Here’s What Newly Launched Accelerator BimaLab Africa Will Offer Startups In Africa

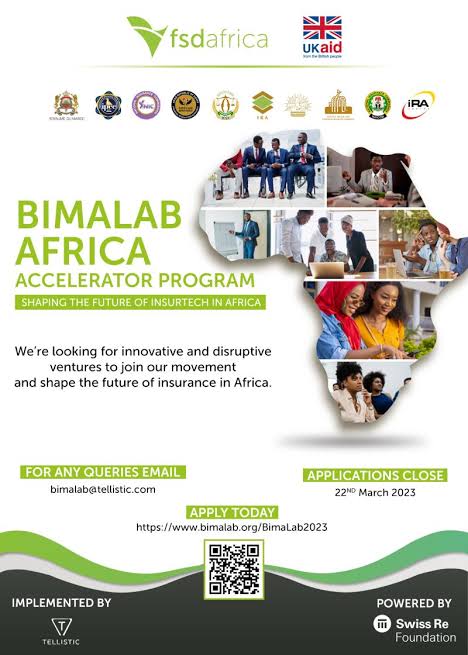

The BimaLab Africa Acceleration Program has announced its expansion to nine countries, in a bid to support entrepreneurs in developing innovative solutions for the insurance sector. The accelerator program was launched by FSD Africa in partnership with the Swiss Re Foundation and the National Bank of Rwanda, after a successful debut in Kenya, Nigeria, and Ghana.

The primary objective of the program is to increase insurance coverage among low-income consumers by investing in insurance technology or Insurtech innovations in Africa. The program will target startups and entrepreneurs from Egypt, Ethiopia, Kenya, Ghana, Morocco, Nigeria, Rwanda, Uganda, and Zimbabwe. The Swiss Re Foundation has contributed $500,000 to support the expansion of the program.

According to FSD Africa, BimaLab Africa has been designed as a model that addresses crucial challenges facing African consumers, particularly those at the base of the economic pyramid. While insurance provides a vital safety net for customers at risk of external threats such as health issues, economic disruptions, and natural disasters, it has been unavailable to many Africans.

read also South Africa’s DA Accuses ANC of Blocking Starlink

Reports suggest that only 3% of the continent’s GDP is driven by insurance, which is less than half the world average of 7%. Kelvin Massingham, Director of Risk and Resilience at FSD Africa, said, “BimaLab offers hands-on venture-building support to high-impact startups that improve the resilience of underserved and climate-vulnerable communities. We are grateful for the financial support provided by the Swiss Re Foundation, which has enabled us to democratize the successful BimaLab model across the region.”

The program will provide applicants with a rigorous five-month incubation period, during which they will receive support with expertise, resources, and scalability. The program has already helped 40 insurtechs scale their innovations, resulting in 20 partnerships and 43 new products in Kenya, Ghana, and Nigeria. It has also reached over 500,000 customers and raised over USD 1 million, promoting innovation and inclusion in the insurance industry. The new program aims to contribute to the growth of the African insurance market and is implemented by Tellistic Technology Services.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard