Kenyan And Nigerian Startups Top Winners Of Jua $2m Fund

In November 2020, one of Zimbabwe’s billionaires, Adam Molai, launched a $1m Jua Kickstarter Fund for African startups. In January this year, he again announced that the fund’s size had been increased to $2m, and then African startups were invited to apply. Now, barely two months and after intense week-lon competition among selected startups, the Fund has announced its top winners. While agritech startup GrowAgric, ecommerce startup, Side and procurement facilitation startup Xetova all come from Kenya, cleantech startup Powerstove Energy and healthtech startup Whispa Health come from Nigeria. Other winners are Bryt-Knowledge (Zimbabwe) and Jirogasy (Madagascar). The selected startups must pass due diligence and other agreed-upon terms and conditions before the transaction can be closed and funds disbursed.

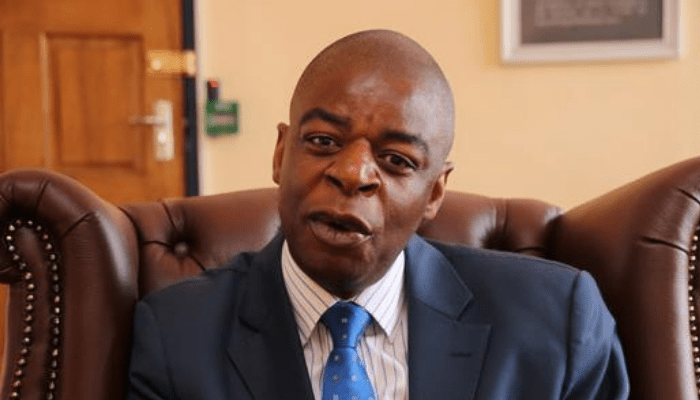

“The Jua fund is a tiny drop in the ocean, in our effort to unite African grey hairs with our bright young future through funding and mentorship support. After listening to the pitches and presentations during the Kickstarter Olympics, my faith and hope has more than been repaid. We have brilliant entrepreneurs on this continent. I and my fellow judges were immensely impressed by all our finalists, even those that fell away during the week,” Molai said.

“We targeted enterprises that are scalable across the Continent and actually address the challenges that are hobbling Africa’s development, and the selected enterprises all do that,” Adam said.

The startups were chosen after a week-long “Kickstarter Olympics,” in which they pitched their ideas to a prestigious panel of judges.

Read also:Nigerian Fintech Startup Flutterwave Raises $170m Series C, Becomes Africa’s Latest Unicorn

The Jua Fund is a private individual’s largest African venture capital fund.

The fund will provide not only equity to the successful startups, but also mentorship and consulting services, as well as link them with other investors.

Molai, who is founder of TRT Investments which manages a diversified sector portfolio and operations in Nigeria, South Africa, Zimbabwe, Zambia, Mozambique and Botswana, and whose latest interests have seen a foray into the US and European markets said that it is critical that entrepreneurs arecreative in their approach to funding.

Read also:Ghanaian Fintech Startup OZÉ Raises $700k In Seed Funding Round

Africa contributes 20% to venture capital transactions, with North America contributing the most at 53%, Asia at 29% and Europe at 15%. This is despite the recent growth spurt, which has seen the total value of venture capital transactions in Africa rise 67% to US$1.4 billion in 2019 from US$300 million in 2017.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer

Jua fund winners Jua fund winners