algeria named host of fourth Intra-African Trade Fair

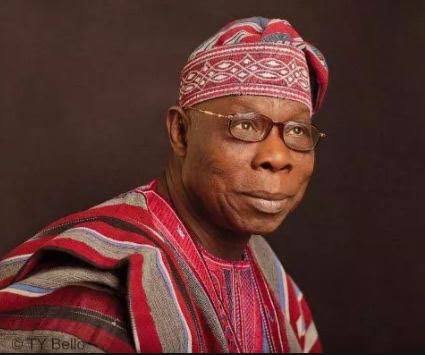

Algeria has been selected to host the fourth Intra-African Trade Fair (IATF2025) scheduled to take place in 2025, Chief Olusegun Obasanjo, Chairman of the Advisory Council of the Intra-African Trade Fair and former President of Nigeria, has announced.

Speaking in Cairo during the Presidential Summit of the third Intra-African Trade Fair (IATF2023), Chief Obasanjo said that the selection followed a rigorous review of bids received by the Advisory Council for the hosting of the continental event.

read also Afreximbank Launches African Gastronomy and Culinary Arts Programme

“We congratulate the government and people of Algeria for winning this bid,” he said, adding, “We look forward to converging in Algiers in 2025”.

With the selection, Algeria will become the third country to host the IATF after Egypt hosted the inaugural edition in Cairo in 2018 and the second edition was held in Durban, South Africa, in 2021. The trade fair returned to Cairo for the 2023 edition.

Speaking at the ceremony held today to hand over the IATF flag to the Algerian authorities, President Obasanjo said that the trade fair had established a tradition of each edition being better than the previous one and expressed a strong conviction that Algeria would maintain that tradition.

He said that with the selection of Algeria as host, the job of the IATF2023 Advisory Council was coming to an end, adding, “from tomorrow, it will be IATF2025 Algiers.”

read also Lessons Learned as Africa-focused FinTech Zazuu Shuts Down After Raising $2M

Abdelaziz Benali Cherif, the Algerian Ambassador to Egypt, who received the IATF flag on behalf of the Algerian Government, said that with the new investment law implemented in his country, Algeria had introduced a lot of economic reforms empowering the private sector to become the engine of growth in the economy.

The country was now open for partners to participate in a win-win situation in the economy, he said, adding that all Africans were welcome to become part of the new dynamics.

The ambassador expressed gratitude to the IATF Advisory Council for its decision to award the hosting of the next IATF to Algeria and pledged the country’s commitment to ensuring a successful event.

“IATF2025 in Algiers will be a true platform for networking and collaboration,” he said, adding that participants should use the event to explore new opportunities.

Kanayo Awani, Executive Vice President, Intra-African Trade Bank, Afreximbank, said that it was necessary to start early to prepare for the trade fair as the event entailed a lot of work. The CANEX WKND, normally hosted in the year preceding the IATF, served as a dry run for the IATF, she added.

Wamkele Mene, Secretary-General of the African Continental Free Trade Area Secretariat, noted that many Africans looked forward to participating in IATF and said that was critical to ensure that those Africans who wished to attend were not held back by issues like visa and duty on goods coming into host country temporarily for the trade fair.

Albert Muchanga, African Union Commissioner for Economic Development, Trade, Tourism, Industry and Minerals, also addressed the ceremony and commended Algeria for winning the bid.

Organised by the African Export-Import Bank, in collaboration with the African Union Commission and the African Continental Free Trade Area (AfCFTA) Secretariat, the IATF provides a unique platform for facilitating trade and investment information exchange in support of increased intra-African trade and investment, especially in the context of implementing the AfCFTA. It is Africa’s largest trade and investment event, attracting thousands of exhibitors, visitors and buyers and generating trade and investment deals running into tens of billions of dollars. Attendees include buyers, sellers, importers, exporters, investors, manufacturers, captains of industry, senior government ministers, trade finance and advisory specialists, trade and economic organisations, senior executives from corporates and multinationals and innovative entrepreneurs from across Africa and beyond.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry