After Calling It A Fraud, American And CEO Of Citron Research Andrew Left Finally Buys Jumia’s Shares

In 2019, when Nigerian ecommerce company Jumia went on its Initial Public Offering (IPO) on the New York Stock Exchange, CEO of American research firm Citron, Andrew Edward Left called it “the worst abuse of the IPO system since the Chinese RTO fraud boom almost a decade ago.”

“As the media in the US is naively anointing Jumia the “Amazon of Africa”,” said Left, then, “the media in its home country of Nigeria has a plethora of articles discussing the widespread fraud in this Nigerian company. Not even that elusive Nigerian prince can cover this one up.”

It is now more than one year after and Andrew Left’s Citron, known for publishing reports on firms that appear to be overvalued or are engaged in fraud, appears to have found new friendship with the company.

“I’m convinced from their prospects now that the fraud seems to be almost completely behind them,” Left said in his latest statement. “Nigeria obviously will not be the only country in the world not to embrace e-commerce.”

Here Is What You Need To Know

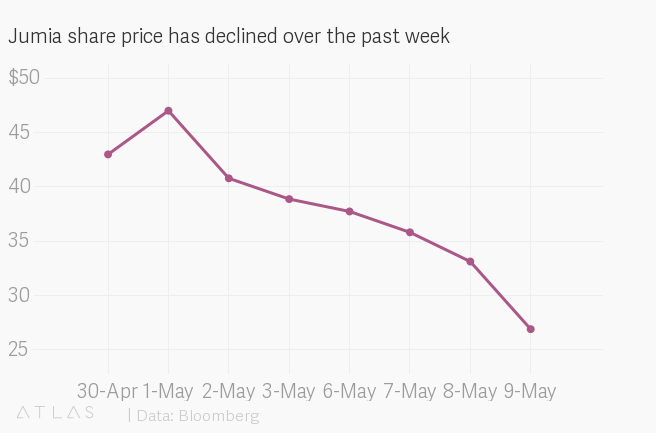

- In 2019, Andrew Left caused Jumia’s stock price to fall.

- He accused the multinational e-commerce company of fraud, which greatly affected its Wall Street adventure.

- Today, the CEO of Citron Research has made a 180-degree turnaround. He is now among those who have bought Jumia shares.

- Following his accusations last year, Jumia’s share fell from a value of $40 to just $5.

- Currently, the stock is experiencing a partial recovery and is valued at $12. And that’s because of a statement by Citron Research on Twitter.

- In fact, on October 09, Left announced that he would not bypass the company during this pandemic period.

Jumia Andrew Left Jumia Andrew Left

What Went Wrong In 2019?

In 2019, Citron Research said that Jumia lied. Not one. But so many times, said the firm. The research firm claimed it had finally laid its hands on Jumia’s most confidential documents before the IPO, and from all indications, Jumia’s equities seemed to be the most worthless ever to be sold on the New York Stock Exchange.

‘‘When a company markets to investors ahead of its IPO and then a few months later omits material facts and makes material changes to its key financial metrics to make the business seem viable, this is SECURITIES FRAUD,’’ the report read.

These Are What The Firm Claimed It Found:

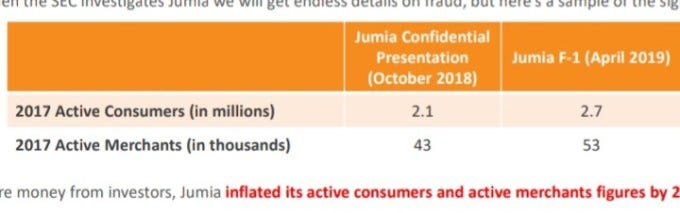

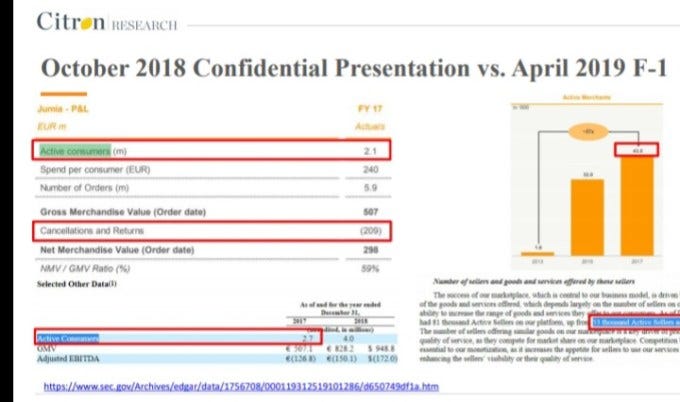

1. ‘‘In order to raise more money from investors, Jumia inflated its active consumers and active merchants figures’’

The inflation came by way of 20–30% increase in the number of Jumia’s active consumers and active merchants, Citron noted.

”The most disturbing disclosure that Jumia removed from its F-1 filing was that 41% of orders were returned, not delivered, or cancelled. This was previously disclosed in the Company’s October 2018 confidential investor presentation. This number is so alarming that it screams fraudulent activities,” the report noted.

”Instead, Jumia disclosed that “orders accounting for 14.4% of our Gross Merchandise Volume were either failed deliveries or returned by our consumers” in 2018. Assuming 41% of orders were returned, not delivered, or cancelled in 2018, this implies that almost 30% of orders were cancelled in 2018. Since Jumia primarily sells consumer electronics, which should not have this high of a cancellation rate, it wreaks of fraud.”

2. ‘‘Just before IPO, a Jumia MD was questioned by Nigerian Police over Allegations of Fraudulent Diversion of Funds’’

The firm claimed Jumia’s fraud started from the top to the bottom. Jumia Co-CEO, Jeremy Hodara, the firm claimed, had engaged in extremely questionable related party transactions that the SEC should immediately question. It went on to provide a sequence to these questionable transactions.

- In February 2016, four of Jumia’s subsidiaries were sold to Jumia’s CEO, Hodara for 1 euro each.

- Despite only generating revenue of 238 thousand euro and net losses of over 3 million euro in 2017, Jumia reacquired these businesses in 2018 from Hodara for an undisclosed price.

- During the same year, Jumia acquired Jumia Facilities, a payroll and support services operation based in Dubai, from Hodara for an undisclosed price.

“…many top directors of Jumia were engaging in serious acts of fraud including diverting money that was supposed to be used for projects into their own bank accounts and using director owned private companies to accept Jumia orders while receiving advance payments but never fulfilling the orders. In some cases, these fraudsters were relatives of senior management and “the directors would sweep the case under the carpet in order to avoid public scrutiny”.

Jumia’s Stocks Came Tumbling Down On The New York Stock Exchange

Following the accusation, Jumia’s investors started pulling out!

In the seven hours of trading on Thursday, 9th May, 2019, Jumia’s share lost 18% of its value.

The Implication Of This Change In Position

The sudden change in position implies many things. First, it means confidence in Africa’s ecommerce future.

“Citron being asked if we would short (i.e., sell Jumia’s shares) $JMIA recent run-up NO WAY. We learned lesson shorting e commerce. Bad risk/reward . Pandemic has changed e-com globally $SE$MELI,” Citron tweeted.

Second, it means Jumia has cleared doubts for future investors concerning its past records.

The company’s losses have, however, persisted. It recently stopped its operations in Cameroon, Tanzania and Rwanda. In April 2020, German tech investor Rocket Internet sold its 11% stake in the company. Just last August, it also paid $5 million in settlement of class action lawsuits won by investors in the US who were not satisfied with the company’s IPO documentation.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer