Playing The Odds: Understanding The 6% Rule When Fundraising For Your Startup

Founders have to be resilient and thick-skinned. Prepare yourself to exhaust your network of investors, and accept the fact that fundraising is going to take time, even if that’s a hard pill to swallow.

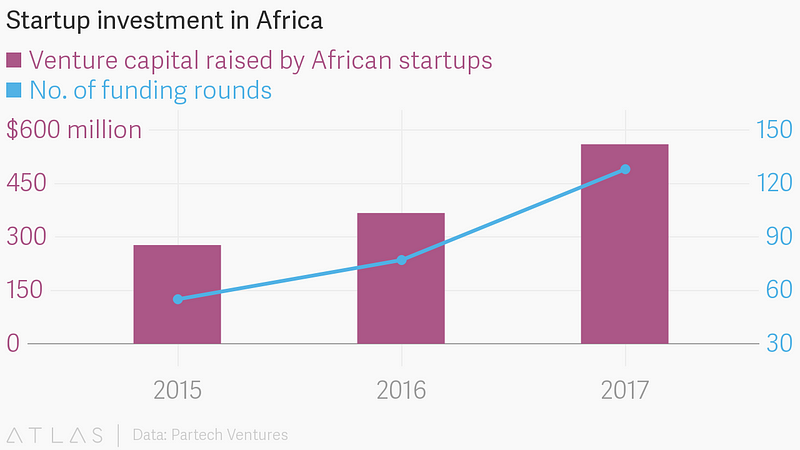

Securing a fresh injection of investment capital can drastically accelerate your startup’s growth, so it’s good to know that there’s no shortage of money up for grabs these days. According to a recent venture capital report from Magnitt, nearly US$800 million in investments were made in the MENA region last year.

But just because the money is out there doesn’t mean the fundraising process will be a breeze. The reality is that investors are picky and often guided by strict criteria to fit their investment thesis. When you seek them out, most will reject you, that’s just part of playing the game. Luckily, there are some rules that can make the process a bit more predictable. Odds are you get a “no”.

Taking into consideration the media’s infatuation with writing articles on multimillion-dollar investments into startups on a daily basis, it can look like these deals happen overnight. They don’t.

In fact, most entrepreneurs will openly tell you about what a struggle the fundraising process can be. Author and business guru Steve Schmitz puts this in perspective in the context of his own fundraising journey.

He wrote: “We raised $40 million of equity from 63 investors. We contacted more than 1,000 prospects. That’s about 6%. That means 94% of the people said no.”

Blackstone CEO Steve Schwarzman had the same 6% hit rate when starting out, too, and his company now manages more than $500 billion of capital.

Think of it this way: let’s assume you’re raising a $600,000 seed round, and the average check size for your investors participating in the round is $100,000. This would mean you’d need six investors in on your round. If you operate under the 6% rule, you would have to meet with 100 investors to close your round.

Keep in mind that the 6% rule holds up for qualified investors who cut checks of the size you’re seeking at companies that are at the same stage you are. If you hit up the SoftBank $100 Billion Vision Fund for a $50,000 unit size, that wouldn’t count as an investor. Being told “no” is normal.

Famed speaker and author Tim Ferriss has an excellent podcast episode about just how critical it is to learn from every “no” we get. One of his guests mentions that she heard “no” at breakfast, at mid-morning coffee, at lunch and twice during the afternoon, before ever getting to dinner (where she heard it again).

Founders have to be resilient and thick-skinned. Prepare yourself to exhaust your network of investors, and accept the fact that fundraising is going to take time, even if that’s a hard pill to swallow.

How To Secure The Magic 6%

The 6% rule can apply in any part of the world, but some places will have to stretch outside their borders to make it work. In the MENA region, fundraising often forces founders to go outside their hometowns and home countries to complete fundraising. Online crowdfunding platforms have been instrumental in removing geopolitical borders stateside, and this will surely benefit the 344 million households in the developing world, too. Regardless of where your investment comes from, you can set workable goals to achieve success under the 6% rule.

Here’s How:

1. Use your unit size to set your investor target list size.

It’s easiest to break the total investment you’re seeking into smaller units for starters. Think back to the example above of the $600,000 investment. If you were aiming for $50,000 units, the 6% rule would require you to talk with 200 qualified investors (assuming each investor bought one unit in the worst-case scenario), or 100 investors at $100,000 unit sizes. You can use the rule and your unit sizes to determine the size of your investor target list.

Egyptian startup Swvl did this when it secured five investors for its $8 million Series A round in April 2018, and the Series B that followed at the end of the year.

Once you determine your list size, create a pitching schedule. Assuming it’s not Ramadan -which tends to bring the investment world to a screeching halt- start pitching five times each week for 20 weeks. Factor in eight weeks of researching targets and eight weeks for term sheets to close the deal, and you’re looking at 36 weeks minimum from start to finish.

2. Be ready with prepped materials.

I always have the staples ready to go during fundraising time. Read Venture Deals by Brad Feld to get your lingo down, and understand the basics, it’s VC 101. Then, put together a pitch deck, a term sheet, a clean cap table, a data room, accurate and up-to-date financial statements, and a financial forecast. Preparation is key to secure and close deals, and doing this homework in advance shows that you know what you’re doing.

Verifiable forecasts coupled with a concrete plan to reach them is what secured Wuzzuf its $8 million investment.

This Egyptian startup bootstrapped its job site and recruiting platform in the aftermath of the 2011 Egyptian revolution.

Having survived the toughest economic conditions, the company is now one of the fastest-growing internet companies in Egypt, with more than 250 employees expecting to help 1 million people get hired by the end of this year.

3. Lose the materials when it’s more about relationships.

Pitch decks are great for angel group presentations and pitch competitions, but I’m not a big fan of bringing all of that to one-on-one pitches. If you’re meeting an investor at your nearest Costa Coffee, pitch without materials.

Building a personal connection is what got Jamalon its $10 million Series B investment, not a stack of papers.

Founder Ala Alsallal credits the mentorship he received from Fadi Ghandour, Aramex founder and Wamda Capital chair, with his success, saying relationships made the difference in getting him where he is today. So put away your computer, break the ice, share your story, and dive into your big vision. If the person shows interest, you can talk about materials.

4. Maintain a pipeline, and take your time.

Organize your resources and manage the investors you talk to in a customer relationship management system or a spreadsheet, just as you would a sales pipeline.

Take a note from the Sandler Training book, and use the “submarine trick,” which is inspired by World War II movies in which crews handle attacks on their submarines by closing the door to each compartment behind them.

Salespeople should close each step completely as they go, that way there’s no risk of needing to turn around, and go back on something that’s already been decided. Never forget that a signed term sheet is engagement, not a marriage.

Definitive documents take time to prepare. Wires take time to transfer. Plan ahead so you don’t run out of cash before you complete your raise.

Ultimately, you won’t fundraise for your startup overnight. And rejections will come. Period. Just remember that even if 94% of investors say “no,” 6% will give you the “yes” you need to make the grind pay off.

Zach Ferres is the CEO, Coplex, a Venture Builder that partners with industry experts and innovative enterprises to start high-growth tech companies.

The startup recently announced a $2.5M equity financing round. The Series Seed Round was led by DFE, the family office of Bennett Dorrance of Campbell Soup fame; and AZ Crown, the family office of Insight Enterprises Co-Founders Tim and Eric Crown.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.