A Proposed Anti-Cash Tax Law In Cameroon Aims At Increased Digital Payments

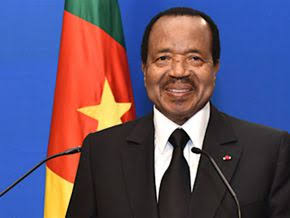

According to the circular relating to the preparation of the 2022 finance law, signed on August 30 by President Paul Biya, Cameroon is preparing fiscal measures targeted at discouraging cash transactions. One of the steps to intensify the fight against tax evasion and fraud, according to the head of state’s circular, is “the implementation of fiscal measures targeted at simplifying cash transactions.” The circular urges that financial administrations continue to collaborate in this regard.

With the latest move, Cameroon appears to be following Gabon’s lead. Cash withdrawals are subject to a tax in Gabon. This tax, which has a rate of 2%, is calculated on the amount of money withdrawn minus taxes. It applies to any natural or legal persons who make one or more cash withdrawals in a month for a total value of more than or equal to five million FCFA, regardless of withdrawal method or frequency. Simply expressed, any cash withdrawal of 5 million FCFA will be subject to a 2% tax. Alternatively, a 100,000 FCFA tax could be imposed during the withdrawal.

Read also:Cellulant Partners Gainde 2000 to Digitise Payments for Governments and Companies

The Gabonese Ministry of Sector claims that “Physical cash transactions are difficult to regulate and promote the informal economy. (…) The goal of this fee is to hasten the shift in consumers’ behaviors by incentivizing them to prefer digital or traceable transactions (through check, bank transfer, payment cards, or even mobile money).”

Read also :With Over 3.5m Downloads, Egyptian Fintech Firm Fawry Scores A Major First

However, it should be emphasized that if such a tax were to be implemented in Cameroon, it would run afoul of the fact that the informal sector accounts for 90% of the country’s GDP, according to the Groupement inter patronal du Cameroun. Furthermore, the banking rate is only 12%. This means that the vast majority of operators do not conduct their business through banks or financial institutions. According to the projections in the National Development Strategy 2020–2030, the government hopes to raise this banking rate to 80% by 2030.

cash tax Cameroon cash tax Cameroon

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer