Nigeria To Begin Implementation Of New Company Law January, 2021

Nigeria’s laws for companies will entirely change from 2021, following the Gazette-ing of the Companies and Allied Matters Act, 2020, which was signed into law on 7th August, 2020 by President Muhammadu Buhari, more than 30 years after the old one. The announcement was made by the country’s Corporate Affairs Commission (CAC) in charge of managing the affairs of companies in Nigeria via its Twitter handle.

Here Is What Your Startup Needs To Know About The New Law

One Person Can Now Form A Company In Nigeria

Under the new law, although public companies are still required to have at least two members, a person can now form a private company. However, even though this is encouraged, the long-term prospects of the startup company should be considered, given that most startups are built for exit through IPOs or acquisitions etc., which makes a one-shareholder structure highly unsuitable for them in practice.

A Private Company May Now Transfer Its Shares

Unlike the old law where share transfer in a private company was restricted, this is not the case with with new law which gives all private companies in Nigeria the option to choose whether or not to transfer its shares in their articles of association. The implication of this is that in private companies, a structure in which most startups exist, shares can now be bought or sold at will. However, the company must obtain the consent of all its members before it sells more than 50% of the assets of the company. A shareholder in a private company is not also permitted to sell more than 50% of his shares to a non-shareholder unless he first offers to existing shareholders the shares meant for sale. He may then proceed to sell to a non-shareholder if the existing shareholders refuse. In the same way, that non-member willing to purchase the shares offered to him must also be ready to buy other shareholders’ interests in the shares offered.

Read also:Plentywaka Expands Business to Abuja With $300k Pre-Seed Funding

No More Need For A Company Secretary

Under the new law, every public or private company still needs to have a secretary. The requirement of a company secretary is only exempted for private companies which are small companies.

Annual General Meetings No Longer Compulsory For Small Companies Or Single Shareholder Companies

By virtue of the provisions of the law, small companies will no longer be mandatorily required to hold Annual General Meetings.

Under the law, a company qualifies as a small company in a year if for that year the following conditions are satisfied —

- It is a private company;

- The amount of its turnover for that year is not more than ₦120 million or such amount as may be fixed by the Commission;

- Its net assets value is not more than ₦60 million or such amount as may be fixed by the Commission;

- None of its members is an alien (a foreigner)

- None of its members is a Government or a Government corporation or agency or its nominee; and

- The directors hold between themselves at least 51 per cent of its equity share capital.

Small Companies Exempted from Audit Requirement

Under the new law, a company (excluding banks and insurance companies) is exempt from the requirements relating to the audit of accounts in respect of a financial year if-

- (a) it has not carried on any business since its incorporation ; or

- (b) its turnover in that year is not more than ₦120 million and the balance sheet total is not more than ₦60 million. In other words, the company is a smalll company.

One Person Can Now Be A Director In A Small Company

The new law also made provisions concerning directors of a company. According to it, the minimum number of directors for every company (whether public or private) shall be two directors. However, in the case of a private company which is a small company, the minimum number of a director shall be one, unless otherwise provided by the company’s articles or any applicable industry specific legislation.

Other notable provisions include that a director of a public company shall not hold position of both the CEO and the Chairman at the same time. Again, a person cannot be a director in more than 5 public companies at a time.

For the first ever, the new company law is properly defining who an independent director is. Consequently, there must be 3 independent directors in every public company, who must not be employees in the company and who have not made or received any payment in excess of N20m from the company. They must also not own more than 30% direct or indirect equity in another company transacting with (transaction sum should not be more than N20m) the company. They should also not own more than 30% direct or indirect equity in the company.

Nigeria company law Nigeria company law Nigeria company law Nigeria company law Nigeria company law

Read also: All Digital Marketplaces In Kenya To Pay 1.5% Digital Service Tax Starting From 2021

Meetings Can Now Be Held On The Internet

The new law is also revolutionary in that it gives wider options to places where the meetings of a company may be held. Accordingly, it states that although all statutory and general meetings of companies may be held in Nigeria, small companies or companies with a single shareholder may hold its meetings anywhere in the world. Again, a private company (and not public companies) may hold all its meetings on the internet provided that it has created room for that in its articles of association.

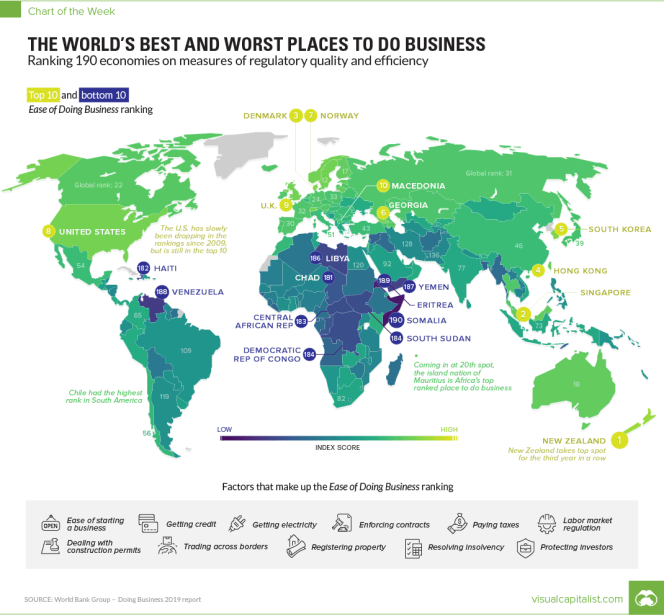

Electronic Communications And Ease of Doing Business

The new law now make it possible for business to be run more easily. For instance, every member can now have a right to attend any general meeting of of a private company (either physically or electronically) and to speak and vote on any resolution (physically or through electronic means) before the meeting. The certified true copies of all such electronically filed documents are now admissible in evidence.

Struggling Companies In Distress Can Now Be Rescued From Total Collapse

Under the new law, the directors of the company may voluntarily arrange with those the company is owing for a way of satisfying all outstanding debts owed by the company.

No More Common Seal For Companies

The law has also put an end to the requirement for each company to have a common seal. In its place, it states that should any document be required by any law or otherwise to be under the common seal of the company, it is enough if the documents were signed by a director and a secretary; or by at least two directors of the company; or by a director in the presence of a witness who shall attest the signature.

Better Legal Framework For A VC Fund

Under Nigeria’s newly passed Companies and Allied Matters Act (‘The CAM Act’), it has also become easier to set up a legal structure for a VC fund. By the terms of the new law, venture capital firms in Nigeria may now be set up as limited liability partnership or limited partnership.

Previously, before the law came into being, it was normal practice to register VC firms as limited liability companies; general or limited partnerships, or as limited liability partnerships under the Partnership Law of Lagos State (Nigeria’s major economic city).

Even though under the old regime, general and limited partnerships could be registered and applied throughout Nigeria whereas limited liability partnerships only applied in Lagos, the new regime spells out definite governance framework for partnerships generally, as well as enlarges the operational scope of partnerships to cover the whole of Nigeria, and not just Lagos alone.

The essential difference between a limited liability partnership and a limited partnership under the new law is that while a limited liability partnership is a corporate body which has a legal personality different from the partnership as well as a perpetual succession, a limited partnership has no separate identity from those of the partners that make it up.

Indeed, a limited partnership under the new law captures the ideal form of most VC funds, which usually have one or more partners called general partners — responsible for the management of the funds under the partnership, and who are also liable for the debts and obligations of the partnership — as well as one or more persons known as limited partners — who contribute certain sums of money or property to the partnership and who shall not be liable to the debts and obligations of the partnership.

Apart from properly providing a clear legal framework for the operation of VC funds in Nigeria, the new partnership regime, under the CAM Act, also functions to provide some clarity about their taxation. To read more on this, click here.

Bottom Line:

Remarkable, especially with the introduction of new provisions that have taken care of the difficulties necessitated by the coronavirus pandemic. However, apart from these, in practice, the law remains substantially the same with the old version. While certain provisions may look attractive given their cost-saving implications, there are several provisions which are unsuitable for companies with long-term vision.

For more on the new law and how it may affect your startup company, click here. (PDF)

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer