The Cairo Angels invests in Nigeria’s CredPal

The Cairo Angels Syndicate Fund (CASF), which invests in early-stage entrepreneurs in the Middle East and Africa, has invested in CredPal.

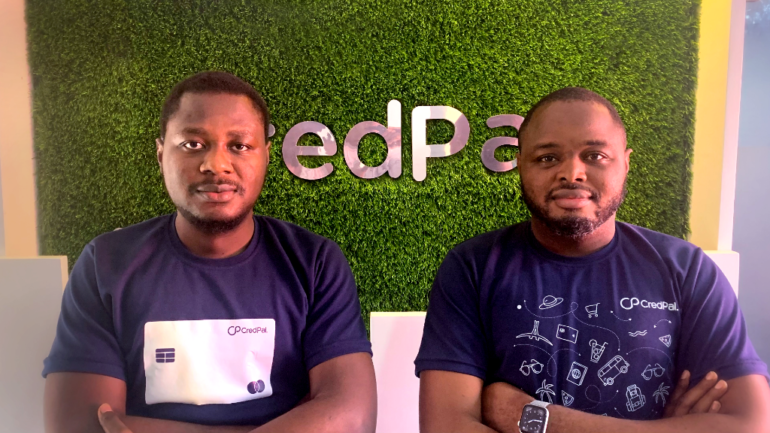

CredPal, launched in 2018 by Fehintolu Olaogun and Olorunfemi Jegede, is a Y-Combinator and Google-backed financial technology firm that allows businesses and people to buy anything and pay for it in instalments across online and offline retailers.

Launched in 2018 by Fehintolu Olaogun and Olorunfemi Jegede, Credpal allows users to set up accounts and establish payment plans using technology to minimize risk and connect to multiple credit-granting financial institutions. CredPal has 85,000 clients and 4,000 merchants. This cash will be utilized to expand across Africa, focusing on Egypt, Kenya, Ghana, and Cameroon.

Read also African fintech Startup MFS Africa Buys US Firm Global Technology Partners, Expands To US

“This support from Cairo Angels Syndicate Fund reinforces our mission to improve the quality of life of Africans through easy access to consumer credit. My co-founder and I are very pleased to have them as investment partners and can’t wait for how much we’ll achieve together” stated Fehintolu Olaogun, Co-Founder and CEO, CredPal.

Read also CredPal Secures $15m To Expand BNPL Product Across Africa

“We couldn’t be more proud of our investment in CredPal, which is our first investment in Nigeria. Fehintolu and Olorunfemi have built an incredible FinTech platform that provides credit to thousands of underserved individuals and businesses in Africa and will be expanding rapidly to other key markets, including Egypt. BNPL has proven to be a successful business model that is a compelling alternative to traditional forms of consumer credit, especially in emerging and frontier markets where credit card penetration is very low and usually unavailable to the masses,” said Aly El Shalakany, CEO of the Cairo Angels Syndicate Fund.

Cairo Angels Credpal Cairo Angels Credpal

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh