Liquidators of Africrypt Gets Additional Powers to Pursue Missing Funds

The high court has granted the liquidators of Africrypt additional powers to track down missing funds, and to sell assets and property belonging to the company.

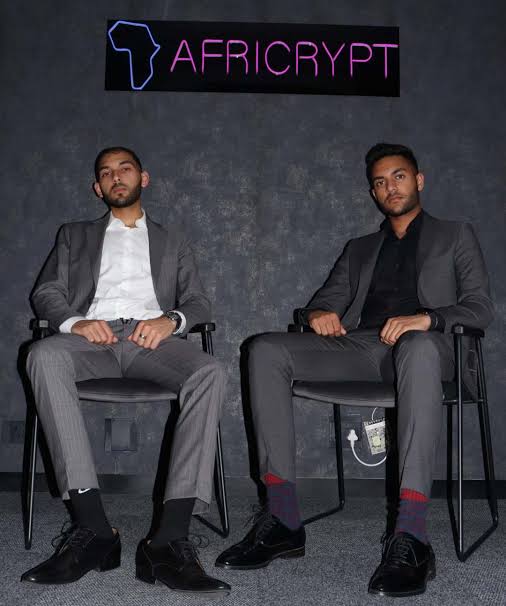

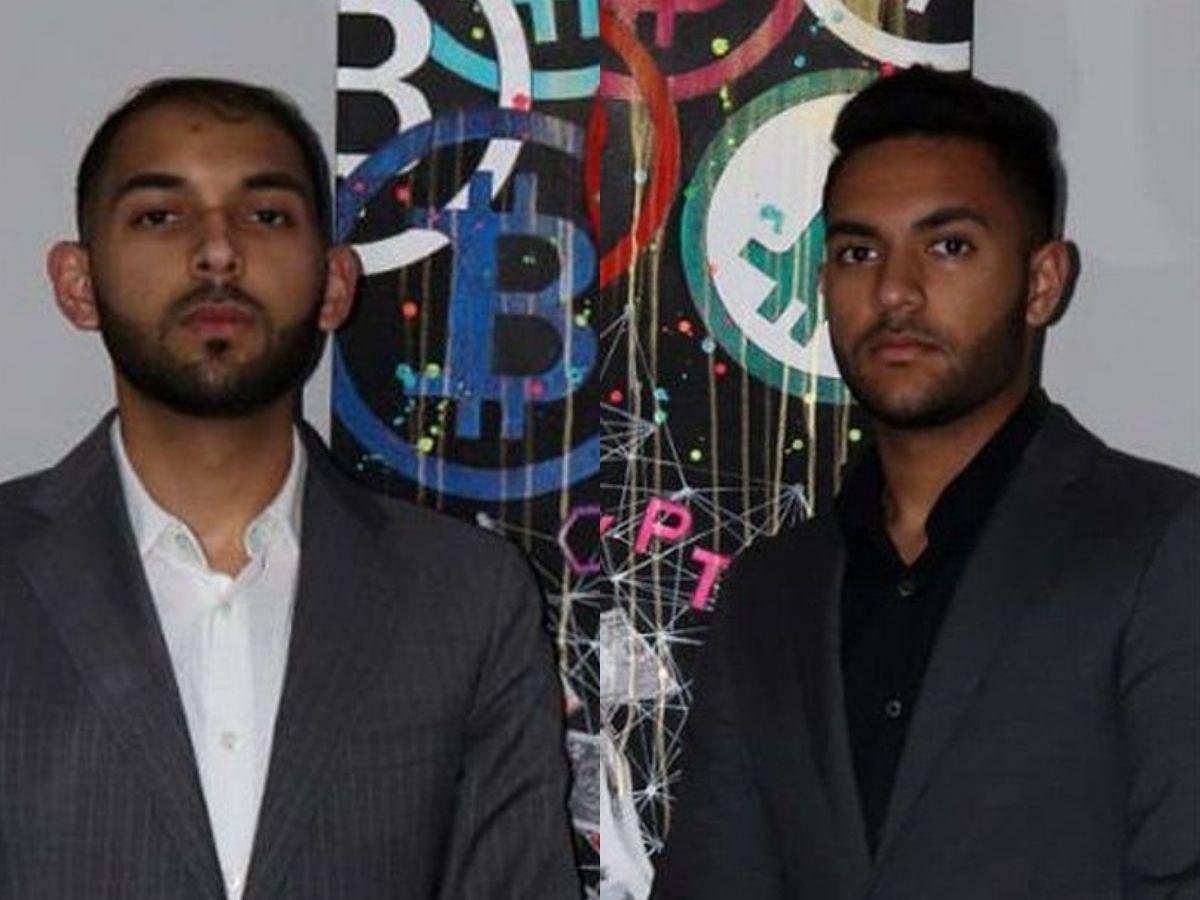

It could be recalled that Africrypt is a crypto investment scheme headed by Raees and Ameer Cajee, was supposedly hacked in April 2021 and its digital wallets emptied of more than R40-billion in bitcoin. Forensic investigator Hamilton Cheong and Darren Hanekom, the attorney representing some Africrypt clients, have raised doubts as to whether it was a hack, given the fact that funds were depleted from Africrypt-controlled wallets months earlier.

The brothers fled South Africa after the alleged hack, claiming they feared for their lives after receiving death threats. Raees Cajee emerged from hiding in Tanzania last month to depose an affidavit opposing the final liquidation of the company, arguing that the alleged hack originated out of a Ukrainian IP address, and that investors had no claim against the company and “it is in the nature of investments that they can be lost”.

Read also:Despite CBN’s Policy, P2P Crypto Transactions In Nigeria Total $204m In First Half Of 2021

The company was placed in provisional liquidation on 26 April after investor group Badaspex launched a liquidation application. A statement issued last week by the liquidators’ legal representative, Ruann Kruger, says the business model of Africrypt “required investors to deposit fiat currency with Africrypt, who used the fiat currency to purchase crypto assets on a number of asset exchanges, and promised investors exorbitant returns of up to 10%/day on their investments.

“There is no evidence that this was indeed a hack of the Africrypt systems, and in support thereof it seems that funds were depleted from the Africrypt wallets four months before the alleged hack.”

Africrypt was placed in provisional liquidation on 26 April after investor group Badaspex launched a liquidation application and obtained a provisional order.

Read also:The Latest Tax Free Destination For Foreign Businesses In Africa Is Zanzibar. Here’s How It Works

The court-appointed liquidators – Eugene Januarie and Welcome Jacobs – say directors of Africrypt intentionally failed to co-operate and are deliberately hampering the investigations into the affairs of the company. An enquiry into the whereabouts of the assets must now be held to ascertain what happened to the funds and to determine what can be recovered.

“There exists a high probability that assets and funds were moved from the business of Africrypt into the names of the directors, related companies and close corporations to the detriment of creditors, and requires urgent investigation,” says the statement.

“The so-called breach occurred on 12 April 2021, causing a loss of approximately R84-million, although an amount of R200-million had been received and invested on behalf of investors.”

This raises questions as to the status of the remaining R116-million (being the difference between the claims of R200-million received and the reported loss of about R84-million), and whether this includes gains and losses from investment, as well as withdrawals.

Read also:The Role Mobile Technology Plays in Africa

The liquidators also want to know why no communication has been issued by Recreate Wealth (Pty) Ltd or ReaCreate Wealth Limited, the two Hong Kong-based companies that were the legal entity that contracted with Africrypt clients.

With the liquidator’s extended powers, they will be able to investigate and interrogate the relevant parties…

“With the liquidator’s extended powers, they will be able to investigate and interrogate the relevant parties, directors and their related companies during the enquiry to uncover the mystery behind this ostensible ‘bitcoin heist’.

“The liquidator’s main objective is to track down assets, attempt to gain access to Africrypt systems and their source codes to recover bitcoin wallets and funds invested and lost by investors.

“In this endeavour, the liquidators have further secured the services of Mahier Tayob of Tayfin Forensic Investigative Auditors to conduct forensic investigations into the affairs of Africrypt and related entities.”

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry